Types Of Startups In India: How Startups Actually Start in India

“The Myth of a One Time “Startup Journey”

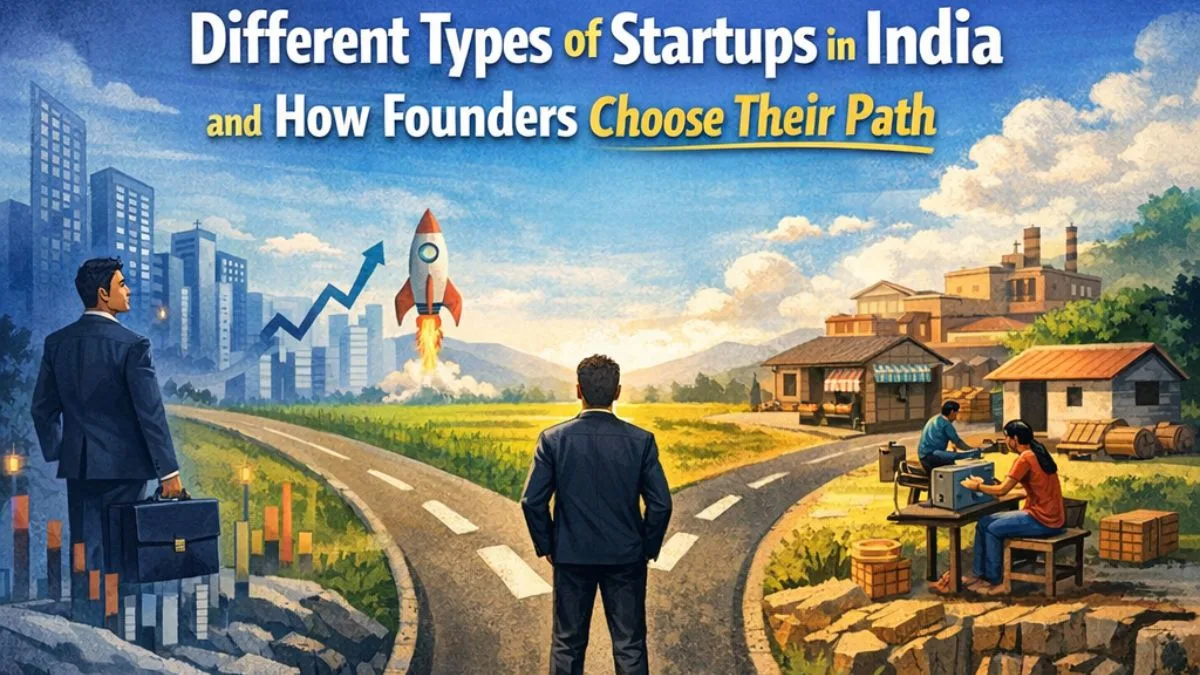

In India, the word startup has been flattened down to a caricature. Popular narratives pare it down to pitcher decks, venture capital rounds, LinkedIn announcements, and an ambiguous promise of “disruption.” In fact, Indian startups are not born out of one template. They are responses to constraints – economic, cultural, regulatory and deeply personal.

This article looks at Different Types Of Startups In India and how startups really do start in India, not at the theory but in the practice. It is a focus on the various types of startups that arise; the ways of thinking of founders behind them; the trade-offs that unflinchingly forge their way long before being seen or funded.

This is not a motivational guide. It is an analytical map for people who are founders, operators, serious students – people who want to understand why Indian startups look the way they do – whether they are founders, analysts, or students.

How The Indian Founders Actually Choose A Startup Path

Before categorizing startups, it’s vitally important to know how founders make their decisions. Contrary to popular belief, most Indian founders do not “choose” an idea out of a menu of opportunities. Their path is shaped by:

- Personal constraints: income of family, educational debt, visa, location

- Exposure: access to industry knowledge, networks or operational insight

- Risk tolerance: Financial Runway Social Safety nets Age Dependent?

- Institutional friction: the regulation, compliance, market opacity

- Time horizon: Need to earn FAST vs need to build SLOW

As a result, Indian startups tend to fall into different categories of behaviour, less so because that is how the founders planned it to be, more the case that circumstances made a particular model imperative.

Bootstrapped Services Startups: The Indian Default

What They Are

These are service-led businesses – IT service, digital marketing, consulting, design, compliance support, staffing – where the starting point is revenue-first logic. They can be afterwards productized, but they are service based at the beginning.

Why Founders Decide to Take This Path

For many Indian founders, this is not by choice – it is the only viable entry point. Services startups require:

- Minimal upfront capital

- Skills that are already possessed by the founder

- Immediate cash flow

- No dependency on investors

This model prevails in India because it does coincide with middle class survival economics.

Founder Mindset

Founders here make decisions in terms of:

- Monthly expenses

- Client acquisition speed

- Payment cycles

- Utilization rates

They almost never talk about “vision” at a young age. They have an operational, rather than aspirational language.

Trade-offs

Advantages

- Financial independence

- Early customer exposure

- Operational discipline

Costs

- Linear scaling

- Founder burnout

- The difficulty in transitioning to products

- Lower public visibility

Many Indian unicorn founders started here, but only after doing years of grime work.

Lifestyle Startups: It’s Stability Not Scale

What They Are

Lifestyle startups are businesses that are optimized for predictable income and founder autonomy instead of exponential growth. Examples of this are niche saas tools, specialized market places, training or local aggregators.

Why Founders Decide to Take This Path

Founders usually go this route when:

- They have past corporate or freelance experience

- They believe in controlling growth

- They distrust pressure from venture capital

- They strive for sustainable personal income

In India this model is typical of second-time founders or professionals in their thirties and forties.

Founder Mindset

These founders are pragmatic. They ask:

- Will this business be able to support my family?

- Can it operate without ceaseless firefighting operating?

- Can I be slow growing and no one is interfering?

They shy away from media attention on purpose.

Trade-offs

Advantages

- Founder control

- Lower stress

- Predictable economics

Costs

- Limited scale

- Minimal recognition of ecosystem

- Fewer exit options

This way often goes unheard of but makes perfect economic sense.

Venture-Scale Tech Startups: The Outliers.

What They Are

These are startups that are logic venture capital based day 1 – SaaS, fintech, healthtech, deep tech, consumer platforms.

Why Founders Decide to Take This Path

Despite the focus on them, these startups are a minority. Some of the qualities frequently found in founders here are:

- Elite education / or corporate backgrounds

- Exposure to Start-upunnel-lynominated global ecosystems

- Access to early networks

- High risk tolerance

In many cases, founders don’t choose venture scale, their background channels them into it.

Founder Mindset

These founders think in:

- TAMs and growth curves

- Hiring velocity

- Capital efficiency

- Signaling to investors

They embrace dilution and loss of control as the cost of speediness.

Trade-offs

Advantages

- Rapid scaling

- Global ambition

- Media and ecosystem support

Costs

- Investor dependency

- Shortened decision cycles

- High failure pressure

- Strategic rigidity

Most venture-scale startups fail, not because startups are incompetent but because the margin for error is thin.

Regional/Vernacular Startups: Solving Non-Metro India.

What They Are

These startups target Tier-2 and Tier-3 markets and the rural market, often vernacular language and offline-online.

Why Founders Opt for this Path

Founders here often:

- Come from non-metro backgrounds.

- Know Inefficiencies at the local Level

- See ignored demand

- Are sceptical of metro-centric solutions

This category has gone up quietly with smartphone penetration.

Founder Mindset

These founders think in:

- Distribution logistics

- Trust-building

- Unit economics at low price points

- Cultural nuance

Technology used itself is a tool, and not the product

Trade-offs

Advantages

- Large underserved markets

- Low competition

- Strong local defensibility

Costs

- Slower scaling

- Infrastructure challenges

- Investor skepticism

- Lower ARPU

This is a path where patience and a deep understanding of context are required.

Founder-Led Manufacturing and D2C Startups: Capital Intensive Fact:

What They Are

These startups are around physical goods – manufacturing, consumer brands, private-label, food processing, textiles, electronics.

Why Founders Opt for This Path

Often driven by:

- Family business exposure

- Industry-specific knowledge

- Supply chain access

- Desire to be moving up the value chain

This is not the path that first-time tech founders typically take.

Founder Mindset

These founders are based on:

- Inventory cycles

- Working capital management

- Vendor negotiations

- Compliance and logistics

Growth is tangible, but slower.

Trade-offs

Advantages

- Real assets

- Brand loyalty

- Market differentiation

Costs

- High capital requirements

- Thin margins

- Operational complexity

- Regulatory friction

This is one of the most challenging startup routes in India and one of the least romanticised ones.

Government Adjacent and Compliance Driven Startup.

What They Are

Startups that are policy gap oriented and focus on compliance complexity or public systems – GST software, legal-tech, agritech with schemes, edtech with exams.

Why Founders Decide To Take This Path

Founders here often:

- Have policy / bureaucratic exposure

- Identify friction others skirt

- Understand sluggish yet sticky markets

Founder Mindset

They optimize for:

- Reliability over speed

- Relationships vs. branding

- Long-term contracts

- Risk mitigation

Trade-offs

Advantages

- High switching costs

- Stable demand

- Institutional trust

Costs

- Long sales cycles

- Policy dependency

- Slow innovation cycles

This path is a disruptive reward for patience and regulatory literacy.

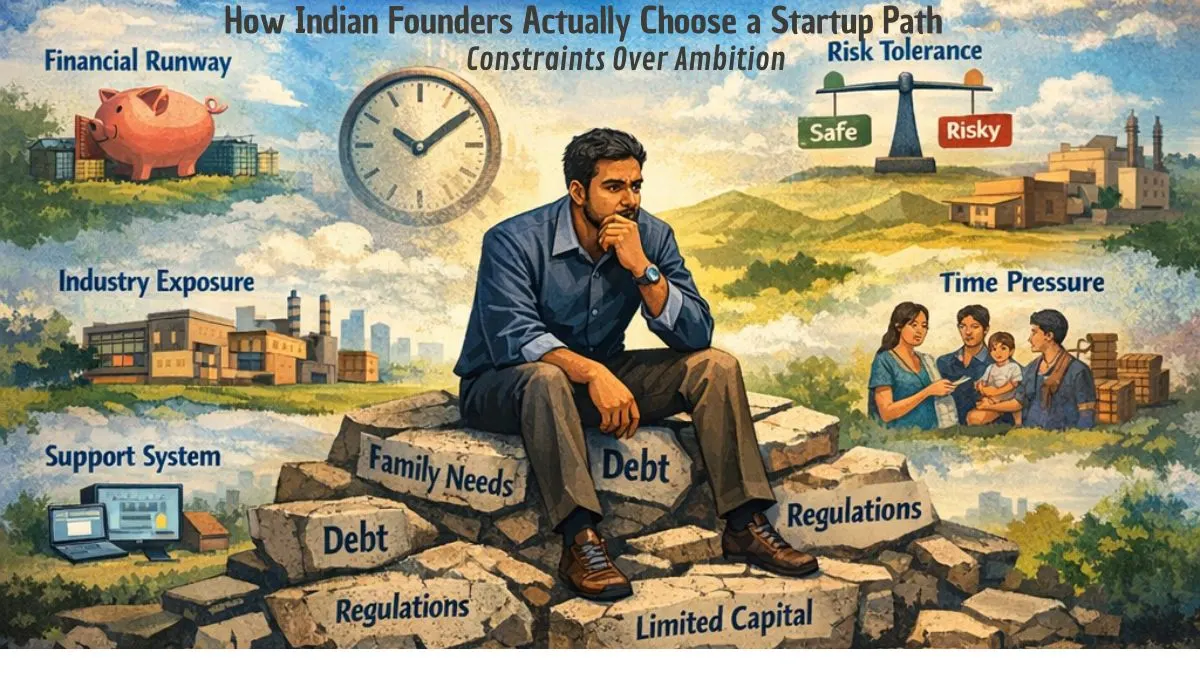

How Founders Make Decisions: A Framework of The Real World

Indian founders do not often ask the questions like “what kind of startup to build”.

They ask:

- Leaving the Cupboard Bare How Long Can I Survive Without Income?

- Who will support me in case this fails?

- What do I already know?

- What risks can I absorb?

Their kind of startup comes out of constraint navigation, not ambition.

Why the Ecosystem Is a Poor Representation of Startup Diversity

The Indian startup ecosystem unwarranted focuses on:

- Venture-funded tech

- English-speaking founders

- Metro-based stories

- High-valuation narratives

This causes a distorted perception that:

- Other paths to start-up are inferior

- Bootstrapping is a fallback

- Services are not “real startups”.

In reality, most sustainable businesses in India are invisible to startup media.

The Hidden Cost of Taking the Wrong Route

Founders who fail to match their startup type with its reality face:

- Financial stress

- Strategic paralysis

- Burnout

- Premature shutdowns

A services founder who is chasing the venture scale often collapses.

A founder of a venture looking to feel good becomes frustrated.

Alignment is more important than ambition.

Indian Startups are Made, Not Imagined

Startups don’t start with ideas in India.

They start with constraints, in the context, necessity.

Understanding the different types of startups; how founders actually choose their paths Over the years, a less-discussed truth has emerged: There’s no one “right” startup model. There are only Hogarth alignments between a founder’s reality and the business he or she builds.

For founders, the real work is not on what sounds impressive, but it’s on what’s survivable, executable, and coherent in the long run.

For polity makers and investors too, the opposite with equal clarity: India’s startup ecosystem is not characterized by its unicorns, but by the millions of founders that build within the constraint – and make rational, really grounded decisions, on a daily basis.

That is how startups start, actually, in India.

Read Forward

If you are building, studying, or advising a startup in India, understanding how founders actually choose their paths matters more than copying success stories.

The Vue Times examines startups as economic systems, not inspiration narratives.

Follow this series to read how Indian businesses truly begin—shaped by capital limits, social structures, regulation, and lived decisions that rarely make headlines.

Frequently Asked Questions

1. Is a services-based business really a startup in India?

Yes, in practice it is.

While popular discourse tends to exclude services from the “startup” tag, most Indian startups start their lives as services led businesses because the latter offer immediate cash flow and not much capital. The difference lies not in economics, but in culture. Many product companies that became visible later began as service firms, and later selectively productized.

2. Why don’t so many Indian founders take venture capital despite the possibility of growth?

When venture capital is introduced, it brings in time pressure, loss of control, and strategic inflexibility. For founders without strong financial safety nets, these risks are greater than these benefits. Avoiding VC is often a rational choice with economics due to survival rather than lack of ambition.

3. Is lifestyle startups a lack of ambition?

No. Lifestyle startups are repentant of deliberate trade-offs, not constrained thinking. Many founders are more focused on autonomy, predictable income, and long-term sustainability than scale. In India, where there are few social and financial buffers and where modes of ironing out paradigms are limited, such an approach is often more resilient than chasing exponential growth.

4. Why do venture scale startups seem to dominate the media coverage for startups?

Because they are more easily told. Funding rounds, valuations and exits make for pretty clean headlines. Bootstrapped, regional or compliance are slower and less visible although they are significant to the economy.

5. Is it possible for founders to change the type of start-ups over time?

Yes, however transitions are not easy.

Common shifts include:

- Services – Product

- Regional – National

- Lifestyle – Venture-scale

Each new shift demands new capital structures, new decision frameworks, and even frequently, a different mindset in the founder. Many of the founders underestimate this internal transformation.

6. Why are Tier-2 and Tier-3 focused startups more difficult to grow?

Due to scale in these markets, dependencies are based on:

- Distribution efficiency

- Trust-building

- Low-margin sustainability

- Cultural alignment

Technology in and of itself is not enough. Growth is slower but some that are more defensible.

7. Is Manufacturing a bad Start Up Choice in India?

It is not a bad choice, but it is capital intensive and operationally demanding. Working capital, in turn, is an issue faced by manufacturing startups; challenges in compliance run rampant, and margins are skinny. They need patience, extensive knowledge of their industry, and a long-term vision – all things that are underappreciated by the startup world.

8. Do government-nearby startups have higher risk?

And they carry different risks, not necessarily higher.

Policy changes, late payments and bureaucratic red tape are all real issues. However, these startups receive benefits such as high switching costs, recurring demand, and institutional stickiness when well implemented.

9. How should the first-time founder choose which startup path is right for him?

By assessing:

- Financial runway

- Personal risk tolerance

- Industry exposure

- Support systems

- Time horizon

The most frequent founder mistake in India is picking a startup model that is out of personal reality.

10. What is the biggest misconception about Indian startups?

That ambition alone determines outcomes.

In reality, constraints shape strategy. Successful Indian startups are less about bold ideas and more about aligned execution within limits.