Introduction: Why Government Borrowing Matters Right Now

Governments around the world are borrowing more, not less. From funding infrastructure and social welfare to managing economic slowdowns and geopolitical shocks, public borrowing has become a central tool of modern governance. Yet for most readers, the mechanics of how a government actually raises money remain abstract.

At the heart of this process are two instruments that quietly shape national budgets, interest rates, and even household savings: Treasury Bills and Bonds. These are not obscure financial products reserved for traders. They are foundational to how states function, how markets price risk, and how citizens ultimately experience economic policy.

Understanding these instruments is no longer optional for students, professionals, or decision-makers. It is an essential context for making sense of fiscal debates, inflation concerns, and long-term economic stability.

This article takes a deep dive approach, breaking down how governments borrow, why these tools exist, how they work in practice, and what they mean for society today and tomorrow.

The Basic Question: Why Does the Government Borrow at All?

At its simplest, government borrowing fills the gap between what the state earns and what it spends.

Governments typically spend on:

- Infrastructure such as roads, railways, and digital networks

- Public services including healthcare, education, and defense

- Welfare programs and subsidies

- Emergency responses to crises, pandemics, or natural disasters

Revenue, on the other hand, comes mainly from taxes, fees, and dividends from public enterprises.

When spending exceeds revenue, borrowing becomes necessary.

Importantly, borrowing is not automatically a sign of mismanagement. Used wisely, it allows governments to:

- Spread the cost of long-term projects across generations

- Stabilize the economy during downturns

- Respond quickly to unexpected shocks

The key question is not whether a government borrows, but how it does so, and on what terms.

Understanding Government Debt Instruments in Plain English

To borrow money, governments issue formal promises to repay. These promises take the form of securities sold to investors.

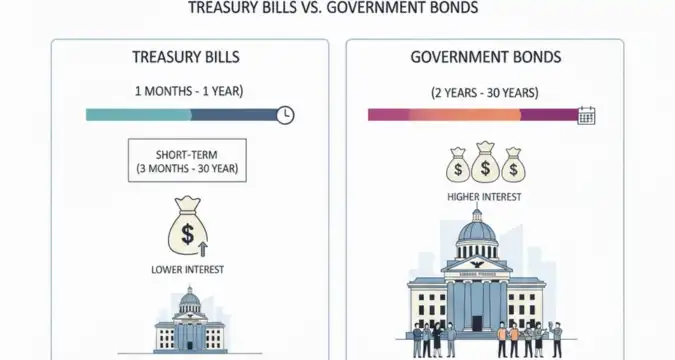

The two most common categories are:

- Short-term instruments, primarily Treasury Bills

- Long-term instruments, commonly referred to as Bonds

Though they serve the same purpose, raising funds, their structure, risks, and economic roles differ significantly.

Treasury Bills: The Government’s Short-Term Borrowing Tool

What Are Treasury Bills?

Treasury Bills, often called T-bills, are short-term debt instruments issued by the government to meet immediate funding needs.

They typically have maturities of:

- 91 days

- 182 days

- 364 days

Rather than paying regular interest, they are issued at a discount and redeemed at face value.

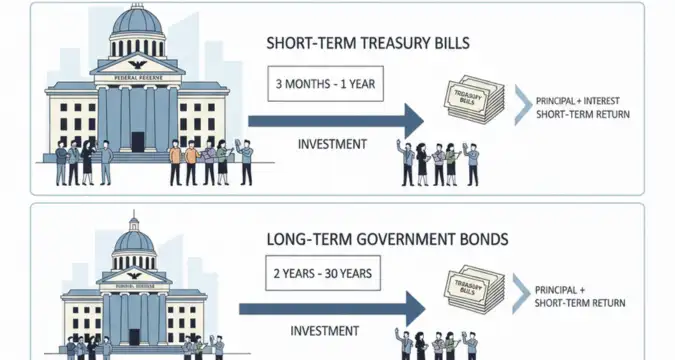

How Treasury Bills Work

Here is a simplified example:

- The government issues a T-bill with a face value of ₹100

- An investor buys it for ₹97

- After maturity, the investor receives ₹100

- The ₹3 difference is the return

This structure makes them straightforward and predictable.

treasuGovernment treasury bills and bonds issuance process illustrated

Why Governments Use Treasury Bills

Treasury Bills are used to:

- Manage short-term cash flow mismatches

- Bridge timing gaps between revenue inflows and expenditures

- Avoid unnecessary long-term borrowing for temporary needs

Because of their short maturity, they carry minimal risk and are considered among the safest financial instruments in an economy.

Bonds: Financing the Long Term

What Are Bonds?

Bonds are long-term borrowing instruments issued by the government for periods ranging from several years to multiple decades.

Common maturities include:

- 5 years

- 10 years

- 20 years or more

Unlike Treasury Bills, bonds typically pay periodic interest, known as a coupon, until maturity.

How Bonds Function in Practice

A typical bond arrangement looks like this:

- The investor lends a fixed amount to the government

- The government pays interest at regular intervals

- At maturity, the original principal is returned

These predictable cash flows make bonds attractive to pension funds, insurance companies, and long-term investors.

Why Governments Issue Bonds

Bonds are suited for:

- Infrastructure projects with long economic lives

- Large-scale reforms requiring sustained funding

- Refinancing older debt at more favorable terms

They help governments lock in funding for extended periods, reducing uncertainty.

Who Lends Money to the Government?

Government securities are not bought by a single group. The investor base is diverse and plays a crucial role in financial stability.

Typical buyers include:

- Commercial banks managing liquidity

- Central banks conducting monetary operations

- Mutual funds and institutional investors

- Pension and insurance funds

- Individual investors seeking low-risk options

This broad participation spreads risk and anchors trust in the financial system.

The Auction Process: How Borrowing Happens Step by Step

Governments do not negotiate privately with lenders. Instead, borrowing happens through transparent auctions.

The process generally involves:

- The government announces the amount and type of security

- Investors submit bids specifying the price or yield they are willing to accept

- The lowest cost bids are accepted first

- Securities are allotted based on auction rules

This market-driven mechanism ensures borrowing costs reflect prevailing economic conditions.

Interest Rates, Inflation, and Government Borrowing

Borrowing costs are closely tied to broader economic forces.

When inflation expectations rise:

- Investors demand higher yields

- Government borrowing becomes more expensive

When growth slows:

- Central banks may lower interest rates

- Demand for safe assets increases

- Borrowing costs may decline

This interplay makes Treasury Bills and Bonds powerful signals of economic sentiment.

A Brief Historical Perspective

Government borrowing is not a modern invention.

Historically:

- War financing accelerated the development of sovereign debt

- Industrialization expanded long-term borrowing needs

- Post-war welfare states normalized persistent public debt

Over time, debt markets became more sophisticated, regulated, and globally interconnected.

Today, government securities form the backbone of financial systems worldwide.

Current Trends Shaping Government Borrowing

Several structural shifts are influencing how governments borrow today.

Rising Debt Levels

Public debt has increased globally due to:

- Pandemic-related spending

- Slower economic growth

- Higher social commitments

This has intensified scrutiny of borrowing strategies.

Changing Investor Expectations

Investors now pay closer attention to:

- Fiscal discipline

- Policy credibility

- Political stability

Borrowing costs increasingly reflect trust in governance, not just economic size.

Greater Market Transparency

Digital platforms and real-time data have made auctions and yields more visible, improving accountability.

Implications for Society and the Economy

Government borrowing affects citizens in indirect but meaningful ways.

Impact on Taxes and Spending

Higher debt servicing costs can:

- Limit future spending flexibility

- Increase pressure for higher taxes

- Crowd out social investment

Impact on Financial Markets

Government securities:

- Serve as benchmarks for other interest rates

- Influence credit availability

- Anchor pension and savings systems

Impact on Intergenerational Equity

Borrowing today shifts some costs to future taxpayers, raising questions of fairness and sustainability.

Common Misconceptions About Government Borrowing

“Borrowing Is Always Bad”

Borrowing can support growth if funds are used productively. The issue is not debt itself, but how effectively it is deployed.

“Treasury Bills and Bonds Are the Same”

They serve different purposes, operate on different timelines, and attract different investors.

“Only Rich Countries Can Borrow Safely”

Credibility, not wealth alone, determines borrowing capacity. Fiscal discipline matters more than size.

What to Watch Next: Signals That Matter

Readers should pay attention to:

- Changes in auction demand and yields

- Shifts in maturity preferences

- Central bank policy signals

- Fiscal policy announcements

These indicators reveal how markets view government credibility and economic prospects.

For deeper context on public finance concepts, readers may also find value in The Vue Times’ explainer on fiscal deficits, which complements this discussion naturally.

Key Takeaways

- Governments borrow to manage spending beyond revenue

- Treasury Bills address short-term funding needs

- Bonds finance long-term commitments

- Borrowing costs reflect economic conditions and trust

- Public debt shapes markets, policy choices, and future generations

Understanding these mechanisms offers clarity on debates that affect everyone, even if the instruments themselves remain largely invisible.

Frequently Asked Questions

Why does government borrowing matter to ordinary citizens?

Government borrowing influences interest rates, inflation management, and future tax policies. Even if individuals never buy government securities, these instruments affect loan costs, savings returns, and public spending priorities. Understanding them helps citizens interpret economic news more accurately and engage with fiscal debates beyond surface-level headlines.

Are Treasury Bills risk-free investments?

They are considered among the safest instruments because they are backed by the government and have short maturities. However, “safe” does not mean high returns. Their value lies in capital preservation and liquidity rather than growth, making them suitable for cautious investors or institutions managing short-term funds.

How do bonds affect long-term economic planning?

Bonds allow governments to fund projects whose benefits extend over decades. This spreads costs fairly across time but also commits future budgets to interest payments. Effective long-term planning requires balancing development needs with sustainable debt levels to avoid limiting future policy choices.

What happens if investors lose confidence in government borrowing?

If confidence declines, investors demand higher yields or reduce participation in auctions. This raises borrowing costs and strains public finances. Sustained loss of trust can force spending cuts or policy adjustments, making credibility a critical asset for any government.

Will government borrowing continue to increase in the future?

Borrowing is likely to remain significant due to demographic pressures, climate adaptation costs, and infrastructure demands. The focus is shifting from how much governments borrow to how strategically and transparently they manage debt over time.