Indian Startup Failure is not a one-off event but an institutional consequence of convergence of capital, regulation, market demand and operating realities in the changing economy of India. The survival rate of new startups in India is still weak after the fifth year of operation despite the booming funding cycles, policy announcements, and the growing pipelines of founders.

Founder mistakes or competition in the market is often thought to be the cause of failure. Nonetheless, at the ecosystem level, Indian Startup Failure is indicative of larger systemic design limitations: capital structure imbalances, regulatory drag, distorted incentives, unequal consumer buying power and inefficiencies in operations.

This article is a structural analysis of the problem and not an emotional one and why majority of the Indian startups fail within the first five years.

Startup Context

The startup ecosystem in India has developed at an extremely fast rate in the past ten years. The inflows of venture capital increased in the period between 2015 and 2022. Unicorn counts multiplied. Incubators expanded. The programs of the government made India a world innovation center.

But it is survival of the fittest.

According to different sets of data, the number of startups that fail in the domestic market in India is a significant proportion. Precise numbers are dependent on industry and definition, but the rate of start-up survival is structurally poor in comparison with developed ecosystems.

The point is not that startups fail, failure is part of being an entrepreneur. The issue is the pattern:

- The concentration of heavy early funding.

- Rapid valuation inflation

- Weak unit economics

- Regulatory unpredictability

Economies of scale are not capital efficient.

The Indian ecosystem remains capitalist as opposed to productivity-driven. That distinction matters.

Structural Breakdown

Funding Structure

The funding model of India is lopsided.

Majority of the venture capitals flows to:

- Consumer internet

- Fintech

- E-commerce

- Quick commerce

- SaaS with global exposure

The availability of seed funding is quite easy in Tier-1 cities. However:

- Concentrated B+ funding.

- Capital available in the late-stage becomes tight in the event of a macro slowdown.

- The pressure of profitability grows fast.

The defect of the structure is the disproportion:

|

Stage |

Capital Availability | Expectation | Risk |

|

Seed |

High (angel networks, micro VCs) |

Rapid user growth |

Burn-heavy |

|

Series A |

Moderate |

Market dominance |

Unit economics ignored |

|

Series B+ |

Selective |

Profit path clarity |

Down-round risk |

| Pre-IPO | Highly selective | Governance maturity |

Liquidity compression |

Startups are not diversified to survive in business.

With tightening of liquidity in the world, Indian startups which rely on foreign capital are caught by surprise on valuation compression. Lack of inner cash discipline wilts the existence.

Business Model Logic

Most Indian startups imitate international patterns on local assumptions:

- Hyper-subsidized client acquisition.

- Cashback-based user growth

- Discount-driven loyalty

- Low customer churning tolerance.

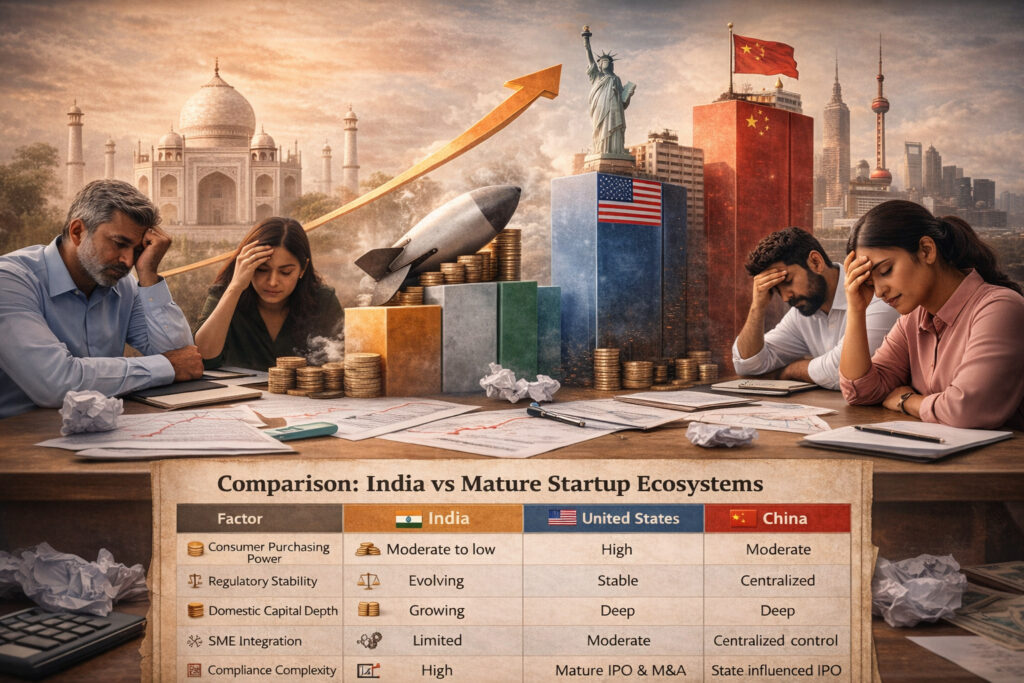

But the economic situation of Indian consumers is different:

- Lower disposable income

- High price sensitivity

- Poor stickiness of subscriptions.

- Fragmented demand patterns

The business model supposes that margins are going to be fixed by scale. Practically, scale increases losses under the case of contribution margins which are negative.

Regulatory Environment

The regulatory landscape in India is dynamic and disjointed in the sectors:

- GST compliance complexity

- Licensing differences on a state level.

- Needs of localization of data.

- Approval lags based on sector.

New companies need to operate through compliance where there is no established compliance infrastructure.

Regulatory cost is excessive in proportion to revenue to many early-stage companies.

This forms structural weakness of the survival rate of startups.

Economic Logic: The Structural Generation of Indian Startup Failure by the Model.

Trying to explain Indian Startup Failure at scale, it is necessary to go beyond the shallow explanations like poor execution or lack of product-market fit. The fundamental problem is economic architecture, that is, how capital, demand, cost structures, and investor expectations interact with India macro-economic environment.

The rate of entrepreneurship survival in India does not simply depend on the ability of entrepreneurs to be present; it depends on structural economic limitations within the ecosystem.

3.1 Economics of the Demand West: Value-Less Volume.

India is a low- volume, high-margin economy.

The per capita income is still very low compared to the developed markets. There is inequality in the disposable income. The purchasing power is concentrated in the urban areas in a stringent scale relative to population density. This consequently creates a paradox with startups:

- Massive saleable markets in print.

- Small sellable segments in the real world.

In the majority of cases, startups determine Total Addressable Market (TAM) using population-based metrics instead of using purchasing capacity-based metrics. This inflames growth assumptions.

For example:

- A food delivery service can boast of scores of millions of potential users.

- Practically, high frequency, regular users form a much smaller segment that is highly concentrated around Tier-1 urban centers.

Unit economics fails when business models presuppose scalable monetization involving large demographics, yet the paying user base is small.

This disconnect of potential TAM and commercializable demand directly influences measures of startup survival rates.

3.2 Unit Economics Perversity by Subsidy Culture.

One of the characteristics of the Indian startup development period (2015-2022) was customer acquisition through subsidies:

- Cashback offers

- Discount coupons

- Zero-fee services

- Free trial extensions

The rationale of these tactics was in a capital-saturated environment. But they developed behavioral conditioning:

Consumers learned to:

- Price is the main point compared within platforms.

- Switch platforms rapidly

- Expect perpetual discounts

This compromises the power of pricing.

Start -ups, in most cases, tend to increase prices once they have established a market share in developed markets. In India, the rise in price often leads to the movement of users to rival companies or back to offline options.

The result:

- Unprofitable contribution margins remain longer.

- Lifetime value projections of customers are exaggerated.

- Break even timetables change back and forth.

- Growth based on subsidies overblows valuation and bad structural profitability.

Capital inflows restricting cause startups to fail to support subsidies and revenue declines drastically, aggravating examples of Indian Startup Failure.

3.3 Cost Structure Misalignment.

The Indian startups have found themselves to be described as asset-light but the reality of business operation does not reflect this story.

Hidden cost layers include:

- Logistics infrastructure

- Vendor management teams

- Marketing of the customer acquisition.

- Technology maintenance

- Compliance and audit costs

- Payment processing fees

- Refund and fraud losses

Gross margin before marketing is not always substantial in industries like food delivery, quick commerce, mobility and e-commerce. It becomes negative after marketing and discounting.

The scaling assumption is:

The fixed costs will weaken away with volume.

However, in India:

- There is an increase in logistics expenses as the geography spreads.

- The higher the competition, the higher the cost of acquiring the customers.

- Inefficiencies in operations are increased in the Tier-2 and Tier-3 cities.

It follows that operating leverage is not always produced with scaling. Rather it may increase losses.

This is a structural economic situation that is the core of the patterns of Indian Startup Failure.

3.4 Capital Efficiency and Growth Efficiency

Indian startups tend to focus on the growth efficiency, but not on the capital efficiency.

Growth efficiency emphasizes on:

- User acquisition rates

- Market share expansion

- Gross Merchandise Value (GMV)

- App downloads

Capital efficiency lays emphasis on:

- Revenue per employee

- Cash conversion cycle

- Working capital management

- Per transaction contribution margin.

The venture capital is such that it is incentivized to growth measures since exits rely on scale impression.

But when the world goes through a downturn in capital cycles (as it has experienced in rises in interest rates or global recessions), the world experiences a sudden slow down in funding.

Growth-optimised startups are under instant pressure:

- Runway shrinks

- Down rounds occur

- Layoffs begin

- Expansion halts

During this funding winter, the start-ups survival rate is worsening as economic architecture was not developed with self-sustenance in mind.

Economics of market fragmentation Economies of scale and scope

3.5 Economics of scope Economics of scale and market fragmentation

India cannot be considered a homogeneous consumer market.

There is fragmentation in:

Language

- Habits of cultural consumption.

- Method of payments (UPI, cash, cards)

- Infrastructure Urban vs semi-urban.

- Interpretations of taxation at state level.

Going national involves scaling that is customized, which makes it expensive to operate.

In America, a start up can expand throughout the country with little cultural adaptation. In India, inter-state meritocracy brings about marketing muddiness and qualitative disparity.

Fragmentation decreases the economies of scale.

Therefore, the cost per acquisition and the cost per transaction tend to be too high outside first urban clusters.

3.6 Exit Market Limitations

A developed startup ecosystem needs to have strong exit mechanisms:

- IPO markets

- Strategic acquisitions

- Secondary buyouts

The IPO market in India has been on the upswing but it is unstable. Profitability and governance are usually important to the public market investors.

A lot of venture-funded start-ups are constructed to be growth stories, not to be disciplined in the public market.

This forms a form of structural gap:

- Logic of public market values.

- Startups that rely on liquidity events are not compatible with a reduced IPO window.

- Low exit depth puts pressure on startups funded by venture capitalists, a factor in Indian Startup Failure rates.

3.7 Foreign Capital Dependence

Much of the Indian venture capital in the past was contributed by:

- US-based funds

- Sovereign wealth funds

- International institutional investors.

This brings about macro vulnerability.

In the event of tightening liquidity in the world market:

- Allotments in emerging markets decline.

- Risk appetite reduces

- Funding cycles freeze

The Indian startups are hence indirectly exposed to:

- US interest rates

- Global recession fears

- Currency fluctuations

Such outside capital dependence creates volatility on the metrics of startup survival.

Operational Challenges

Failure of operations is not by chance but it is predictable.

Compliance Burden

The compliance ecosystem in India consists of:

- ROC filings

- GST filings

- TDS and payroll compliance

- Labour regulations

- Sector-specific audits

In case of a startup, where there is not a lot of administrative bandwidth to comply, compliance is:

- Time-consuming

- Costly

- Risk-prone

Failure to comply may cause stagnant operations or financial aid.

Capital Management

Revenue velocity and cash burn do not usually go hand in hand.

Common patterns:

- High marketing spends

- Rapid recruitment prior to revenue base.

- Prolonged receivable cycles (B2B in particular).

- Vendor advance payments

Startups operate out of runway sooner than expected without strict capital management.

Market Fragmentation

India is not a single market.

Differences across:

- Language

- Payment preference

- Urban vs rural demand

- Logistics infrastructure

Going national increases operation complexity.

Scalability Limits

Technology scales. Operations do not go–at the same rate.

Acquisition of customers can become digital. But:

- The physical build-out is needed in delivery networks.

- The support systems require manpower.

- The supply chains require relations with vendors.

Operating at a higher rate than a maturity of operation raises the risk of collapse.

Interaction Effects of Policy on Indian Startup Failure.

In India, startups are greatly affected by government policy. Regulatory design has structural friction, even though the policy frameworks are designed to assist the entrepreneurship.

Policy does not exist in a vacuum; it is one which determines cost forms, capital flows and the ability to operate.

5.1 Complexity and Compliance Cost of taxation.

The tax regime of India has:

- Goods and Services Tax (GST)

- Corporate tax

- TDS obligations

- Professional tax

- State-specific levies

Even after GST harmonized indirect taxation, the level of compliance is still a problem.

Startups must:

- Submit several returns on a monthly basis.

- Have invoice-level documentation.

- Navigation of input credit reconciliation.

In any firm that lacks significant accounting infrastructure and has limited staff, compliance is skewed.

Startups do not have the scale to effectively amortize compliance costs unlike the large corporate entities.

This regulatory burden is part of Indian Startup Failure and this has clogged managerial bandwidth to product and growth.

5.2 Policy Uncertainty and Volatility.

The regulatory changes in some industries are common:

- Fintech: RBI guidelines

- Edtech: Education policy alignment.

- Online commerce: Laws governing the marketplace.

- Information-based enterprises: Data localisation standards.

The uncertainty in regulations raises the strategic risk.

For example:

- Lending models may be scaled by a fintech startup.

- Regulatory circular makes alterations in capital adequacy or KYC norms.

- The business model should be restructured.

This kind of volatility makes long term plans less clear.

In other settings such as the United States ecosystem, regulatory systems tend to be more transparent and litigation-driven. Circular-based adjustments that are brought in India contribute to quicker but less predictable changes.

This makes the systems more vulnerable and has an impact on the outcome of startup survival rates.

5.3 Fragmentation of State-Level Policies.

The federal structure of India implies:

- States are competing on the startup investments.

- Incentives vary widely.

- There is a variance in bureaucratic efficiency.

Although this brings about competition, it brings about inconsistency.

A startup that is growing in more than one state has to:

- Register locally

- Know that of state labor norms.

- Navigate local inspectors

- Deal with different compliance schedules.

- This increases administrative complexity.

The accruing cost decreases the ability to be agile in its operations and it is more likely to be unsuccessful in 5 years.

5.4 Design of incentives: Funding vs Sustainability.

The programs of government usually reward:

- Startup registration

- Incubation participation

- Innovation competitions

Nevertheless, motivation hardly targets:

- Profitability training

- Compliance infrastructure

- Governance education

- Cash flow management

The environment is conducive to the development of startups, but not always to the sustainability of startups.

The policy structures focus on entry rather than survival.

This is a structural imbalance in the Startup Failure rates in India.

5.5 Government Procurement Barriers.

Startup companies could get consistent flows of revenue through government procurement.

However:

- Tender procedures are complicated.

- Payment cycles are long.

- The qualification criteria tends to favor the established players.

New companies face difficulties when trying to be part of the government contracts.

This limits:

- Diversification of revenue in a stable manner.

- Long-term client retention

- Predictable cash flow

Startups need anchor clients, which are not stable in the absence of consumer markets or venture capital.

5.6 Angel Tax and Capital Sentiment Legacy.

The angel tax controversy of the past left some doubts with regard to early-stage investments.

Although there were reforms, the message to the investors was well understood:

- There may be a change in interpretation of tax.

- Capital has a preference of predictability.

- Reg is fuzzy: this results in a slackening of investor sentiment.

This has an impact on seed-stage funding indirectly affecting the dynamics of startup survival rate over time.

Founder Implications

The founder behavior is influenced by the structural environment.

Capital-Driven Decisions

In situations where survival is determined by funding:

- Valuation becomes priority.

- The profitability is delayed.

- Growth measures are put in perspectives of retention measures.

It is incentive alignment with investors, this is not emotional misjudgment.

Risk Compression

The founders tend to underestimate:

- Compliance risk

- Regulatory lag

- Capital drought cycles

The five-year survival means that one should be designing down times rather than up times.

Governance Gaps

Rapidly scaled startups do not include:

- Strong financial controls

- Independent level of board governance.

- Organized compliance procedures.

Weak governance hastens failure when there are crises.

Future Outlook

Indian ecosystem is coming into maturity.

Key shifts underway:

- Profitability Focus: Investors now prioritize:

-

- Unit economics

- EBITDA path clarity

- Sustainable growth

- Capital Discipline: Burn rates are scrutinized.

- Sector Diversification: Deep-tech, climate tech and B2B SaaS are on the rise.

- Tier-2 Expansion: The emerging cities can be relatively cheaper in structure, which can enhance the survival rate of start ups.

- Domestic Capital Growth: The emergence of family offices in India and home funds decreases dependence on external capital flows.

Nonetheless, there are still structural problems:

- Compliance burden

- Market fragmentation

- Regulatory unpredictability

- Price-sensitive consumers

This means that unless these structural factors change, Indian Startup Failure rates are going to be high.

Conclusion

It is not all about the capability of the founders in Indian Startup Failure. It is concerning structure design.

Perception of startup survival is limited in India because of:

- Capital mismatch

- Low profit margins in price elastic markets.

- Regulatory unpredictability

- Operational complexity

Founders and investors are not incentivized in the same direction.

- Five-year survival requires:

- Discipline in capital valuation growth.

- Before scale logic Before profit logic.

- Compliance-first architecture

- Maturity in governance at the start of the life cycle.

Indian Startup Failure can diminish as the ecosystem of India matures but only when there are structural corrections made at funding, policy and operational levels.

Until that time, failure will be statistically widespread – not due to lack of ambition among entrepreneurs, but since the system requires more resilience than it was set up.