Why IMF, World Bank And WTO Matter Right Now

In an era marked by global economic uncertainty, trade tensions, debt distress in developing countries, and debates over globalization, three institutions frequently appear in headlines and policy discussions: the International Monetary Fund, the World Bank, and the World Trade Organization.

They are often mentioned together, sometimes confused with one another, and occasionally criticised as symbols of global economic power. Yet their mandates, tools, and impacts are fundamentally different. For students preparing for competitive examinations like UPSC, professionals tracking global policy, or citizens trying to understand how international decisions shape national outcomes, clarity is essential.

This article adopts a myth-busting approach. It breaks down what each institution does, how they differ, and why those differences matter in practice. It also places them in the broader context of globalization, current global trends, and future challenges.

Understanding the Global Economic Architecture

After the devastation of the Second World War, the international community recognised that economic instability, protectionism, and uncoordinated policies could lead to conflict. The result was the creation of institutions designed to promote cooperation rather than competition.

- Two of them, the IMF and the World Bank, emerged from the Bretton Woods Conference of 1944.

- The third, WTO, evolved later, in 1995, from the General Agreement on Tariffs and Trade (GATT).

Together, they form the backbone of the modern global economic system, each addressing a different dimension:

financial stability, development, and trade rules.

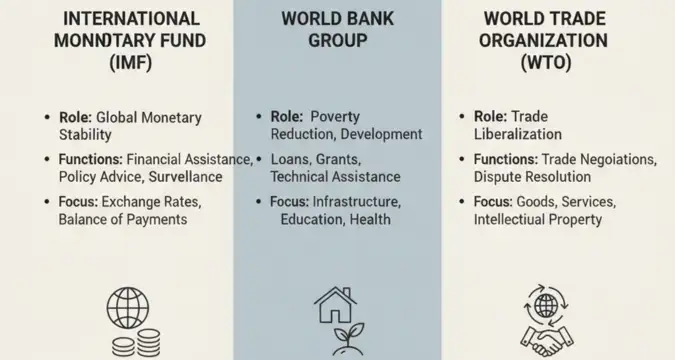

What Each Institution Actually Does

The International Monetary Fund: Guardian of Financial Stability

The IMF is best understood as a crisis manager and policy advisor for the global monetary system.

Primary purpose

- Ensure stability in exchange rates and international payments

- Prevent financial crises from spreading across borders

How it works

- Provides short- to medium-term financial assistance to countries facing balance of payments problems

- Offers policy advice on fiscal discipline, inflation control, and exchange rate management

- Conducts economic surveillance through regular country assessments

Who it serves

- All member countries, but especially those facing currency or debt crises

In simple terms, when a country runs out of foreign exchange and struggles to pay for imports or service external debt, the IMF steps in with temporary support, usually linked to economic reforms.

The World Bank: Development and Poverty Reduction Engine

Unlike the IMF, the World Bank is not about crisis firefighting. Its focus is long-term development.

Primary purpose

- Reduce poverty

- Support economic development and infrastructure growth

How it works

- Provides long-term loans and grants for projects such as roads, schools, healthcare, water supply, and digital infrastructure

- Offers technical expertise and policy guidance for institutional reform

Institutional structure

- International Bank for Reconstruction and Development (IBRD)

- International Development Association (IDA), which supports the poorest countries

In essence, the World Bank finances growth-enabling investments that countries may not afford on their own.

The World Trade Organization: Referee of Global Trade

The WTO governs the rules of international trade.

Primary purpose

- Ensure trade flows smoothly, predictably, and fairly

How it works

- Sets and enforces trade agreements

- Resolves disputes between countries through a legal framework

- Monitors national trade policies

What it does not do

- It does not lend money

- It does not fund development projects

The WTO’s power lies in rules, not resources. It shapes how countries trade with one another.

IMF vs World Bank: Key Differences Explained for UPSC

Although they were born together at Bretton Woods, the IMF and World Bank serve very different functions. Confusing them is common, and costly in exams.

Difference Between IMF and World Bank (Tabular Form)

| Aspect | IMF | World Bank |

| Core Objective | Financial and monetary stability | Long-term economic development |

| Nature of Assistance | Short-term financial support | Long-term loans and grants |

| Focus Area | Balance of payments, currency stability | Infrastructure, poverty reduction |

| Policy Approach | Macroeconomic reforms | Structural and sectoral reforms |

| Time Horizon | Immediate to medium term | Long term |

| Typical Beneficiaries | Countries in crisis | Developing and low-income countries |

In one line:

The IMF stabilizes economies in trouble; the World Bank builds economies for the future.

Difference Between WTO and World Bank

The WTO and World Bank operate in entirely different domains, though both influence globalization.

| Aspect | WTO | World Bank |

| Primary Role | Regulating global trade | Financing development |

| Key Instrument | Trade agreements and dispute settlement | Loans, grants, technical assistance |

| Nature of Power | Legal and rule-based | Financial and advisory |

| Focus | Trade liberalization | Poverty reduction and growth |

While the World Bank may fund a highway project, the WTO influences whether goods produced using that highway can be exported under fair trade rules.

WTO and IMF: Difference in Function and Influence

The IMF and WTO are sometimes grouped together as “economic regulators,” but their tools differ sharply.

- The IMF deals with money, exchange rates, and macroeconomic stability

- The WTO deals with trade rules, tariffs, and market access

They intersect when trade imbalances create financial stress, but their mandates remain distinct.

Role of IMF, World Bank, and WTO in Globalization

Globalization is not driven by markets alone. Institutions shape its pace, direction, and distribution of benefits.

IMF’s Role in Globalization

- Promotes open capital flows and currency convertibility

- Encourages macroeconomic discipline to integrate economies into global markets

World Bank’s Role in Globalization

- Builds infrastructure that connects countries to global supply chains

- Supports institutional reforms that attract investment

WTO’s Role in Globalization

- Reduces trade barriers

- Creates predictable rules that enable cross-border commerce

Together, they lowered barriers to global economic integration, though not without controversy.

Broader Context: Criticism and Debate

These institutions have faced sustained criticism, especially since the late 1990s.

Common concerns

- IMF programs allegedly impose harsh austerity

- World Bank projects sometimes overlook social and environmental costs

- WTO rules may disadvantage developing countries

These critiques have pushed reforms, including:

- Greater focus on social safety nets

- Environmental safeguards

- Special treatment for developing nations in trade rules

Understanding these debates is crucial for nuanced answers in exams and informed public discourse.

Current Trends and Developments

The global economic landscape is changing rapidly.

Shifts in IMF Approach

- Greater flexibility in lending conditions

- Increased attention to inequality and climate risks

World Bank’s Evolving Focus

- Climate finance

- Digital public infrastructure

- Human capital development

WTO at a Crossroads

- Stalled dispute settlement mechanism

- Rising protectionism and trade wars

- Push for reform to address digital trade and sustainability

These shifts reflect a world that is more fragmented, multipolar, and risk-prone than before.

Implications: Why This Matters to Readers

For policymakers, these institutions influence fiscal space and development choices.

For students, clarity can be the difference between average and high-scoring answers.

For citizens, their decisions affect prices, employment, and national policy autonomy.

As explored in a related analysis on how global economic institutions shape domestic policy on The Vue Times, understanding institutional roles helps decode global news beyond headlines.

Common Misconceptions Clarified

Misconception 1: IMF and World Bank do the same thing

They do not. One manages crises; the other funds development.

Misconception 2: WTO controls national trade policy

The WTO sets rules agreed upon by members; enforcement depends on collective compliance.

Misconception 3: These institutions serve only rich countries

While power imbalances exist, most beneficiaries are developing and emerging economies.

What to Watch Next

- Reform of global financial governance

- Greater emphasis on climate-linked financing

- New trade rules for digital services and data flows

Future relevance will depend on how well these institutions adapt to emerging challenges without losing legitimacy.

Key Takeaways

- IMF, World Bank, and WTO serve distinct but complementary roles

- IMF focuses on financial stability

- World Bank drives long-term development

- WTO regulates global trade rules

- Their influence on globalization is significant, contested, and evolving

Understanding these differences is essential for exams, policy analysis, and informed citizenship.

Frequently Asked Questions

Why is understanding the difference between the IMF and World Bank important today?

Economic crises and development challenges often occur simultaneously. Knowing which institution addresses which problem helps interpret global responses accurately. For students and professionals, this clarity improves analytical depth and avoids oversimplified conclusions.

How does the WTO differ from financial institutions like IMF?

The WTO does not lend money or manage crises. Its authority comes from trade agreements and dispute resolution mechanisms. It shapes how countries trade rather than how they manage finances.

Do these institutions still matter in a multipolar world?

Yes, but their influence is evolving. Emerging economies demand greater representation, and reforms are underway. Their relevance now depends on adaptability rather than dominance.

Are IMF programs always harmful to developing countries?

Outcomes vary. Some programs stabilize economies effectively, while others face criticism for social costs. Context, implementation, and domestic policy choices matter greatly.

Will globalization weaken or strengthen these institutions in the future?

As globalization becomes more complex and contested, these institutions may gain relevance, provided they reform governance, address inequality, and respond to new global risks.

Stay ahead of global shifts that shape India’s future. Read more clear, in-depth explainers on The Vue Times.