The export economy of India does not work in vacuity. It is closely linked to tariff regimes, bilateral trade agreements, retaliatory duties, and change in policies in the key importing countries. The question of the impact of tariffs on Indian exporters and understanding how tariffs impact Indian exporters explained with trade figures is critical not only for policymakers and businesses, but also for citizens trying to make sense of fluctuating export numbers, job creation, and industrial growth.

Tariffs might seem a mere tax on border crossing produce, but the actual consequences of this practice on Indian exporters are complex, information based, and often contradictory. This article has tried to explain how tariffs affect the performance of Indian exports in terms of sector, region, and time, using the official trade data, government data, and the institutional reports.

Exposure to Tariffs in the Indian Trade.

Tariff is a duty granted to a country on imported goods. In the case of Indian exporters, destination countries impose tariffs on the Indian products during the importation of Indian products into their countries. These obligations have direct implications on price competitiveness, market accessibility, and long-term supply contracts.

The basket of export of India is diverse, including petroleum products, pharmaceuticals, engineering goods, textiles, gems and jewellery, chemicals, agricultural products and most recently, electronics. All these industries have varying tariff conditions in relation to the country of importation.

The ministry of commerce and industry reports that India has trade relations with more than 200 countries and they all have their own tariff structure. This renders tariff exposure unequal and complicated.

Export Performance of India using official data at a glance.

In order to appreciate the effects of tariffs, we have to examine the baseline export data.

According to the Directorate General of Commercial Intelligence and Statistics and the ministry of commerce:

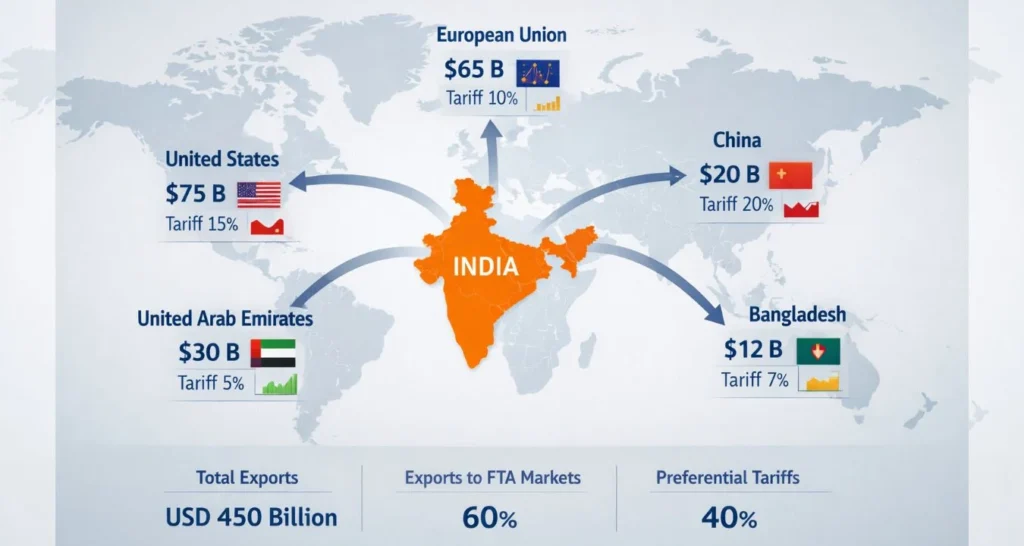

The exports of merchandise in India have gone beyond USD 450 billion during the past financial years.

The leading countries to which it exports are the United States, European Union, the United Arab Emirates, China, Bangladesh and Singapore.

Almost 60% of India exports pass to nations to which the tariff rate is affected by free trade arrangement or preferential trade arrangement.

These figures are important since tariffs are hardly uniformly applied. A relatively minor shift in a sizable market such as the United States or the EU can shift the export patterns of whole sectors.

Tariffs, the Indian Exporters and Sector Wise.

Goods and industrial products engineering.

Engineering goods constitute the foremost category of Indian export accounting for more or less a quarter of the consignments of merchandise as detailed by EEPC India and Commerce Ministry data.

The effect of tariff in this industry is especially strong since:

- Margins are thin

- There is a high level of competition among China, Vietnam, and Mexico.

- Customers are very sensitive about prices.

Auto components, or machinery exported to India will lose business immediately when the importing countries raise tariffs on steel products. Trade statistics provided by the government indicate that an increase in tariffs in North America and Europe has historically resulted in a loss of volume in less than two quarters.

Apparel Exports and Textiles.

The textile industry has millions of people working and it is highly tariff sensitive.

The Ministry of Textiles and WTO data shows:

The average tariffs on Indian apparel exports in the large market in the West is between 8 and 12%.

The trade agreements grant competing countries such as Bangladesh and Vietnam lower or zero tariffs.

This leaves competitiveness undermined by higher tariffs, despite Indian textiles being of equal quality as their counterparts all over the world. Exporters either must bear the cost of the loss in duty or lose customers all. This is one reason why the growth of exports of India’s textile sector has continued to be slowed by the lack of peer economies alarming production.

Export of Agriculture and Food.

- Tariffs and non tariff barriers have an effect on agricultural exports.

- According to trade data provided by APEDA and DGFT, there are:

- Indian rice, sugar, spices and marine export can attract different tariffs based on destination.

- The rejection of shipments or a possible renegotiation of the contract may be caused in the case of sudden tariff increases in the country of importation.

- Income volatility to small exporters is brought about by the unpredictability in tariffs particularly in the perishable products.

Pharmaceuticals and Chemicals.

- One of the popular exporters of generic drugs is India.

- The statistics provided by the Pharmaceuticals Export Promotion Council show that:

- The tariff rates on the developed markets are comparatively small.

- New economies however tend to charge more on finished formulations.

- This has pushed Indian pharma exporters to target regulated markets and restrict in-law areas of penetration regardless of demand.

The Tariff Impact on Margins and Pricing of Exports.

Tariffs have a direct effect on the cost of land within a country of importation. When tariffs increase, Indian exporters have only three choices:

- Lower export price and recoup losses.

- Transfer the price to consumers and risk losing business.

Exit the market

According to trade information given by RBI and Export Credit Guarantee Corporation, the existence of the small and medium exporters would suffer most since they do not have power of pricing and hedging.

Gradually, the accumulated tariffs attract exporters to markets with favourable entry, although the volumes are less.

Case Study on trade figures: Tariffs in the United States and Indian exports.

The US is the largest export market of India.

Official U.S. international trade commission data and the Commerce Ministry of India have shown that:

India sells more than USD 75 billion worth of products to the U.S. every year.

Past years have had a direct impact on Indian exporters of steel, aluminium and certain engineering goods due to tariff changes.

Following the increase in tariffs there was a slowdown in exports in categories where the tariffs were increased whilst other sectors whose duty regimes remained unaltered grew. This break demonstrates clearly that tariffs reform the composition of exports.

Effects of Free Trade in mitigating the effects of tariffs.

The trade agreements of India are important in that they alleviate tariff damage.

According to data released by the Department of Commerce, it indicates that:

On average, there is a growth of exports to the FTA partner countries than to non FTA markets.

The agreements with UAE, ASEAN and Japan have enabled tariff reductions that have enhanced market accessibility in India.

But India has not been a member of some large regional trade blocs and this has restricted the benefits of the tariffs in some markets which has influenced the positioning of exporters in the global markets.

Global Supply Chain Shifts and Tariffs.

Tariffs are not a limited field. They engage with supply chains.

Based on trade statistics of UNCTAD and reports of the Indian government, it can be noted that:

The sourcing patterns are diverted by the tariff wars.

Indian exporters are likely to benefit with the competition having higher duties.

When India is attacked without any concessions, they lose their grounds.

This is why the export volumes spur and fall all at once without affecting domestic production within financial years.

Reduction on Employment and MSMEs.

Export oriented MSMEs absorb a considerable amount of the Indian workforce.

According to government statistics:

Small enterprises form more than 40% of the exporters.

Increases in tariffs impact MSMEs because of lack of scale.

When the export orders decline owing to tariff barriers, the employment contracts especially in labour intensive industries such as textile and leather industry.

Indian Government Response to Tariff Pressures.

The Government of India employs various instruments against tariff impact:

- WTO complying with export incentives.

- Trade negotiations and dispute resolution.

- Diversification programs in the market.

- Support in export credit and export insurance.

According to the statistics of the Commerce Ministry, export diversification has decreased over time dependence on a limited number of markets that are tariff sensitive.

What the Trade Figures Tell Us on Long term Trends.

Considering the last twenty years of export statistics:

- Tariff heavy market demonstrates erratic growth.

- Preferential access markets record consistent growth.

- Tariffs are resistance to high value exports compared to commodity exports.

- This is the reason why India is moving strategically to value added manufacturing and technology oriented goods.\

The importance of Data Driven Export Analysis.

Trade commentary writing on opinion tends to lack structural reality. Discussing the trade figures in more detail, one can see a better picture:

- Tariffs also affect not only quantity, but product mix.

- The resilience of exports relies not on competitiveness only, but policy alignment as well.

- The access to the market is as important as the production volume.

- This is the reason why the effect of tariffs on Indian exporters explained using trade figures is a critical paradigm to understand the future of India as far as trade is concerned.

Indian Exporter The Road Ahead.

Due to the increased global protectionism, the Indian exporters need to adjust by:

- Market diversification

- Product upgrading

- Policy factoring in with trade partners.

- Data driven decision making

According to government trade data, in case of global disruptions, exporters who enter into low tariff markets early enough would continue registering growth.

Frequently Asked Questions

What are tariffs and why are they important to Indian exporters?

Tariffs are levies that are paid by importing nations. This is important as they raise product prices and make Indian exports uncompetitive.

What are the most impacted Indian export industries by tariffs?

Most of the sectors affected by changes in tariffs concern the textile industry, engineering products, agriculture, and the MSME.

What is the role of government trade data to exporters?

With official data, the exporters can make a decision or plan the growth or tariff risks based on facts and not speculations.

Are tariff impacts done away with in free trade agreements?

They lower or abolish tariffs to other partner countries and enhance their competitiveness without eliminating all barriers to trade.

Survival of Indian exporters in high tariff markets.

High tariff environments can only support operations of a strong branded exporter, a strong technology exporter, or a niche product exporter.