Money Bills frequently appear in news during budget sessions, parliamentary debates, constitutional challenges, and judicial scrutiny. Despite being a core concept of Indian Polity, many aspirants find the idea of a Money Bill confusing due to its technical nature and evolving constitutional interpretation.

This article explains the concept of a Money Bill in simple yet exam-ready language, covering its constitutional basis, procedure, importance, controversies, differences from other Bills, and relevance for aspirants, followed by short notes and MCQs.

Why Is the Money Bill in News?

Money Bills often become headline topics during:

- Union Budget sessions

- Passage of taxation or welfare legislation

- Disputes between Lok Sabha and Rajya Sabha

- Supreme Court cases questioning parliamentary procedure

In recent years, several legislations were passed as Money Bills, leading to allegations that the government used this route to bypass the Rajya Sabha, where it did not have a majority. This raised fundamental questions about:

- Bicameralism

- Federal balance

- Separation of powers

- Role of the Speaker

- Judicial review of parliamentary decisions

For exam preparation, aspirants must focus not on political opinions but on the constitutional framework, procedure, implications, and debates surrounding Money Bills.

What Is a Money Bill?

A Money Bill is a special category of Bill in the Indian Parliament that deals exclusively with financial matters concerning the revenue and expenditure of the Union government.

In simple words:

If a Bill deals only with how the government raises money or spends public money, it may qualify as a Money Bill.

This exclusivity is the most important feature. The presence of any non-financial provision disqualifies a Bill from being a Money Bill.

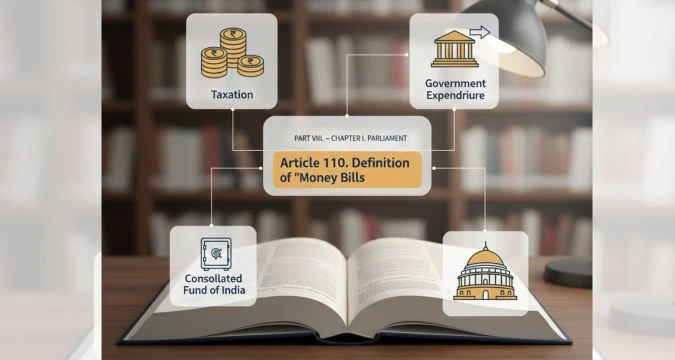

Constitutional Provision Related to Money Bill

The concept of a Money Bill is defined under Article 110 of the Indian Constitution.

Article 110 lays down:

- What constitutes a Money Bill

- The matters that can be included

- The authority to certify a Money Bill

This article is frequently tested in UPSC Prelims and Judiciary exams.

Matters Covered Under a Money Bill (Article 110)

According to Article 110(1), a Bill is deemed to be a Money Bill if and only if it contains provisions dealing only with one or more of the following matters:

1. Taxation

- Imposition

- Abolition

- Remission

- Alteration

- Regulation of any tax

2. Government Borrowing

- Regulation of borrowing by the Union government

- Giving guarantees by the government

3. Consolidated Fund of India

- Custody of the Consolidated Fund

- Withdrawal of money from the Consolidated Fund

4. Appropriation of Funds

- Appropriation of money out of the Consolidated Fund of India

5. Charged Expenditure

- Declaration of any expenditure as charged on the Consolidated Fund

6. Audit and Accounts

- Receipt of money into the Consolidated Fund or Public Account

- Audit of government accounts

7. Incidental Matters

- Any matter incidental to the above financial provisions

⚠ Exam Alert:

If a Bill includes even one non-financial clause, it cannot be classified as a Money Bill.

Who Decides Whether a Bill Is a Money Bill?

The Speaker of the Lok Sabha has the authority to decide whether a Bill is a Money Bill.

Key Points:

- The Speaker’s certificate is endorsed on the Bill

- Traditionally considered final

- Mentioned under Article 110(3)

Judicial Evolution:

While earlier judgments treated the Speaker’s decision as final, recent constitutional debates suggest that limited judicial review may be possible if there is:

- Constitutional violation

- Mala fide intention

- Colorable exercise of power

This evolution makes the topic highly relevant for UPSC Mains (GS II).

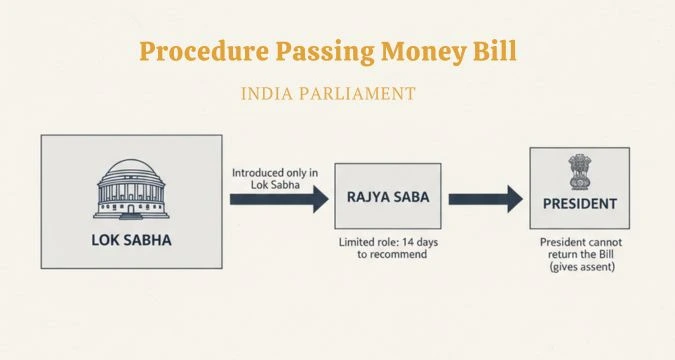

Procedure for Passing a Money Bill

The procedure of a Money Bill is significantly different from an Ordinary Bill, mainly because of the restricted role of the Rajya Sabha.

Step 1: Introduction

- A Money Bill can be introduced only in the Lok Sabha

- Introduction requires prior recommendation of the President

Step 2: Lok Sabha Approval

- The Bill is debated and voted upon

- Passed by a simple majority

Step 3: Rajya Sabha’s Role

- Sent to Rajya Sabha for recommendations

- Rajya Sabha cannot amend or reject the Bill

- Must return it within 14 days

Step 4: Deemed Passage

- If Rajya Sabha does not return the Bill within 14 days, it is deemed passed

Step 5: Presidential Assent

- Sent to the President for assent

- The President cannot return a Money Bill for reconsideration

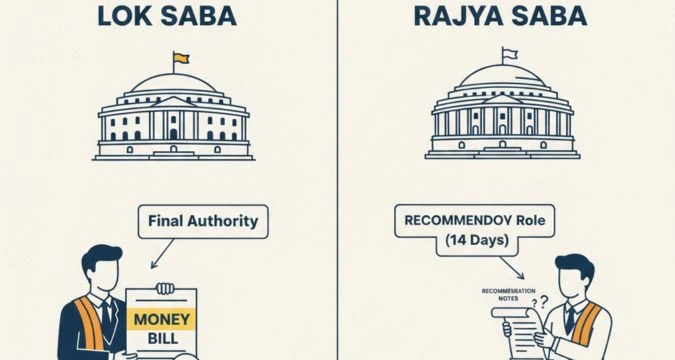

Why Is the Role of the Rajya Sabha Limited?

The framers of the Constitution limited the powers of the Rajya Sabha over Money Bills to ensure:

- Democratic Accountability

- Lok Sabha directly represents the people

- Control Over Taxation

- Those who pay taxes must control taxation laws

- Executive Responsibility

- The government is accountable to the Lok Sabha

This principle reflects the democratic idea of:

“No taxation without representation.”

Money Bill vs Financial Bill

This is a high-frequency exam question.

| Aspect | Money Bill | Financial Bill |

| Constitutional Article | Article 110 | Article 117 |

| Introduction | Only Lok Sabha | Lok Sabha |

| President’s Recommendation | Mandatory | Mandatory |

| Rajya Sabha Powers | Only recommend | Can amend or reject |

| Speaker’s Certification | Mandatory | Not required |

| Scope | Only financial matters | Financial + non-financial |

| Return by President | Not allowed | Allowed |

Money Bill vs Ordinary Bill

| Feature | Money Bill | Ordinary Bill |

| House of Introduction | Lok Sabha only | Either House |

| Rajya Sabha Powers | Limited | Equal |

| Speaker Certification | Required | Not required |

| President’s Recommendation | Mandatory | Not mandatory |

| Subject Matter | Financial only | Any subject |

Importance of Money Bill in Parliamentary Democracy

1. Financial Control

Ensures parliamentary oversight over taxation and expenditure.

2. Executive Accountability

Prevents financial decisions without legislative approval.

3. Democratic Supremacy

Strengthens the role of the directly elected House.

4. Efficient Governance

Prevents legislative deadlock over budgetary matters.

Controversies Surrounding Money Bills

In recent years, concerns have emerged regarding:

- Passage of complex laws as Money Bills

- Inclusion of non-financial provisions

- Marginalisation of the Rajya Sabha

- Erosion of bicameralism

Constitutional Concerns:

- Weakening of federal structure

- Concentration of power in Lok Sabha

- Reduced deliberation

Judicial Scrutiny:

Courts have examined:

- Whether Speaker’s certification is absolute

- Whether misuse violates constitutional morality

Summary

A Money Bill is a constitutionally defined financial legislation that grants primacy to the Lok Sabha in matters of taxation and public expenditure, making it central to India’s parliamentary democracy and competitive exam preparation.

MCQs on Money Bill

Q1. Money Bill is defined under which Article of the Constitution?

- Article 109

B. Article 110

C. Article 111

D. Article 117

✅ Answer: B

Q2. Who certifies a Bill as a Money Bill?

- President

B. Prime Minister

C. Speaker of Lok Sabha

D. Finance Minister

✅ Answer: C

Q3. Which House can introduce a Money Bill?

- Rajya Sabha

B. Lok Sabha

C. Either House

D. Joint Session

✅ Answer: B

Q4. Rajya Sabha can delay a Money Bill for a maximum of:

- 7 days

B. 10 days

C. 14 days

D. 30 days

✅ Answer: C

Q5. Which of the following is NOT a feature of a Money Bill?

- Speaker certification

B. Equal powers of both Houses

C. President’s recommendation

D. Lok Sabha supremacy

✅ Answer: B

Q6. The President can return a Money Bill for reconsideration.

- True

B. False

✅ Answer: B

Q7. Which principle justifies Lok Sabha’s primacy over Money Bills?

- Federalism

B. Judicial review

C. No taxation without representation

D. Rule of law

✅ Answer: C