The Rise of Make in India 2.0

A decade ago, the phrase “Make in India” was more of an aspiration than a reality. Launched in 2014, it aimed to transform India into a global design and manufacturing hub. But in 2025, Make in India 2.0 is no longer just a campaign — it’s a revolution redefining the country’s role in the global economic order.

From Apple assembling iPhones in Tamil Nadu to Tesla eyeing India for its next Gigafactory, global giants are now turning east — but this time, not to China. India is emerging as the world’s new manufacturing powerhouse, blending affordability, talent, and technology like never before.

This transition is more than just economics; it’s a story of policy, people, and potential.

How the World’s Manufacturing Map Is Changing

For years, China was known as “the world’s factory.” Its infrastructure, low costs, and government-backed exports made it the go-to destination for global manufacturing. But the tides are shifting.

Trade wars, rising labor costs, strict zero-COVID policies, and increasing political tensions have forced global firms to rethink their dependence on China.

Meanwhile, India — the world’s largest democracy — offers a stable, young, and growing market. With its robust digital infrastructure, improving logistics, and strategic government incentives, India has become the most attractive alternative for global investors seeking resilience and growth.

From Vision to Execution: The Make in India Evolution

The original Make in India initiative focused on 25 key sectors like automobiles, electronics, and textiles. Over the years, it laid the foundation for policy reforms, ease of doing business, and foreign direct investment (FDI) inflows.

Now, Make in India 2.0 takes it further — integrating Industry 4.0 technologies like AI, IoT, robotics, and green manufacturing.

Some of the most impactful reforms under this new phase include:

- Production Linked Incentive (PLI) Scheme – Encouraging global manufacturers to set up plants in India with lucrative tax benefits.

- National Single Window System (NSWS) – A digital portal to simplify regulatory approvals for businesses.

- Atmanirbhar Bharat – Promoting self-reliance in key sectors like defense, semiconductors, and electronics.

- Digital India and Startup India – Empowering entrepreneurs and tech innovators to build world-class solutions.

- Make in India + Serve the World – Expanding from manufacturing to design, innovation, and global exports.

Together, these initiatives are building a 21st-century industrial ecosystem that can rival the best in the world.

Global Giants Betting Big on India

Let’s look at who’s leading the shift.

- Apple has started producing nearly 25% of its global iPhones in India, employing thousands of workers through Foxconn and Pegatron facilities.

- Samsung operates one of its largest smartphone manufacturing units in Noida, Uttar Pradesh.

- Foxconn, a major Apple supplier, is planning a semiconductor fabrication unit worth billions in Gujarat.

- Tesla is negotiating with the Indian government for a manufacturing plant, indicating strong future interest.

- Amazon and Microsoft are expanding their data centers and cloud infrastructure in India, serving Asia-Pacific clients.

- Ola Electric and Tata Motors are taking the lead in electric vehicle manufacturing, aligning with India’s sustainability goals.

Each of these examples highlights a critical pattern: global firms no longer view India as just a market — but as a manufacturing partner.

Why India Over China: The Strategic Edge

- Labor and Demographics:

India’s median age is 28, compared to China’s 39. This means a larger, younger, and more trainable workforce — ideal for industries that rely on both labor and innovation. - Cost Efficiency:

While Chinese wages have nearly tripled in the last decade, India still offers competitive labor costs without compromising on skill quality. - Government Incentives:

Schemes like PLI and FAME-II (for EVs) have made India a lucrative base for manufacturing high-value goods. - Market Size and Demand:

India’s 1.4 billion population represents not just labor supply but huge domestic demand, encouraging companies to produce locally for local consumption. - Strategic Location:

India’s access to the Indian Ocean and proximity to Middle Eastern and Southeast Asian markets make it a logistical hub for exports. - Political Stability and Global Relations:

India maintains strong diplomatic ties with the U.S., Japan, Australia, and the EU — creating an environment of trust for global investments.

Government Policies Driving Make in India 2.0

India’s government has understood that attracting investment is not just about slogans — it’s about simplifying processes, cutting red tape, and building confidence.

Here are some of the flagship reforms and initiatives that have driven this transformation:

- Ease of Doing Business: India jumped from 142nd in 2014 to 63rd globally.

- FDI Liberalization: 100% FDI allowed in sectors like electronics, defense manufacturing, and telecom.

- PM Gati Shakti Plan: Integrating roads, railways, ports, and airports under a single digital infrastructure platform.

- National Logistics Policy: Reducing logistics costs to make exports more competitive.

- BharatNet and Digital Connectivity: Ensuring digital reach to 6 lakh villages to support rural entrepreneurship.

Each of these steps makes India not just an alternative to China — but a superior long-term bet.

How Startups Are Strengthening the Make in India Story

While multinational giants are driving large-scale manufacturing, Indian startups are fueling innovation and localization.

Companies like Ather Energy, Zetwerk, and Agnikul Cosmos are redefining what “Made in India” means — combining indigenous research with global standards.

Ather Energy has become a major EV brand, manufacturing electric scooters entirely in India.

Zetwerk supplies precision components to industries worldwide.

Agnikul Cosmos is developing India’s first private rocket engine using 3D printing.

These startups are the silent backbone of Make in India 2.0, showing that homegrown talent can compete globally.

Digital India Meets Manufacturing

Another reason India is attracting investors is its digital-first transformation.

From UPI payments to e-governance and AI-driven logistics, India’s tech infrastructure is unmatched among developing nations.

Global companies prefer ecosystems where data, regulation, and logistics move at the same pace. India offers exactly that — a mix of tech innovation, democratic stability, and scalable markets.

Digital twins, IoT sensors, predictive maintenance, and smart factories are becoming standard across new industrial corridors like Pune, Hyderabad, and Ahmedabad.

This blend of digital + manufacturing is the real power of Make in India 2.0.

Sustainability: India’s Green Manufacturing Revolution

In today’s global market, manufacturing isn’t just about output — it’s about responsibility.

India’s push for renewable energy, electric mobility, and carbon neutrality makes it a sustainability leader among developing nations.

Solar parks, wind energy projects, and green hydrogen missions are ensuring that India’s manufacturing growth doesn’t come at the cost of the environment.

Major global firms have pledged to use 100% renewable energy in their Indian operations by 2030.

This “Green Make in India” is not just a moral choice — it’s an economic advantage.

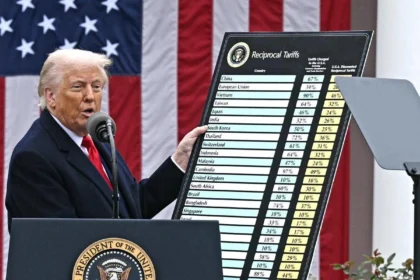

The Geopolitical Shift Fueling India’s Rise

The global manufacturing story is no longer about cost — it’s about trust and resilience.

After the pandemic, most multinational corporations realized that over-dependence on a single country could cripple global supply chains.

When factories in China shut down, the world faced shortages of semiconductors, medicines, and even basic consumer goods. That’s when global companies began asking one question: What’s our Plan B?

The answer, increasingly, is India.

India offers geopolitical neutrality and a stable democratic system, which global businesses view as long-term safety nets. Unlike China, India is open to foreign participation, joint ventures, and public-private partnerships.

Its strategic partnerships with the U.S., Japan, and the EU further strengthen its position as a reliable and transparent manufacturing partner.

China Plus One Strategy: India Takes Center Stage

In boardrooms from Silicon Valley to Seoul, CEOs are adopting what’s called the “China Plus One” strategy — diversifying operations by adding another major manufacturing base.

India is the biggest beneficiary of this shift.

Why? Because India doesn’t just offer a replacement — it offers growth.

- India’s digital infrastructure enables seamless data management and real-time monitoring.

- English-speaking talent makes communication easier for global teams.

- Vast internal markets mean companies can sell locally and export globally.

Southeast Asian nations like Vietnam and Thailand are part of this diversification trend, but they lack India’s scale, innovation ecosystem, and domestic demand.

That’s why India isn’t just “Plus One” anymore — it’s becoming the primary manufacturing pillar in many global strategies.

The Technology Backbone of Make in India 2.0

The first phase of Make in India focused on manufacturing volume. The second phase is about value and innovation.

Artificial Intelligence, Machine Learning, Internet of Things (IoT), and Robotics are becoming the foundation of smart factories across India.

Here’s how technology is transforming the landscape:

- AI-powered quality control is reducing defects in automotive and electronics manufacturing.

- IoT-based predictive maintenance ensures smoother production lines and fewer downtimes.

- 3D printing and digital twins allow prototyping in days instead of months.

- Robotic automation is enhancing both safety and precision on factory floors.

The government’s SAMARTH Udyog Bharat 4.0 program supports these changes by providing infrastructure, training, and technology support to small and medium manufacturers.

This integration of digital and physical manufacturing is why Make in India 2.0 is no longer just an industrial movement — it’s a technological transformation.

India’s Emerging Innovation Corridors

The government and private sector are jointly building industrial corridors across the nation to connect talent, infrastructure, and innovation.

Some key examples include:

- Delhi-Mumbai Industrial Corridor (DMIC) – Focused on smart logistics and green manufacturing.

- Chennai-Bengaluru Industrial Corridor – Powering automotive and electronics hubs.

- Hyderabad Pharma City – Supporting India’s position as the global pharmacy.

- Dholera Special Investment Region, Gujarat – A futuristic city built for Industry 4.0.

These corridors aren’t just economic zones — they are integrated ecosystems where startups, corporations, and R&D centers collaborate.

This approach aligns perfectly with the Make in India 2.0 vision — manufacturing not just for the world, but for the future.

Case Study: Apple’s iPhone Revolution in India

When Apple first began assembling iPhones in India in 2017, few believed it would expand significantly. But the past three years have changed everything.

Today, India produces nearly a quarter of all iPhones sold globally. Foxconn’s plant in Tamil Nadu employs tens of thousands of workers and supports an entire network of local suppliers.

The benefits go far beyond Apple — component suppliers, logistics providers, and small-scale units are thriving around these facilities.

The government’s PLI scheme has incentivized Apple and its partners to increase production, ensuring that India becomes an integral part of Apple’s global supply chain.

This success has sent a clear message to the world — if Apple can do it, anyone can.

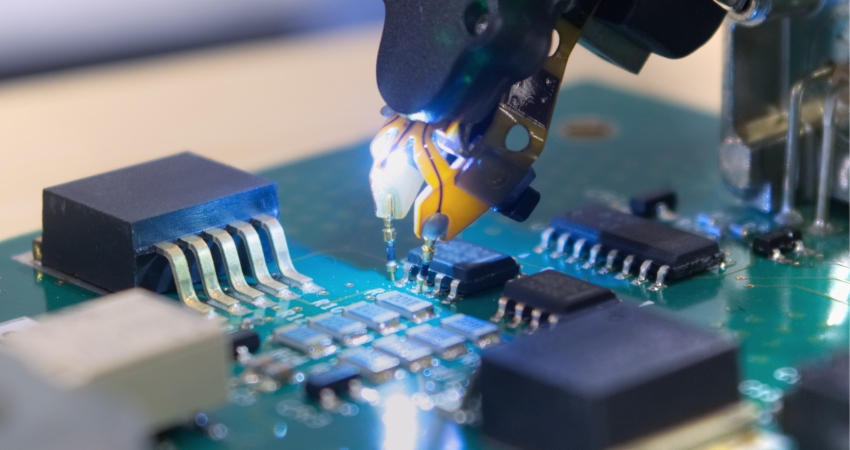

The Semiconductor Opportunity

If Make in India 2.0 has a crown jewel, it’s semiconductors.

Semiconductors are the backbone of every modern industry — from smartphones to satellites. For decades, India imported almost all its chips, but that’s changing fast.

The government’s Semicon India Program, worth billions of dollars, offers incentives for chip design, fabrication, and testing.

Foxconn, Micron, and Vedanta have already announced major projects in Gujarat and Karnataka.

With a strong base in software and electronics engineering, India could soon become a global semiconductor design hub, reducing its dependence on imports and strengthening national security.

The Role of MSMEs in the Make in India Mission

Micro, Small, and Medium Enterprises (MSMEs) are the heart of India’s manufacturing economy.

They account for nearly 30% of GDP and employ over 100 million people.

Under Make in India 2.0, MSMEs are being digitally empowered to access global markets. Platforms like GeM (Government e-Marketplace) and ONDC (Open Network for Digital Commerce) allow small manufacturers to reach large buyers, including government agencies and e-commerce platforms.

Digital tools, online payments, and logistics innovations mean a local unit in Pune can now sell directly to a client in Paris.

This grassroots empowerment makes the Make in India movement inclusive and sustainable.

Logistics Revolution: Connecting Bharat to the World

You can’t make globally if you can’t move globally. India’s logistics backbone is now stronger than ever.

Projects like PM Gati Shakti and the National Logistics Policy are reducing transport costs, improving port efficiency, and creating multimodal networks connecting highways, railways, and air routes.

For example, the Dedicated Freight Corridors (DFCs) between Delhi and Mumbai are revolutionizing cargo movement, cutting transit times by half.

The result? Products made in India now reach global markets faster, safer, and cheaper — making exports more competitive.

Skill India: Powering the Workforce of Tomorrow

One of the most ambitious aspects of Make in India 2.0 is its focus on human capital.

Through initiatives like Skill India, PM Kaushal Vikas Yojana, and Atal Tinkering Labs, the government is training millions in AI, robotics, manufacturing technology, and data analytics.

The idea is simple — a skilled workforce attracts high-value industries.

In partnership with companies like Siemens, Tata, and Bosch, India is setting up centers of excellence that prepare youth for advanced manufacturing roles.

The result is an ecosystem where innovation and employment grow together.

Challenges That Still Need Attention

Despite the tremendous progress, the road isn’t without bumps.

- Infrastructure Gaps: While improving, some regions still face power and logistics constraints.

- Complex Regulations: Although simplified, compliance systems can still feel heavy for small firms.

- Land Acquisition: Industrial expansion in certain states faces delays due to legal complexities.

- R&D Investment: India’s R&D spending remains lower compared to global peers like the U.S. or South Korea.

However, each of these challenges represents an opportunity for reform — and most are already being addressed through digitization and public-private collaboration.

A Nation at the Crossroads of Change

India today is not the same as India in 2014.

With a booming startup ecosystem, advanced technology infrastructure, and a rapidly improving business climate, India is positioning itself not as a substitute for China — but as the next global manufacturing and innovation leader.

Every new factory, every startup, every PLI project contributes to a single narrative: India is ready to lead.

Vision 2047: India as a Global Manufacturing Leader

As India celebrates 100 years of independence in 2047, the nation’s leaders envision a fully developed economy driven by technology, youth, and innovation.

Make in India 2.0 is not just a policy but the economic backbone of this vision.

By 2047, India could lead in:

- Green and digital manufacturing

- Global supply chain design

- Artificial Intelligence-driven production

- Renewable energy exports

- Space and defense technologies

If the current momentum continues, India’s transformation from an import-dependent nation to a global export powerhouse is inevitable.

Actionable Takeaways for Businesses and Professionals

For companies — both Indian and global — this is the perfect time to invest and scale.

- For Startups:

Explore PLI-linked sectors and collaborate with government programs for incentives and funding. - For Corporates:

Invest in AI-driven manufacturing and sustainability initiatives to align with India’s future goals. - For Professionals:

Upgrade skills in automation, data analytics, and global supply management — these are the skills future employers seek. - For Policy Analysts and Students:

Track reforms under DPIIT, NITI Aayog, and state industrial departments to understand India’s evolving economic landscape. - For Global Firms:

Think beyond outsourcing — India offers end-to-end manufacturing, design, and innovation capabilities.

The future belongs to those who build in India, for the world.

Make in India 2.0 — The Global Trust Revolution

The success of Make in India 2.0 isn’t about slogans or symbolism — it’s about substance and strategy.

It represents a shift from dependency to dominance, from cost-based competitiveness to capability-based leadership.

Global firms are not just choosing India because it’s cheaper — they’re choosing India because it’s reliable, resilient, and ready for the future.

With a strong policy framework, youthful workforce, world-class digital infrastructure, and visionary leadership, India stands at the threshold of an economic renaissance.

The world’s supply chains, technologies, and innovations are being rebuilt — and India is writing the next chapter.