How Startups Actually Start in India – Series | The Vue Times

Why This Distinction is More Important in India Than Everywhere Else

In India, the debate on how a startup is started is not aesthetic. It is structural.

Bootstrapped and venture-funded startups do not merely differ in capital source; they diverge in decision-making speed, founder psychology, market selection, risk tolerance, governance, and even ethics.

Globally, often, this difference is talked about in more abstract terms. In India, it is very much (em) down to earth.

Most of the Indian founders start with:

- Limited personal capital

- Weak safety nets

- Family obligations

- Highly Price Sensitive Customers

- Infrastructure constraints

- Regulatory friction

These realities make the way of initiating more consequential than the idea itself.

This article examines how bootstrapped and venture-funded startups actually begin in India, based not on pitch decks or success stories, but on lived founder behaviour, operational trade-offs, and structural incentives.

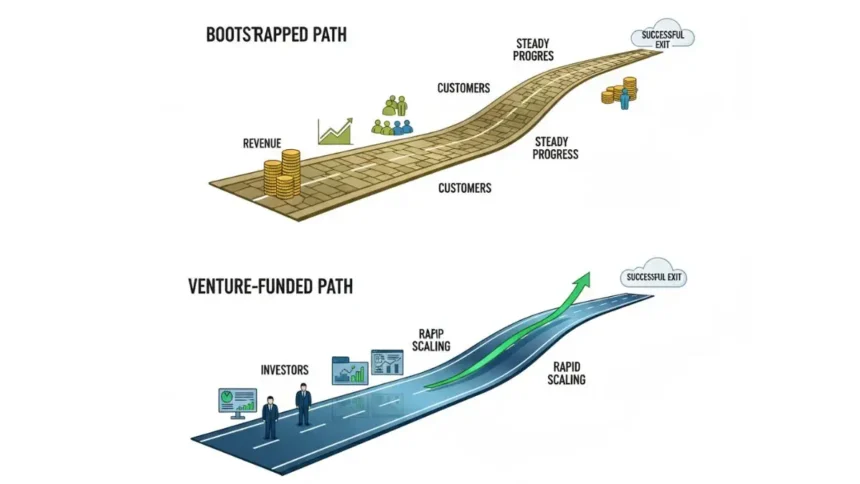

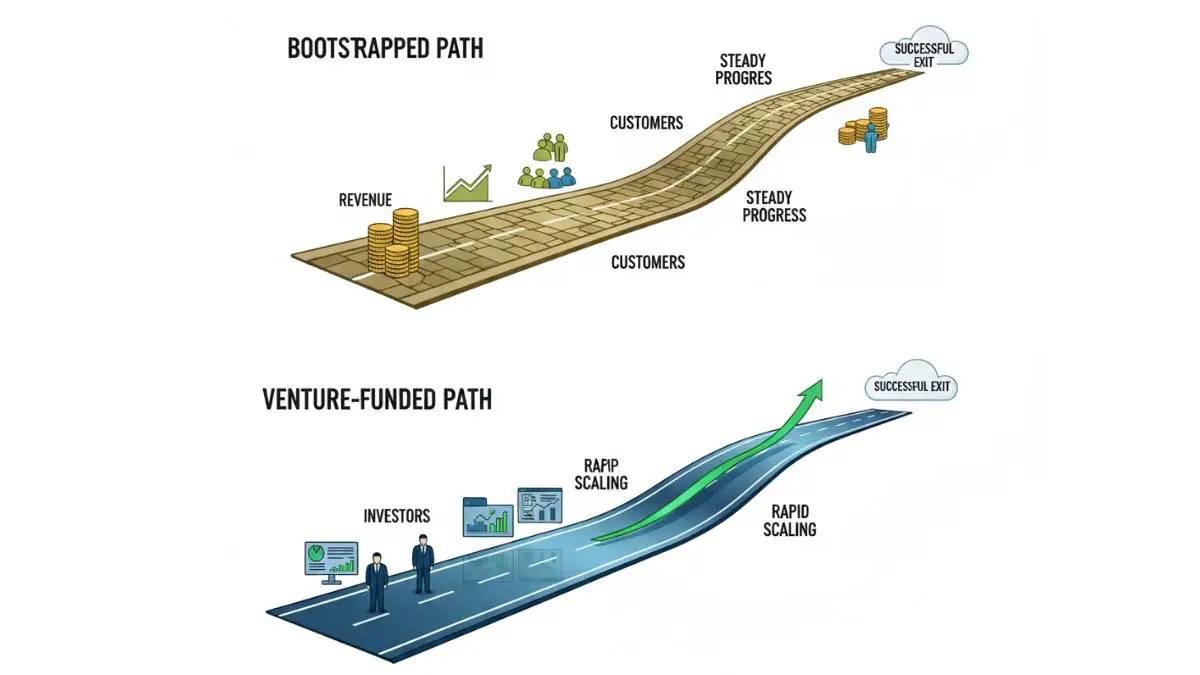

Two Starting Lines, Not Two Labels

“Bootstrapped” and “venture-funded” are frequently used as terms used after the fact.

And, in reality, they are beginning lines that influence everything that follows.

A startup bootstrapped in the beginning of the company, starts with:

- Personal savings OR operating cash flow

- Immediate revenue pressure

- Founder-controlled decision-making

- Incremental expectations for growth

A venture funded startup starts with:

- External capital

- Predefined growth narratives

- Investor accountability

- Time-bound milestones

From day one these startups are living in different economic universes.

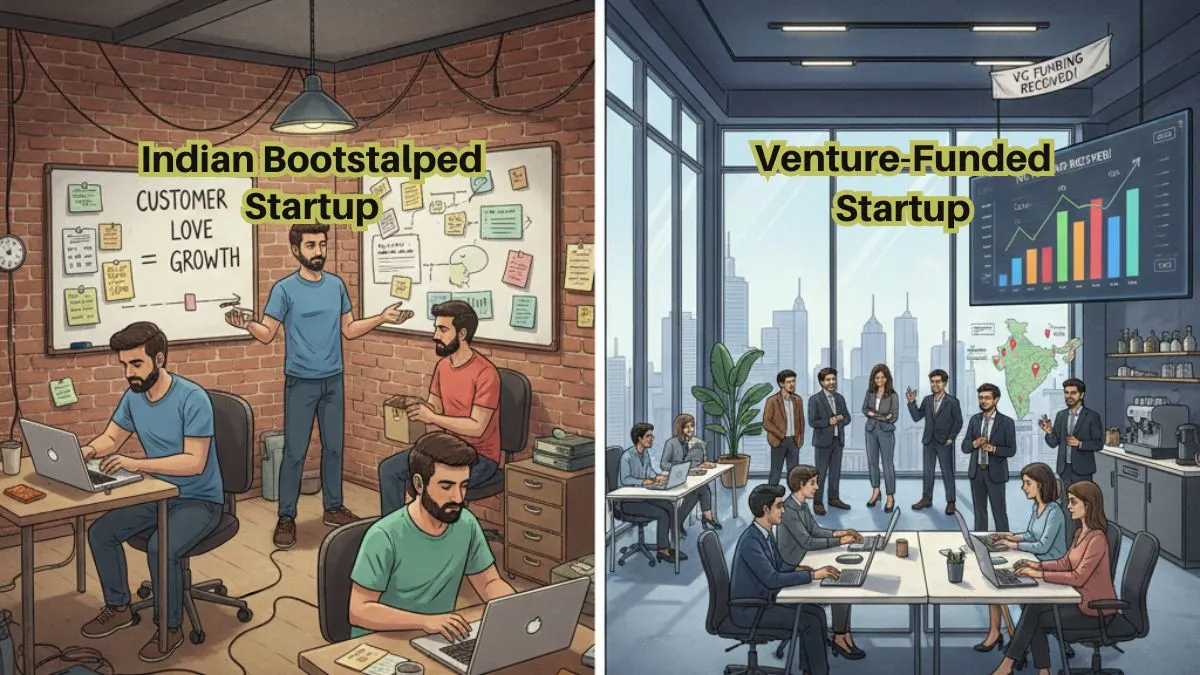

The Bootstrapped Founder’s Mentality: Get your Company to Survive, not Scale

Capital as a Scarcity Not as a Weapon

Indian bootstrapped founders do not “choose” frugality as a philosophy.

They get in the way and exercise it as a constraint.

Typical early questions are:

- Can this be a revenue-generating feature now?

- With this hire, will the burn of cash decrease immediately?

- Can the founder play this role instead?

Every expense is considered not in terms of elegance, but on a cash basis.

This creates a mindset where:

- Revenue is validation

- Customers are the most important feedback loop

- Failure is individual, not remotely

The Psychological Burden of Ownership

Bootstrapped founders are likely to carry:

- Personal debt exposure

- Family expectations

- Reputation Risk in Intimate Networks

This leads to:

- Slower decision-making

- Conservative expansion

- Reluctance to pivot drastically

But it also creates:

- Deep customer intimacy

- High accountability

- Strict operational discipline

In India bootstrapping is less of an independence, more a risk containment.

The Venture Funded Founder’s Mindset: Momentum Before Margin

Capital as a Strategic Tool

For venture funded startups, capital is not just funding; it is the product being leveraged.

Early questions are different sounding:

- How fast can we acquire users?

- What story supports the next round?

- Which Metric WillInvestors Tracking This Quarter?

This mindset prioritizes:

- Speed over certainty

- Scale over efficiency

- Market positioning Vs. profitability

Psychological Separation from Failure

Venture funding provides for shared risk.

Although there is still pressure on founders, failure is often:

- Financially distributed

- Socially normalized

- Professionally recoverable

This allows for:

- Aggressive experimentation

- Frequent pivots

- Risky market bets

In the ecosystem of India, while this can bring innovation, it can also have the opposite effect of camouflaging weak fundamentals.

How Ideas are Chosen Differently

Bootstrapped Idea Selection: Revenue-Proximate Problems

Bootstrapped founders prefer to pick:

- Problems that they understand personally

- Markets with Immediate Paying Customers

- Solutions that can be sold early

Common traits:

- B2B services turning into products

- Niche SaaS

- Localized platforms

- Operational tools

These sorts of ideas rarely are “headline-grabbing” but are cash-aligned.

Venture Backed Idea Selection: Market Narratives

Venture-backed notions can often be found coming from:

- Global trend replication

- Market-size storytelling

- Platform or ecosystem logic

The emphasis is on:

- TAM (Total addressable market)

- Category creation

- Scalability potential

In India, this can mean:

- Importing models without local fit

- Overstating willingness to pay

- Underestimating execution friction

The concept may have to be validated by investors before customers.

Hiring: Capability vs Optics

Bootstrapped Hiring: The Utility Over Credentials

Existing boot startups hire for:

- Immediate execution

- Multi-role capability

- Cost flexibility

Degrees, brands and titles play less of a role than:

- Problem-solving ability

- Willingness to adapt

- Long-term commitment

Founders themselves are very operational – often putting off senior hires.

Venture-Funded Hiring: Signalling and Scale

Venture backed startups recruiting early to:

- Signal seriousness

- Build teams rapidly

- Prepare for scale

This can lead to:

- High fixed costs

- Role redundancy

- Cultural fragmentation

In India, where hiring talent at scale is iffy, there are hidden risks in this approach.

Product Development: Push or Pull

Bootstrapped Products Being Towed by Customers

Bootstrapped startups:

- Build incrementally

- Prioritize paid features

- Respond closely to the feedback of users

Roadaps are flexible based on:

- Sales conversations

- Support tickets

- Churn reasons

The product changes as a commercial instrument.

Venture Funded Products Are Forced Into Markets

Venture-funded startups:

- Build towards a long-term vision

- To invest massively in UX and branding

- Delay monetization

Product decisions are determined by:

- Investor expectations

- Competitive positioning

- Growth narratives

This can result in innovation, but also feature bloat and low depth of use.

Growth: Organic Constraining vs Artificial Accelerating

Bootstrapped Growth: Is Earned Uneven

Growth in bootstrapped Startups =:

- Slower

- Regionally concentrated

- Operationally grounded

It depends on:

- Word of mouth

- Repeat customers

- Sales efficiency

This growth is often durable, but not so visible.

Venture Funded Growth: Bought and Measured

Venture backed-growth : this often involves:

- Paid acquisition

- Discounts and incentives

- Aggressive expansion

Metrics are more important than margins.

Where price is sensitive in the Indian markets, this can:

- Inflate user numbers

- Distort product-market fit

- Delay sustainability

Governance and Control

Bootstrapped Governance: Reality of the Founder Led

Bootstrapped startups do business with:

- Minimal formal governance

- High founder autonomy

- Informal processes of decision making

This allows speed but risks:

- Blind spots

- Over-centralization

- Burnout

Venture Governance: Organizational Accountability

Venture funding introduces:

- Board oversight

- Reporting discipline

- Pressure for strategic alignment

This can improve:

- Transparency

- Strategic clarity

But it can also:

- Reduce founder flexibility

- Favor exits over endurance

Exit Thinking: Optional or Mandatory

Bootstrapped Exit Logic

BootStrapped founders tend to think in terms of:

- Cash flow

- Long-term ownership

- Sustainable income

Exits are an option not an assumption.

Venture Exit Logic

Venture funded startups need to:

- Target liquidity events

- Fit fund timelines

- Optimize the outcomes of valuations

This influences choices from at the beginning stages and often happens unconsciously.

Hybrid Paths: The Reality of the Indians

Many Indian startups start out with bootstrapping and then go on to raise money.

This transition does not occur without problems.

Common friction points:

- Cultural shift

- Loss of control

- Metric redefinition

Founders with the highest success here know:

- Why they are raising

- What they are trading

- What they refuse to lose

What Should Be Understood by Serious Founders, Students

This is not a moral debate.

It is a structural analysis.

Bootstrapping rewards:

- Discipline

- Patience

- Deep market understanding

Venture funding rewards:

- Speed

- Narrative control

- Risk tolerance

Neither guarantees success.

Both have costs – financial, psychological, and strategic.

Adam here asks an analysis question to help the group make an embedded grounded conclusion.

In India, the startups have not failed because they opted for bootstrapping or venture funding.

They fail because the founders misjudge the constraint into which they are being placed.

Bootstrapping constrains:

- Speed

- Visibility

- Optionality

Venture funding constrains:

- Autonomy

- Profit timelines

- Strategic freedom

The critical question is not:

“Which path is better?”

But:

“Based on my thinking, deciding, and enduring, which set of pressures do I”

At The Vue Times, we don’t look at startups as inspirational tales but rather as economic systems that are affected by incentives.

Understanding how they actually get started is the first step to understanding why so many don’t do well and why a few simply go silently.

Part of the Ongoing Series

How Startups Are Getting Started in India

A business intelligence perspective from The Vue Times

Frequently Asked Questions

1: Is bootstrapping more realistic than venture funding of Indian startups?

Yes– bootstrapping will be structurally realistic at the start with most Indian start ups. The shortage of access to early-stage capital, extended sales cycles, and price-sensitive clients typically require the company to grow revenue first before the external funding can be raised. The financing of the venture is open to a small group of startups that meet particular scale and story criteria.

2: Are venture funded startups in India more likely to fail than bootstrapped ones?

Both models have high rates of failure yet venture-funded startups fail in different ways. They usually overstep the scale prematurely, they overestimate the readiness of a market, or they burn money without attaining unit economic sustainability. Bootstrapped startups fail in less notorious ways, typically because of slow growth or founder burnout, as opposed to implosion.

3: Is it possible to have a bootstrapped company raise venture capital in India at a later date?

No, and several of them do–but change does not come naturally. There is a difference between how investors will view bootstrapped startups, and they look at the quality of the revenue, prices, and repeatability of the startups as opposed to growth alone. Including the raise of capital, founders should be ready to change the governance of changes in the expectation of growth and control.

4: What model will provide founders with more control in the Indian ecosystem?

Bootstrapping establishes the highest level of operational and strategic control, particularly during their first couple of years. Venture financing brings in common control in terms of boards, reporting and rights of the investor. This loss of flexibility can have a significant impact in India where markets can tend to change in unforeseen ways.

5: What is the best choice between bootstrapping and funding by first-time founders in India?

The move and course of action should be evidenced by the individual risk tolerance, market forces, and type of business rather than trends. There may be a need to fund capital-intensive, winner-take-most markets. Niche or operational types of businesses which are revenue driven are usually better to bootstrap. The attempt to make the wrong decision tends to increase the pressure instead of diffusing the problems.