Why Inflation Feels Personal for India’s Middle Class

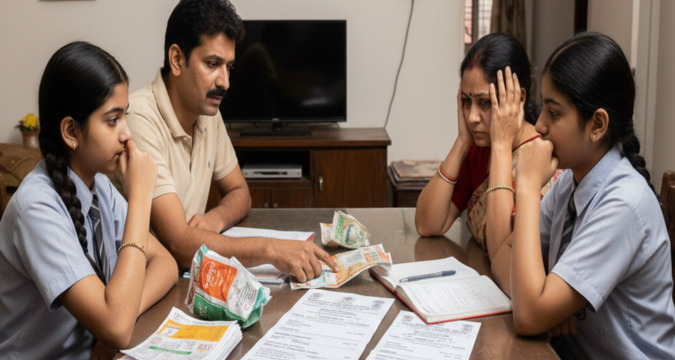

Inflation is often discussed in abstract terms, percentages, policy statements, macroeconomic indicators. But for India’s middle-class households, inflation is not an academic concept. It is experienced every month, sometimes every week, through grocery bills, school fees, rent, medical expenses, and fuel costs.

In recent years, inflation has remained a persistent concern despite periods of strong economic growth and stable headline numbers. While policymakers track averages, middle-income families feel the uneven pressure of rising prices on everyday essentials, coupled with slower income growth and limited financial buffers.

This matters now more than ever. India’s middle class is expanding in absolute numbers but remains economically vulnerable. Inflation directly influences household consumption, savings behavior, debt levels, and long-term financial security, making it a central issue not only for families but also for the broader economy.

This article explains how inflation affects middle-class households in India, why the impact is often sharper than headline data suggests, and what trends are shaping the inflation experience today.

Read More: GDP in India Explained

Understanding Inflation in Practical Terms

Inflation refers to a sustained increase in the general price level of goods and services over time. When inflation rises, the purchasing power of money falls, each rupee buys less than before.

For households, inflation is not uniform. Price increases vary across categories such as food, housing, healthcare, education, and transport. Since middle-class families spend a large share of their income on these essentials, even moderate inflation can significantly alter household budgets.

Key characteristics of inflation that matter to households include:

- Persistence, not just short-term spikes

- Category-specific inflation, especially food and services

- Mismatch between income growth and price growth

Inflation becomes problematic when household incomes do not keep pace with rising costs, leading to real income erosion.

The Middle Class in India: A Unique Economic Position

India’s middle class occupies a distinct economic space. It is neither insulated like high-income groups nor supported by extensive subsidies like lower-income households.

Typical features of middle-class households include:

- Dependence on salaried or small business income

- Limited access to inflation-indexed income

- Significant expenditure on education, housing, and healthcare

- Aspirations tied to upward mobility and asset creation

This combination makes inflation particularly disruptive. Unlike businesses, households cannot easily pass on higher costs. Unlike wealthier groups, they often lack diversified assets that benefit from inflationary periods.

Read More: How RBI Controls Inflation Explained in Simple Terms

How Inflation Affects Household Budgets

Rising Cost of Essentials

Food inflation is one of the most visible pressures. Items such as vegetables, pulses, cooking oil, and dairy products tend to experience frequent price volatility. Even small increases add up over monthly consumption.

Beyond food, other essentials have seen steady increases:

- Electricity and water charges

- Public and private transport costs

- Household services and maintenance

Since these expenses are non-discretionary, families have little room to adjust without sacrificing quality of life.

Housing and Rent Pressures

Urban middle-class households face rising housing costs, either through rent increases or higher loan-related expenses. Property taxes, maintenance charges, and utility costs add to the burden.

For those with home loans, changes in interest rates, often influenced by inflation conditions, can directly increase monthly outgo.

Education and Healthcare: The Silent Inflation Drivers

Education and healthcare inflation often outpaces headline consumer inflation. School fees, coaching classes, higher education costs, and medical expenses have risen steadily over the years.

Middle-class households typically prioritize these areas, making them unavoidable expenses. The result is budget compression elsewhere, such as reduced discretionary spending or lower savings.

Unlike food inflation, which can fluctuate, education and healthcare costs rarely decline once they rise.

Inflation, Income Growth, and Purchasing Power

A critical issue for middle-class households is the gap between inflation and income growth. Salaried incomes often adjust slowly, typically through annual increments that may not reflect actual cost increases.

When inflation exceeds income growth:

- Real wages decline

- Household purchasing power erodes

- Consumption patterns shift toward essentials

Over time, this weakens demand for discretionary goods and services, affecting broader economic activity and GDP growth.

Impact on Savings and Financial Security

Inflation alters how households save and invest. Traditional savings instruments may struggle to deliver returns that outpace rising prices, reducing real wealth accumulation.

Common household responses include:

- Lower monthly savings rates

- Increased preference for assets perceived as inflation hedges

- Greater reliance on credit to maintain lifestyle

For the middle class, reduced savings can delay long-term goals such as home ownership, children’s education, or retirement security.

Debt and Inflation: A Double-Edged Sword

Inflation interacts with household debt in complex ways. On one hand, inflation can reduce the real value of fixed-rate debt over time. On the other, rising interest rates, often used to control inflation, can increase borrowing costs.

When central banks adjust monetary policy through tools such as the repo rate and reverse repo rate, the transmission to households is indirect but impactful:

- Loan EMIs may rise

- Credit becomes more expensive

- Consumption financed by borrowing slows

Middle-class households, which often rely on loans for housing, vehicles, or education, feel this pressure acutely.

Read More: Common Money Mistake Middle Class Do

Broader Economic Context: Inflation and Growth Trade-offs

Inflation management is closely linked to economic growth objectives. Policymakers aim to balance price stability with growth momentum.

For households, this balance plays out through:

- Employment opportunities

- Wage growth prospects

- Stability in the cost of living

Periods of high inflation can force tighter monetary conditions, slowing economic activity and affecting job security, another source of anxiety for middle-income families.

Current Trends Shaping Inflation’s Impact

Several structural and cyclical factors are shaping how inflation affects India’s middle class today:

Shift Toward Services Inflation

As incomes rise, household spending shifts toward services such as education, healthcare, and personal care, areas where prices tend to rise steadily.

Urban Cost Pressures

Urbanization has increased demand for housing, transport, and infrastructure, pushing up costs in cities where most middle-class households reside.

Global Influences

Energy prices, supply chain disruptions, and currency movements affect domestic inflation, often beyond the immediate control of households or even national policymakers.

Social and Cultural Implications

Inflation does more than strain budgets, it reshapes behavior and expectations.

Middle-class families increasingly:

- Delay major life decisions

- Reassess consumption priorities

- Experience heightened financial stress

Over time, this can alter consumption patterns, reduce discretionary spending, and influence social mobility perceptions.

Common Misconceptions About Inflation’s Impact

“Moderate Inflation Is Harmless”

While moderate inflation may support economic activity, its impact is uneven. For households with fixed or slowly adjusting incomes, even modest inflation can erode living standards.

“Inflation Affects Everyone Equally”

In reality, inflation impacts households differently based on spending patterns, income sources, and asset ownership. The middle class often bears a disproportionate burden.

“Policy Measures Immediately Reduce Household Inflation”

Policy actions take time to transmit through the economy. Households may continue to face high prices even after inflation peaks.

What to Watch Next

Several signals will shape the inflation outlook for middle-class households:

- Trends in food and services inflation

- Wage growth relative to cost increases

- Housing affordability indicators

- Policy responses affecting credit and liquidity

Understanding these signals helps households anticipate pressure points rather than react after budgets are already strained.

Key Takeaways

Inflation affects middle-class households in India in ways that go far beyond official statistics. Rising costs of essentials, education, healthcare, and housing strain budgets, while income growth often lags behind.

The impact is cumulative, influencing savings, debt, consumption choices, and long-term financial security. As India’s economy evolves, addressing inflation’s uneven household impact remains critical for sustaining inclusive growth and middle-class stability.

Frequently Asked Questions

Why does inflation feel higher than official numbers for middle-class families?

Official inflation averages prices across categories, but middle-class households spend more on essentials like food, education, and healthcare, which often rise faster than the overall index. This makes inflation feel more intense at the household level.

How does inflation affect long-term financial planning?

Inflation reduces the real value of savings and increases future costs. For middle-class households, this can delay goals such as retirement planning, higher education funding, or home ownership if income growth does not keep pace.

Does controlling inflation slow economic growth?

Efforts to control inflation can temporarily slow growth by tightening credit and reducing spending. However, stable prices support sustainable growth over the long term by protecting purchasing power and economic confidence.

Why are education and healthcare costs rising faster than other expenses?

These sectors face rising demand, limited supply, and higher input costs. Since households prioritize them, providers can pass on costs more easily, leading to persistent price increases.

What should households monitor to understand inflation trends better?

Households should track price trends in essential categories, wage growth patterns, housing costs, and broader economic signals rather than relying solely on headline inflation figures.

Stay informed on the forces shaping everyday life. Read more in-depth economic explainers and ground-level insights on The Vue Times.