Fiscal Deficit

Every year, when the Union Budget is presented, one term quietly dominates policy discussions, exam questions, and economic commentary alike: fiscal deficit. It is often quoted as a percentage, debated in Parliament, and scrutinised by markets, yet rarely understood in its full depth by readers and students.

Right now, fiscal discipline is back at the centre of national conversation. Rising public expenditure, global economic uncertainty, and post-pandemic recovery pressures have made government finances more complex than ever. For students preparing for competitive exams, professionals tracking economic stability, and informed citizens trying to make sense of budget headlines, understanding fiscal deficit is no longer optional. It is foundational.

This article takes an explainer-style deep dive into fiscal deficit. It breaks the concept down step by step, places it in historical and global context, addresses common misconceptions, and explains why examiners care so much about it. More importantly, it explains why you should care—beyond memorising definitions.

Understanding the Core Idea: What Fiscal Deficit Really Means

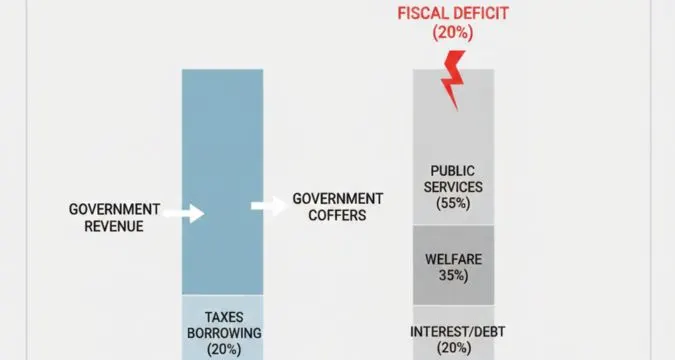

At its simplest, fiscal deficit represents the gap between what the government earns and what it spends in a financial year, excluding borrowings.

In practical terms:

- Government income includes tax revenue and non-tax receipts

- Government expenditure includes salaries, subsidies, interest payments, welfare schemes, and capital investment

When total expenditure exceeds total receipts (excluding borrowings), the difference is called the fiscal deficit.

Instead of treating it as a dry accounting number, it helps to think of fiscal deficit as a measure of how much the government needs to borrow to meet its obligations.

A Simple Analogy

Imagine a household that earns ₹10 lakh annually but spends ₹12 lakh. The ₹2 lakh shortfall must be funded through loans or savings. That ₹2 lakh is comparable to a fiscal deficit at the household level.

At the national level, the stakes are much higher. Borrowing decisions affect interest rates, inflation, investor confidence, and long-term growth.

Breaking Down the Components of Fiscal Deficit

To understand fiscal deficit clearly—especially for exams—it is important to know what goes into it.

Government Receipts

Government receipts are broadly divided into:

Revenue receipts

- Tax revenue (income tax, GST, customs duty, excise)

- Non-tax revenue (dividends from PSUs, fees, fines)

Capital receipts (non-debt)

- Disinvestment proceeds

- Recovery of loans

Borrowings are not counted as receipts when calculating fiscal deficit.

Government Expenditure

Government spending falls into two major categories:

Revenue expenditure

- Salaries and pensions

- Interest payments

- Subsidies

- Welfare schemes

Capital expenditure

- Infrastructure projects

- Defence procurement

- Long-term asset creation

Fiscal deficit reflects the total mismatch between these expenditures and non-borrowed receipts.

Why Fiscal Deficit Is Expressed as a Percentage

In most budget documents and exam questions, fiscal deficit is expressed as a percentage of GDP, not in absolute numbers.

This is done for three reasons:

- It allows comparison across years

- It shows sustainability relative to the size of the economy

- It enables international comparison between countries

A fiscal deficit of ₹10 lakh crore means very different things for an economy of ₹100 lakh crore versus ₹300 lakh crore. The percentage context matters.

Fiscal Deficit vs Other Deficit Concepts

Exams often test conceptual clarity by asking candidates to distinguish between different deficit measures.

Fiscal Deficit vs Revenue Deficit

Revenue deficit focuses only on the gap in day-to-day operations.

- Revenue deficit = Revenue expenditure – Revenue receipts

- Fiscal deficit includes both revenue and capital spending

A country can have a fiscal deficit without a revenue deficit, but not the other way around.

Fiscal Deficit vs Primary Deficit

Primary deficit removes interest payments from the equation.

- Primary deficit = Fiscal deficit – Interest payments

This shows how much the government is borrowing to meet current needs, excluding past debt obligations.

Understanding these distinctions is crucial for analytical questions in economics and general studies papers.

The Broader Economic Context of Fiscal Deficit

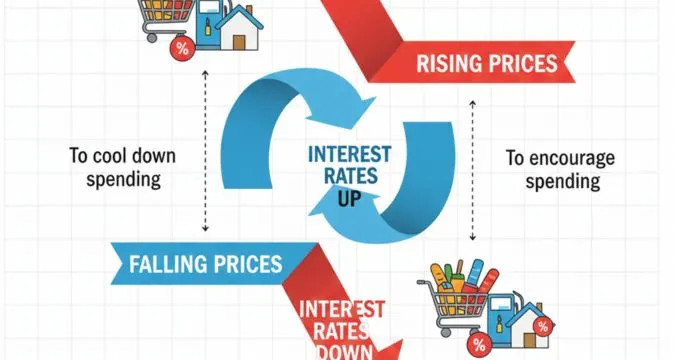

Fiscal deficit does not exist in isolation. It interacts constantly with growth, inflation, and financial stability.

Why Governments Run Fiscal Deficits

Contrary to popular belief, a fiscal deficit is not automatically a sign of mismanagement. Governments deliberately run deficits for several reasons:

- Stimulating growth during economic slowdowns

- Financing infrastructure and development projects

- Managing emergencies such as pandemics or natural disasters

In periods of low private investment, public spending funded through deficit can act as an economic stabiliser.

The Cost of Persistent High Deficits

Problems arise when fiscal deficits remain high for extended periods without corresponding growth benefits.

Long-term consequences may include:

- Rising public debt

- Higher interest burden

- Reduced fiscal flexibility

- Pressure on future budgets

This balance between growth support and fiscal responsibility lies at the heart of economic policymaking.

Fiscal Deficit in India: A Brief Historical Perspective

India’s approach to fiscal deficit has evolved over decades.

In the early post-independence years, deficits were used to fund planned development and public sector expansion. During the 1991 economic crisis, high fiscal deficits exposed structural weaknesses, leading to major reforms.

Subsequently, fiscal responsibility became a policy priority with the introduction of the Fiscal Responsibility and Budget Management (FRBM) framework. The idea was to impose discipline while allowing flexibility during exceptional circumstances.

Recent years have tested this balance again, as global shocks and domestic priorities reshaped budget strategies.

Why Fiscal Deficit Matters So Much for Exams

For competitive exams, fiscal deficit is not just a definition-based topic. It is a lens through which examiners test economic understanding.

Frequently Tested Dimensions

- Conceptual clarity and formula-based questions

- Interpretation of budget data

- Linkages with inflation, growth, and debt

- Policy implications and trade-offs

Examiners often frame questions that require explanation, not memorisation.

Why Examiners Focus on This Topic

Fiscal deficit sits at the intersection of governance, public finance, and macroeconomic stability. Understanding it demonstrates that a candidate can connect numbers to real-world outcomes.

Current Trends Shaping Fiscal Deficit Discussions

Several ongoing developments have reshaped how fiscal deficit is viewed today.

Changing Spending Priorities

Governments are increasingly emphasising capital expenditure over revenue spending. This shift aims to ensure that borrowed money creates productive assets rather than short-term consumption.

Global Economic Uncertainty

Volatile global markets, supply chain disruptions, and geopolitical tensions influence fiscal planning. Flexibility in deficit targets has become more common worldwide.

Greater Transparency and Data Scrutiny

Budget numbers are now analysed not only by policymakers but also by investors, rating agencies, and the public. This has increased accountability and debate.

The Real-World Impact of Fiscal Deficit

Fiscal deficit decisions affect different stakeholders in different ways.

Impact on Citizens

- Influences taxation levels in the long run

- Shapes availability of public services

- Affects inflation indirectly

Impact on Businesses

- Determines interest rate environment

- Influences infrastructure investment

- Affects market confidence

Impact on Future Generations

Borrowing today creates obligations tomorrow. Sustainable deficit management ensures that future taxpayers are not unduly burdened.

Common Misconceptions About Fiscal Deficit

Despite frequent discussion, several misunderstandings persist.

“Fiscal Deficit Is Always Bad”

This oversimplification ignores economic cycles. During downturns, higher deficits can prevent deeper recessions.

“Lower Fiscal Deficit Means Better Economy”

A low deficit achieved by cutting productive spending can harm long-term growth. Quality of spending matters as much as quantity.

“Fiscal Deficit Equals Government Failure”

In reality, it reflects policy choices shaped by economic conditions, priorities, and constraints.

Understanding these nuances helps candidates write balanced answers instead of extreme judgments.

How Fiscal Deficit Is Used as a Policy Signal

Fiscal deficit is not just an outcome; it is also a signal.

- It communicates government intent to markets

- It influences sovereign credit perception

- It shapes monetary policy coordination

A credible fiscal path reassures investors and institutions about economic stability.

Linking Fiscal Deficit With the Budget Narrative

The Union Budget is where fiscal deficit becomes a narrative tool.

Through deficit projections, the government communicates:

- Growth priorities

- Welfare commitments

- Fiscal discipline roadmap

Reading the budget through this lens allows deeper understanding beyond headline announcements. For a related explainer on how budget proposals become law, readers may find context in The Vue Times’ coverage of legislative processes.

What to Watch Next: The Future of Fiscal Deficit Management

Looking ahead, fiscal deficit management is likely to focus on balance rather than rigid targets.

Key signals to monitor include:

- Composition of expenditure, not just size

- Debt sustainability indicators

- Alignment with growth strategy

- Transparency in off-budget borrowing

For students and professionals alike, the ability to interpret these signals will remain a valuable skill.

Key Takeaways for Readers and Exam Aspirants

- Fiscal deficit measures the government’s borrowing requirement

- It reflects policy choices, not just financial stress

- Context and composition matter more than absolute numbers

- Exams test understanding, interpretation, and balance

- Sustainable deficit management supports long-term stability

Understanding the fiscal deficit is about seeing the economy as a system, not a spreadsheet.

Frequently Asked Questions

Why is fiscal deficit discussed every year during the Budget?

Fiscal deficit reflects how the government plans to balance spending and income for the coming year. It signals policy priorities, borrowing needs, and fiscal discipline. Because the Budget sets this roadmap annually, fiscal deficit naturally becomes a central point of analysis and debate.

Does a higher fiscal deficit always lead to inflation?

Not necessarily. Inflation depends on multiple factors, including demand conditions, supply constraints, and monetary policy. A higher deficit can be inflationary if it fuels excessive demand without increasing productive capacity, but deficit-funded investment can also support stable growth.

Is fiscal deficit more important than revenue deficit?

Both serve different analytical purposes. Revenue deficit highlights whether routine expenses are being funded through borrowing, while fiscal deficit shows overall borrowing needs. Examiners value understanding of both, along with their implications.

Will fiscal deficit remain relevant in the future?

Yes. As economies face climate transitions, demographic shifts, and global uncertainties, fiscal choices will become more complex. Fiscal deficit will continue to be a key indicator for assessing how governments manage competing priorities responsibly.