Reserve Bank of India maintained the policy repo rate at 5.50% on October 1, 2025 and maintained its position as the neutral position but indicated that it would adopt a wait-and-watch attitude to any additional easing. Immediate factors behind that judgement are that there was a sharply benign inflation environment, and to start of the fiscal year, a surprisingly robust output. Simultaneously, new external headwinds (largest U.S. tariffs on Indian exports by far) represent short-term negative impacts of growth and on the rupee) necessitating the soothing aspect on the move toward additional rate cuts by the RBI.

I have outlined a step-by-step account below of the timeline, the economics of the decision, the mechanics and risks that RBI is considering, the implications of the decision to households and businesses along with a forward-moving analysis of the probable paths that the policies may follow and the impact on the market.

In simple terms, What the RBI has Decided

- The setting of the policy repo rate was 5.50% with the policy remaining neutral by the Monetary Policy Committee. The vote was unanimous. Inflation outlook was reported by Governor Sanjay Malhotra as being more benign due to falling food prices and recent reduction in the tax rates, with the governors saying that growth has nevertheless been resilient.

- The central bank still has a vigilant eye on the effects of previous reductions of rate as well as the recent tax reforms. It indicated explicitly the necessity to consider the effects of U.S tariff action on the external sector prior to engaging in a chosen direction of ease. One way markets see the choice is that it did not close-off the possibility of future cuts later in the year but only after RBI is satisfied with the effects of pass through and stability in the currency.

Timeline and How We Got Here

The decision of 2025 is placed in the context of the policy moves.

- Feb 2025: RBI launched an easing cycle and reduced the repo rate by 25 basis points, to 6.25%, due to a reduction in inflation and to promote growth.

- April 2025: MPC reduces further, by 25 basis points, to 6.00%, further signaling a gradualist movement of the policy.

- June 6, 2025: the RBI gave a more comprehensive, 50 basis point reduction to bring the Level down to 5.50% and at the same time cut the cash reserve ratio as a method to pump permanent liquidity in the banking system. This action was intended to increase transmission to credit and liquidity to promote growth.

- August 2025: RBI put a pause, and maintained the repo unchanged at 5.50%, stating that it was necessary to review the impact of previous easing and new fiscal and tax policies. Through September, the central bank and markets began to incorporate the disinflationary impact of a large GST rationalization which would come into effect later in September.

The second straight hold however followed an active easing period earlier in the year. RBI is juggling significantly low headline inflation and strong GDP releases with foreign risk.

Why Inflation is Suddenly Accommodative

Three long run and long cycle trends have undergone as to why headline inflation in 2025 in India remains abnormally low:

- Food price disinflation. However, food prices, including vegetables and other food products, plummeted down through the spring and summer seasons, pushing headline CPI down. The headline CPI readings are close to multiyear lows and the provisional CPI is 2.07% in August 2025 based on official MoSPI numbers. These prints allow the RBI to consider reducing.

- GST 2.0 rationalisation. Next quarter All of this is likely to take off several tens of basis points of the headline CPI due to the GST reorganization by the government in September, which made more consumer items subject to lower rates, effective beginning September 22, 2025. It is a mechanically disinflationary change in policy and would soon alter the inflation path to FY26. Hence most forecasters currently indicate a range of 25 to 2 Express within the FY26 means.

- Base and non-discretionary effects. In the recent months, low oil and commodity pass-through further supported lower food inflation with added bonus on when the harvests are in and a well-attracted monsoon season. Core inflation is even more balkish than headline and the overall outcome is a significantly friendlier CPI picture than the one estimated earlier in the year.

When combined, these factors are the reason why lots of independent forecasters and rating agencies are chopping FY26 averages into the 2.6% range. The disinflationary observation can be found in the public narrative of the RBI, who continue to take care in varying official projections until they will see the actual outcomes of the GST pass through and the festive demand cycle realized on the ground.

Why Growth Looks Better Than Expected

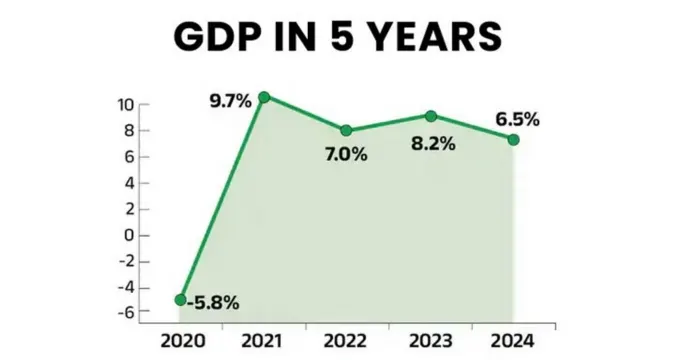

In the first quarter of FY26, India had a positive economic surprise regarding the real GDP. Official quarterly forecasts indicate that real GDP is expected to grow 7.8% in April-June 2025, the best reading since the recession and a full two and a half percent above the forecasts at the baseline. This growth was widespread with very good showing in services particularly. Good capital expenditure by governments and households have been key supports.

Even though Q1 over performance supports the idea of policy providing support against a pull back by maintaining momentum, the policy makers are clear that the solid early-year print might not be able to cushion the economy fully against a slowdown in those sectors exposed towards exports in the event that the tariffs bite. Therefore the RBI neutral stand is seen as a way of facilitating growth even as trends outside are strictly monitored.

The External Danger which Alters the Calculus

Trade policy abroad is an important new variable this year. In 2025, the United States imposed large tariffs on a number of Indian export manifests. These tariffs result in an export shock and an earnings shock to manufacturing and part of services. What they also do is bring pressure on depreciating the rupee and can be fueled by domestic inflation in case of prolonged action. Repeatedly, the RBI has indicated that it is interested in gauging the extent and the transmission mode of the tariff shock before it goes to greater extents with rate cuts. The October hold would explain this judgement better than weak domestic data would.

What the Markets and the Economists Thought

According to a Bloomberg poll and other polls, the market was divided before the decision in October. The majority predicted a hold though a significant minority anticipated a 25 basis point cut would be forthcoming in October and many houses predicted more easing further down the cycle should inflation keep itself in check, and the currency level itself stabilizes. Other forecasters even envisage the policy repo taking the floor to 5.0% in the easing train, provided the position of the external two is held constant. The RBI communications look like it is aimed to save optionality without making a mistake in the policy.

Practical meaning- who comes out as a winner, who observes and what to do.

Coming to the households and the borrowers.

Borrowing costs in the presence of both mortgage and variable-rate loans borrowers however will remain gradually subsiding as banks transit through to lower policy rates and the CRR savings made by banks earlier this year are tested on the funding costs of banks. Not quite, pass-through is not instantaneous. When banks are observed reducing lending spreads remarkably, consumers ought to schedule big discretionary borrowing during times of this visibility.

To savers and fixed income investors

The non-inflammatory inflationary context squeezes yields in real terms and implies a small-scale recovery in the government bond market when attempting to price smart changes in calculating yield, liquidity and inflation conditions. Observe RBI remark on WACR and liquidity windows since the alteration of operative liquidity set-up affects the rates of the money market.

Companies and exporters

The GST cut support to domestic demand can offset some of the export weakness of consumer-oriented firms. In the tariff-prone sectors, exporters would encounter a more difficult situation in the near term and need to speed up their hedging and market diversification strategies. There can also be purposeful subsidies or incentives to exporters supplied by policy makers who can seek to offset the effects of tariffs.

It Affects Banks and Financial Stability

Decreases in policy rates and the CRR will raise the capacity of banks to lend, although compression of margins is probable when competition is more rapid. The quality of credit should be put on a very close care in tariff-exposed corporate portfolio. More probably, RBI will oversee the liquidity activities of the system and the operating WACR target to control short-term market rates.

Probabilities and the Near-Term Policy Path

By piecing it together, the upcoming three months seem the most probable way to go:

- Near-term status quo. RBI will keep one in October and it will explain through Governor commentary how it will evaluate the impact of a GST pass-through and tariff impact.

- Prerelease at yearend. In case the CPI printing in October and November are low, despite GST passing through, and rupee stays the same or neutralised, the RBI may issue us a minor cut of 25 basis points of either December or the first quarter of 2026. The first easing then goes into several models of the private sector. There is room to spike, but with perceptibility of external and currency sources.

- Alternative scenario. Should the rupee slump significantly or should CPI core inflation start to pick up with a higher progress rate of pass-through by imported goods, the RBI will withhold and hold up cuts until there are indications that inflation is within control. Such is the tail risk which the central bank is hedging.

Business and policy insights Policy and business implications– applied and looking ahead

- To policy makers: Co-ordination is everything. Assuming fiscal and trade policy results also make exporters less volatile and anti-profiteering regulations make GST benefits passed on to consumers, then monetary easing will have the positive-most impact on growth. Monetary credibility will also be retained through clear and forward guiding communication.

- To business leaders: Take advantage of this window to turbo efficiency reforms and export hedging policies. Demand reallocation is important in firms in consumer segments whose relative prices are now changed by GST changes.

- To investors: Rehydrate fixed income defined duration each time and keep an eye on the CPI print and FX reserves. The first beneficiaries of reduced costs of financing and tax cuts can be equities in domestic consumption, healthcare and some of the financials.

Closing Assessment

The October decision by the RBI can be understood to be pragmatic and dependent on data. The bank has already taken action in favour of growth with a bold easing package made earlier in the year. As the headline inflation has become unusually low and the GST overhaul creates a disinflationary effect, the argument in favor of further easing has a convincing quality. Nonetheless the central bank is justified to consider external shocks and currency risk and consider making the next tranche of easing open. That uncertainty stance is meant to leave optionality intact and quash a subsequent overturn in the policy.

Executive Summary

The Reserve bank of India (RBI) has maintained its repo rate at 5.50 and revised its FY26 inflation target to 2.6% against 3.1%, projecting a higher growth of the GDP. Governor Sanjay Malhotra raised an alarm and pointed to the tariff shock in the United States, and the necessity to provide a stable currency. Economists anticipate that a low repo rate may drop down to 5% in the early 2026 in case the inflation is kept low as well as external risks are managed.

Reason why RBI Defied Logic

On October 1, 2025, the RBI’s Monetary Policy Committee (MPC) voted unanimously to hold the repo rate steady. The decision reflects a balancing act between:

- Record-low inflation after food price corrections and the recent GST 2.0 tax rationalisation.

- Stronger-than-expected GDP growth, with Q1 FY26 registering a robust 7.8% expansion.

- External risks from rising U.S. tariffs on Indian exports, which threaten the rupee and trade balance.

Governor Sanjay Malhotra said the RBI was in “a wait-and-watch mode,” preserving space for easing later in the year.

“Room for a rate cut exists, but not without visibility on external and currency dynamics.” – RBI observers

Outlook of Inflation: So Low Does it appear?

The headline CPI inflation in India dropped dramatically to 2.07% in August 2025 in comparison with the previous headlines. There are three large drivers to this disinflation:

- Food price remedies: healthy monsoon season made the prices of vegetable and grain products light.

- GST reforms: The September GST 2.0 has lowered taxes on various consumer goods alleviating the inflation pressure.

- Stable commodities: Chevron oil and import prices constrained pass -through into core inflation.

This caused the RBI to double its FY26 inflation projection to 2.6 as compared to the previous projection of 3.1.

Projections: HO Economy of the World Fast Tracking India.

The economy of India performed unexpectedly in the first quarter of FY26 where the GDP increased by 7.8% as compared to the previous 5 quarters. The growth was general:

- The industry of manufacturing and construction broke out as a result of government investment in infrastructure.

- The services industry did not suffer as much with IT and financial services performing well.

- The rise in private consumption started following GST reductions that reduced consumer prices.

- According to the RBI, more (greater) GDP growth can be seen in FY26 as domestic demand is benefiting it.

Tariffs and External Risks

Domestic conditions are reported to be favorable, but the global trade tensions put a cloud in the outlook. The tariffs on Indian exports into the United States have brought up concerns on:

- Threats to export earnings in textiles, pharmaceuticals and auto-parts.

- Depreciation of the rupee that could contribute to inflation by increasing the import prices.

- Corporate level under-performance in export industries, which affects the quality of credit.

The conservative attitude of the RBI is an indication of the efforts required in checking these risks prior to taking a step forward of reducing the rate.

Market Expectation and Future Action Plan

Prior to the ruling, the survey of economists conducted by the Bloomberg outfit indicated:

- 24 out of 39 economists projected a stand at 5.5%.

- A reduction by 25 basis points was expected by 15 economists.

- A number of analysts are projecting the repo price to drop to 5% by early 2026 when inflation is kept down.

Through the following, the RBI has left a door that could result in a December rate cut open:

- Post GST inflation remains low.

- The rupee is stable under tariff shocks.

- Aggressive inflation does not recover during the festive season.

What This Means for You

Borrowers:

- Rates of home loans as well as business loans can become even less competent as banks broadcast previous RBI discounts.

- Expectation of the borrowers should be low backward EMIs by the beginning of the year 2026 in case the repo decreases again.

Savers and Investors:

- High inflation causes real yields to be compressed, which drives demand to equities and longer-term bonds.

- It would be best that investors strike an equilibrium between fixed-income exposure and growth-oriented assets.

Businesses and Exporters:

- Cuts in GST will positively affect domestic demand and reduce inflation.

- Exporters have to prepare to respond to tariff shocks and to diversify rapidly.

October 2025 policy of RBI Fact Sheet.

- Repo Rate: 5.50% (unchanged)

- Projection of Inflation (FY26): 2.6 (previously 3.1)

- GDP Growth (Q1 FY26): 7.8 (five-quarter high)%age.

- Cash Reserve Ratio (reduced June 2025): reduced as a way of freeing up liquidity.

- US Tariff Effect: Export risks and rupee stability risks.

- Outlook: Repo has a chance to drop to 5% cycle based on stability.

Closing Analysis

The decision of the RBI in October 2025 promises a wise middle way. It recognizes a robust Indian growth and its lowest level of inflation ever, and hedges against external shocks caused by tariffs. With the rupee staying constant and inflation steadily on a downward slide, a rate cut in December 2025 would become progressively more likely.

The combination of monetary policies in India, fiscal reforms in GST and new infrastructure spending indicate that the economy is in a better position than others to withstand the headwind in the global economy. Some months on, the future looks like whether India that will make it to 2026 on repo rates of between 5, which will be adaptable to provide a new impetus on credit, investing, and consumer confidence.