A New Front in Trump’s Tariff Wars

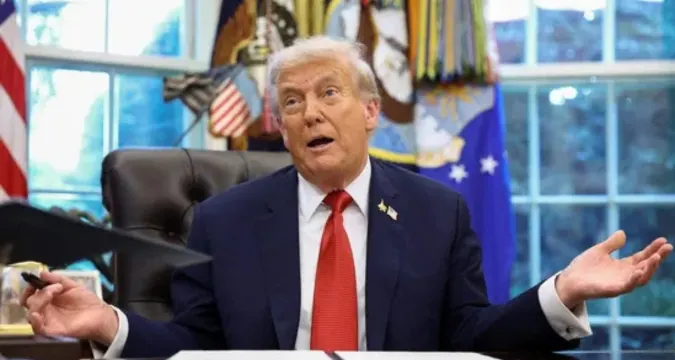

Washington is once again a place where a declaration of policy that is likely to shake the global markets, has been announced. On September 25, U.S. President Donald Trump announced that after October 1, 2025, pharmaceutical imports under a brand and patent would be subject to a 100% tariff unless the firm had current plans to produce domestically.

This recent action follows an earlier move on the sweeping tariffs already imposed using 50% and a 25% penalty surcharge on the Indian export that has persistently traded with Russia in oil. America First manufacturing agenda by Trump now focuses on the healthcare industry- a sector where U.S. consumers have long relied on inexpensive imports especially that of India.

Why the U.S. Is Targeting Pharma

White House has vindicated such tariffs under an umbrella of national security and other causes. Although no substantive legal rationale is forthcoming, the Trump statement emphasized that only those companies which make a physical investment in U.S. soil, those companies breaking ground or currently under construction would be erected out of the new duties.

This framing symbolizes Trump habitually shaping it to be self-sufficient nationally, identifying this domestically as national security. Similar to the tariffs on steel, aluminum, and semiconductors in the past, which were presented as crucial factors to American independence, the new tariff blitz by Trump tries to make the United States less reliant on international drug supply chains.

Even so, health economists contend that pharmaceuticals are not steel or furniture. They are saving necessities in life – a lack of, or an increase in the cost of, this industry has a human cost.

India at the Center of the Storm

The Indian pharmaceutical business is among the biggest ever and a significant competitor to the U.S. market. As per the Pharmaceuticals Export Promotion Council of India (Pharmexcil):

- India in FY 2023-24 exported pharmaceutical products worth 27.9 billion.

- America contributed 31 percent worth $8.7 billion (77,000 crore).

- Indian pharma exports in the U.S. alone were 3.7 billion (32,500 crore) in 2025, in the first half of the year.

India supplies:

- Agreement on more than 45 out of the total employed generics in the U.S.

- 1/5th of bio-similar intake in the U.S.

- The market can be compared to Dr. Reddy Laboratories, Aurobindo Pharma, Zydus Lifesciences, Sun Pharma or Gland Pharma, which have densely concentrated their businesses around the U.S. market: 30-50% of their global earnings may come from the sales in the United States.

Generics vs. Patented Drugs: Who Gets Hurt?

The announcement made by Trump specifically identified branded and patented drugs, a category in which giant multinational pharmaceutical companies prevail. This seems to save Indian exporters, typically dealing primarily with generics.

However, the industry analysts caution that the line between so-called branded, patented and complex generics is getting more and more unclear. For example:

- Complex generics like injectable, inhalers and biosimilars are more expensive to manufacture and are very technologically advanced.

- Indian companies have penetrated these sophisticated markets in great numbers, and which may be readily tariff inspected in case leading-edge U.S. extends the definitions.

- So, although China looks like a victim of big American and European pharma companies, it is still not certain whether the Indian companies that work on short fuses and which will not be able to adapt the additional charges without reflecting it on the final customers.

The U.S. Consumer Dilemma

In a very ironic way it may be the American population, who may experience the immediate pinch. Indian generic medicine is about 80-90 percent cheaper than U.S. drug equivalents. The Association of Accessible Medicines (AAM) estimates that generics contributed to saving more than $408 billion to the U.S. healthcare system in 2022 alone, with India producers playing a central role.

An increase in import prices at once by a factor two may:

- Instigate increased out-of-pocket payments among patients.

- Add pressure to insurance funds and Medicare/Medicaid bank wallets.

- Result in pharmaceutical shortages, particularly in such much needed lines as antibiotics, cancer therapy, and blood pressure medication.

According to Pharma analysts, such huge tariffs will cause healthcare inflation in time when health care is already hurting the cost of living among U.S. voters.

Indian Pharma’s Counterplan

The giant Indian companies have already predicted protectionist moves by the United States. Similar companies such as Sun Pharma, Lupin, and Dr. Reddy have established or invested in production facilities in the United States that may protect portions of the portfolio.

But small and mid-sized exporters with no capital to construct overseas might counterpart this. This gap would redefine the sector to rely on big consolidated firms to the detriment of smaller pioneers.

On the policy front, India could be interested in appealing the tariffs at the World Trade Organization ( WTO ) concerning the fact that the pharma trade has always been viewed as a state activity rather than a political bargaining item.

Travel Uses and Business Implications.

The tariffs are not limited to boardrooms for traveling and professional mobility.

The Indian pharma executives who regularly visit the U.S. to submit regulatory applications, FDA inspection, and alliances may now be exposed to an unpredictable market situation that might put a halt on new approvals.

There may also be an implication on medical tourism: American patients who are traveling to foreign countries such as India to obtain cheaper treatment may be impacted on a package of care through high prices of imported medication.

International investors eyeing the Pharma capital of India- Hyderabad, Pune, Ahmedabad and Visakhapatnam might think again on its course of expansion after changing interplay of trade conditions.

What Comes Next?

Implementation of the tariff date (1st October 2025) does not give companies and governments time to respond (less than one week to respond). Many questions rise up big, they include:

Will Indian firms have hidden costs, or will exemptions be made clear on generics?

- What happens if the U.S. goes far to end its legal excuse of national security?

- Can India settle on a compromise to protect both itself and its industry and the affordability of American consumers?

- At this point, what Trump said underlines one thing: the tariff war in 2025 is no longer only about steel, cars, or electronic products. It has penetrated the sphere of life-saving drugs.

Conclusion

India, the pharmacy of the world, is standing at a knife point. The estimated 9 billion dollars on average annually exported to the United States might have been shaken overnight and this shocking benefited patients, companies, and governments on either side of the ocean.

The global economy is observing keenly as trade wars intensify to determine whether economic nationalism can be compatible with the global need to access affordable healthcare. The coming months will determine whether tariffs will be a weapon that weakens not the markets alone – but medicine cabinets as well.