The Production Linked Incentive Scheme is an intended change in the institutional structure of the Indian industrial policy towards a more performance-oriented fiscal intervention structure. The scheme, which aims to promote scale production by inducing output-related incentives gradually, is a break with the previous system of subsidy regimes based on either protectionism, capital grants, or tariff protection. Rather, Production Linked Incentive Scheme is an implementation of an outcome-focused, quantifiable model that is embedded in the larger Indian policy agenda on manufacturing.

Introduced in 2020 during systemic global disruptions in supply-chain, and structural geopolitical reorganization, the scheme covers 14 areas of importance and an authorized

spending of about ₹1.97 lakh crore in five years. Its objectives include catalyzing domestic capacity, halting reliance on imports and export competitiveness as well as replacing India into global value chains. It is an organized institutional and economic account of the scheme, its background, form, the dynamics of its functioning, its financial consequences, the holes left by its working, and long-term path.

Policy Context

Procedural Constraints in Manufacturing

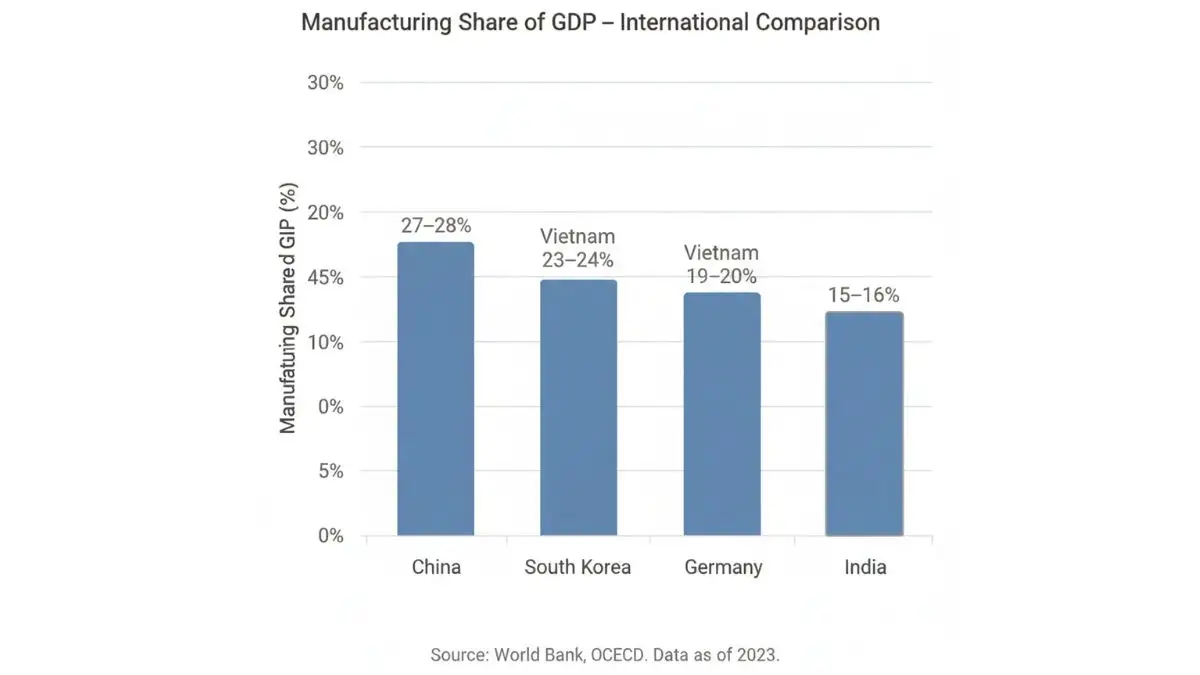

In India, industrial policy after independence has been very volatile between state planning and market liberalization. Although economic reform began in 1991, the contribution of manufacturing to GDP has been characteristically held back at about 14–17% that is far lower than that of peer economies.

Share of comparative manufacturing: (applied recent estimates)

|

Country |

Manufacturing % of GDP |

|

China |

27–28% |

|

South Korea |

25% |

|

Germany |

19–20% |

| Vietnam |

23–24% |

| India |

15–16% |

This continued under performance is symptomatic of structural bottlenecks:

- Fragmented supply chains

- Limited economies of scale

- Dominant logistics expenses 13–14% of GDP

- Reliance on foreign raw materials

- Regulatory complexity

Pre-PLI Sectoral Vulnerabilities

Electronics

Before 2018, India had imported a substantial amount of electronic components especially semiconductors and display units. The number of mobile handset assembly rose, though there was a low domestic value addition.

Pharmaceutical APIs

About 60–70% of the active pharmaceutical ingredients APIs import by India came through China.

Solar Modules

Local production could not keep up with the pace of worldwide demand leading to reliance on imports.

Strategic Trigger Events

- Supply chain disruptions caused by COVID-19

- US-China trade tensions

- Global China diversification strategies

- There is need to stabilize the current account vulnerability

The Production Linked Incentive Scheme was a systematic reaction to these weaknesses in a new policy focus on manufacturing in a contextualization of scale, export capacity, and priority sector.

Institutional Architecture

Fiscal Authorization and Executive Approval

The Union Cabinet approved the scheme which was entrenched in annual Union Budget allocations. Instead of being a separate piece of legislation, it is done by the executive notification in respective ministries.

Total authorized expenditure: estimated at ₹1.97 lakh crore.

The spending is sanctioned through budgetary allocations made by parliament through the Finance Act process. Monitoring watches over include:

- Audit review by Comptroller and Auditor General CAG

- Parliamentary scrutiny by Standing Committee

- Immoral counsel ministries

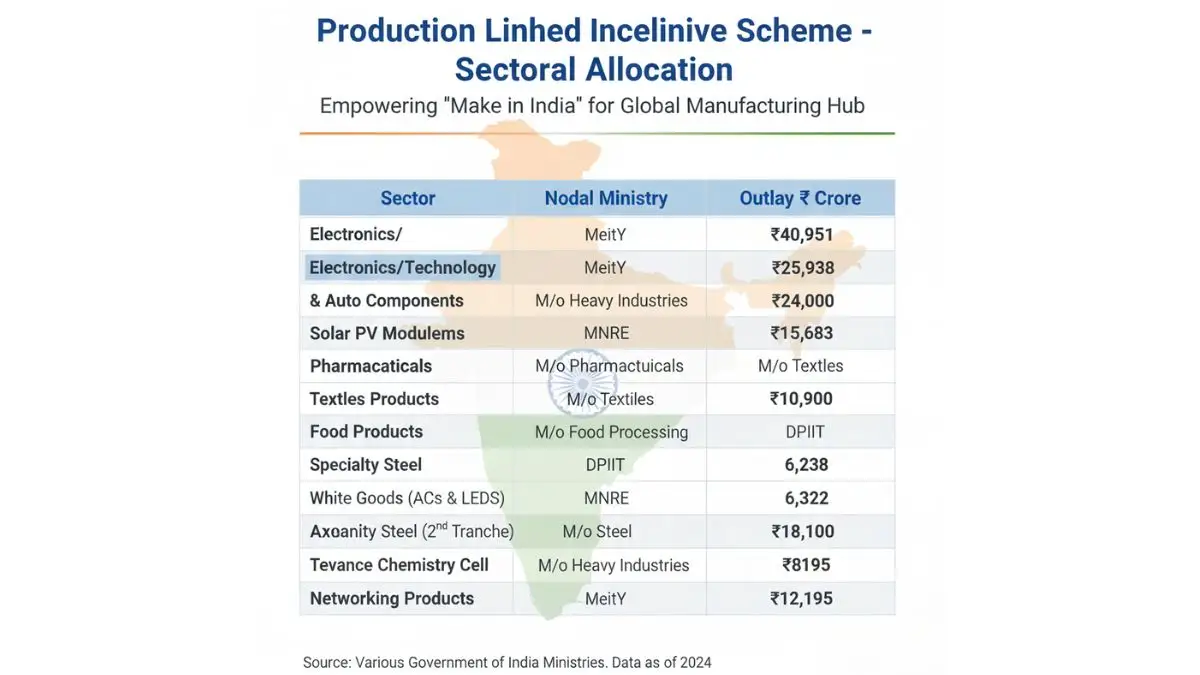

Sectoral Distribution

The scheme spans 14 sectors. Approximate allocations:

| Sector | Nodal Ministry |

Outlay ₹ Crore |

| Large Scale Electronics | MeitY | 40,951 |

| Pharmaceuticals | Department of Pharma | 15,000 |

| Automobile & Auto Components | Ministry of Petroleum and Natural Gas. | 25,938 |

| Advanced Chemistry Cells | Ministry of Petroleum and Natural Gas. | 18,100 |

| Telecom & Networking | United Arab Emirates Telecom. | 12,195 |

| Solar PV Modules | MNRE | 24,000 |

| Specialty Steel | Ministry of Steel | 6,322 |

| Textiles MMF & Technical | Ministry of Textiles | 10,683 |

| White Goods | DPIIT | 6,238 |

| Food Processing | Ministry of Food Processing | 10,900 |

| Drones & Components | Civil Aviation | 120 |

| Medical Devices | Department of Pharma | 3,420 |

Federal Implications

Although centrally funded, territoriality is state based in implementing it. States provide:

- Land allotment

- Stamp duty waivers

- Electric tariffs subsidies

- Local infrastructure support

- Local infrastructure support

The result of this stratified design of incentive is a competitive federalism dynamic. Existing industrial ecosystems have led to the emergence of states like Tamil Nadu, Uttar Pradesh, Gujarat, and Maharashtra as the major beneficiaries.

RBI Interface

The scheme is not administered by the Reserve Bank of India but provides checks on macroeconomic spillovers among which include:

- Effect on current account deficit

- Capital formation trends

- Expansion of credit in the production

Therefore, their operationally distinct and independent, the scheme overlaps monetary and macro-financial frameworks of stability.

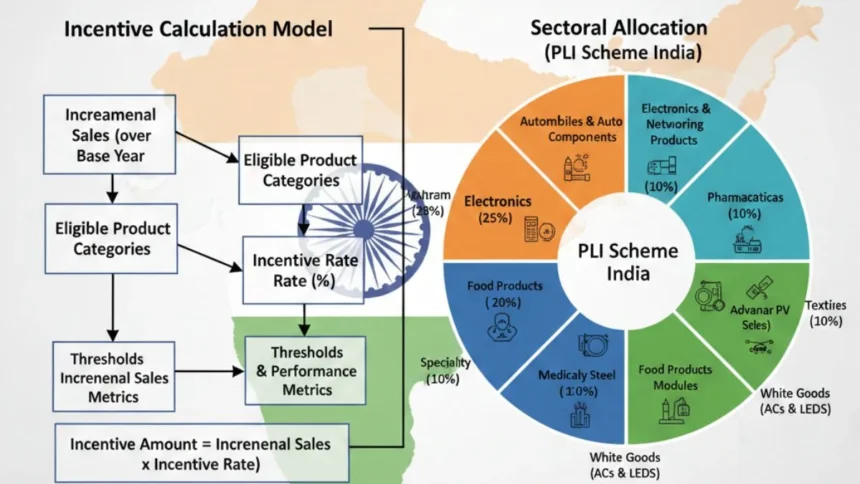

Mechanism and Operation Framework of the Production Linked Incentive Scheme

Core Logic

The Production Linked Incentive Scheme is a performance-based incentive scheme:

Incentive = out-of-unaffected sales made during a base year times predetermined percentage.

The initial year is normally FY 2019–20 in case of early sectors.

The structure is known as Incentive Tapering Structure

| Year |

Incentive Rate % |

|

Year 1 |

6% |

|

Year 2 |

5% |

|

Year 3 |

5% |

|

Year 4 |

4% |

|

Year 5 |

4% |

Some sectors have different rates, but all seek a downward trend so as to promote early scaling.

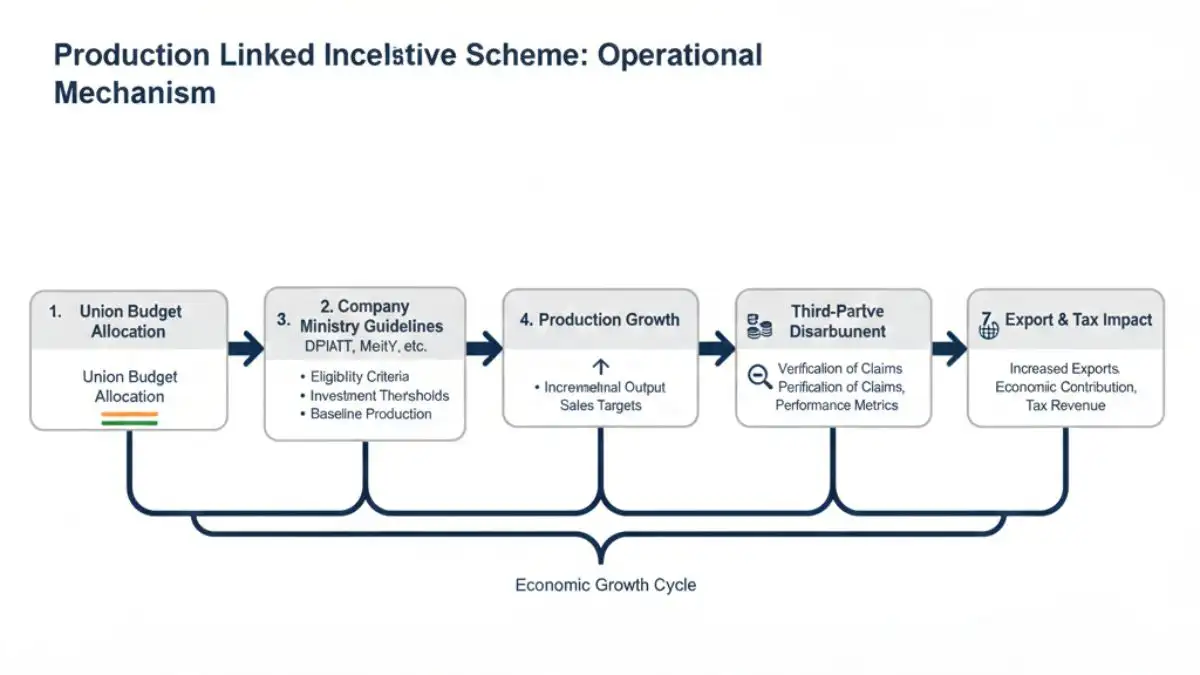

Structural Flow Diagram

- Union Budget Allocation

- Guidelines of Sectoral Ministry

- Company Application and Qualification

- Minimum Investment Furtherment

- Growth Production Achieved

- Third Party Audit Working

- Incentive Disbursement

- Tax & Export Effects

Eligibility Criteria

- Minimum capital investment level

- Domestic value adding standards

- Incremental sales targets

- Environmental and quality safety

Take An Example

Base year sales: ₹1,000 crore

Current year sales: ₹1,700 crore

Incremental sales: ₹700 crore

Incentive rate: 6%

Payout = ₹42 crore

This type of conditionality minimizes front-end fiscal risk.

Implications on Economics and Governance

Production Multiplier

Projected production effect across industries will be more than ₹30 lakh crore in five years. This will inferred an increase in the multiplier of production to incentive more than 15x in comparison to fiscal expense.

Electronics Sector Case

During the period of expansion of PLI, mobile phones began to be manufactured in large quantities. The exports are estimated as having been over $15 billion in recent years as compared to less than $5 billion in the part of the decade. Although this cannot be reduced to PLI alone, it is correlated having structural momentum.

Fiscal Considerations

Impact Fiscal has been found to have an effect across dimensions:

- Direct incentive payout

- Tax revenue generation

- Reduced import expenditure

- High employment taxation

Potential revenue streams:

- GST on domestic sales

- Corporate income tax

- Customs duty adjustments

- Payroll taxation

Current Account Effects

Less dependence on imports in:

- APIs

- Solar modules

- Electronics components

Enhances stability of the balance of trade, dependent on the long-term domestic value addition.

Administrative Burden

Governance requires:

- MIS systems used to track production

- Independent audit agencies

- Inter-ministerial coordination

The issue of administrative capacity results in binding constraints whereby there are delays in the verification.

Implementation Gaps

Domestic Value Addition

Domestic value addition in the field of electronics is still pegged at an estimated 15–20% in most types of products. The ecosystem with the upstream components is not highly developed.

MSME Exclusion

Direct integration by small and medium enterprises is prevented by high investment requirements, but indirect integration of the supply chain could be realized.

Regional Concentration

Regional disparities may be enhanced by investment clustering in a limited number of states.

Compliance Complexity

There are several industry-specific rules that make regulation more complicated.

Disbursement Delays

The lag in verification can impact the working cash forecast of companies.

Criticism and Counter-Arguments

| Criticism | Analytical Response |

| Fiscal strain | Output incentives are provided; this curbs wasteful spending. |

| Corporate concentration | Scale manufacturing calls upon the capital-intensive players. |

| Temporary output spike | Capital formation is long lasting. |

| WTO risk | Not export contingent, but production contingent. |

Relative measurement needs to be in terms of multi-year change in productivity as opposed to outputs over the short run.

Comparative Perspective

Global parallels include:

- Science Act semiconductor incentives of US

- The industrial subsidies in China

- Tax concessions associated with FDI in Vietnam

The characteristic feature of India is the sales incentives that are incremental in nature as opposed to initial tax holidays.

Future Outlook 5–10 Years

Key indicators to monitor

| Indicator | Desired Direction |

| Manufacturing share of GDP | Rise toward 20%+ |

| Electronics value addition | >40% |

| Export growth | Sustained double-digit |

| Supply-chain localization | Deepening |

Potential evolution

- Incentives in the fabrication of semiconductors

- Genesis with National Logistics Policy

- Digital oversight of compliance

- Increased incentives based on improved R&D

Design might be improved with time by institutional review by NITI Aayog and parliamentary committees.

Teenagers are impacted more by the environment than by policies an organization develops. Teenagers are influenced more by the environment than policies that an organization formulates.

Structural Flow

- Global Supply Chain Shift

- Realigning the manufacturing policy

- Production Linked Incentive Scheme

- Private Capital Investment

- Capacity Building in Industry

- Export Integration

- Macroeconomic Stabilization

This environmental scheme portrays that the initiative is a structural tool in the re-working of the manufacturing policy in India.

Conclusion

Production Linked Incentive Scheme: It is a performance-based fiscal policy that has been integrated into the modern policy framework of manufacturing of India. It tries to strike a balance between fiscal care and industrial activation by pegging incentives on incremental output. It has a complex layering of governance through its institutional structure multi-ministerial administration, parliamentary budgetary approval and federal collaboration.

We shall rely on value addition that is long-term in nature, competitiveness in the export of their produce, development of the ecosystem, and administrative discipline to sustain the effectiveness of the scheme. Provided that implementation continues to increase productivity over the incentive horizon, the Production Linked Incentive Scheme can potentially be a structural inflection point in the industrial path of India. Otherwise, it would run a risk of returning to the vicious cycle of subsidies.

The analysis in the coming decade will answer the question of whether the current manufacturing policy in India has shifted to non-protective intervention to global competitive industrial strategy.

Also Read: National Educational Policy 2020 Explained In Competitive Perspective

Serious About Knowing the Policy Architecture of India?

The Vue Times is developing the most mind-stretching platform on governance, economic reform, and government systems in India.

Be part of our team of policymakers, aspiring populations and followers, researchers, and founders who read beneath caricature-like accounts.

Subscribe. Analyze. Lead.