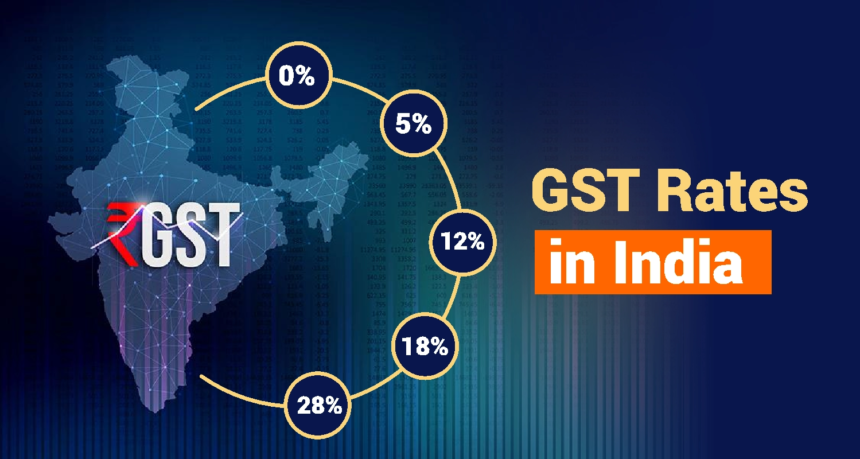

The much-awaited GST Utsav beginning from September 22 has created a wave of curiosity, expectations, and cautious optimism among India’s middle-class households. For years, families have felt the pinch of rising prices, inflation, and high taxation on everyday essentials. Whether it is groceries, healthcare, education, fuel, or transportation, the indirect tax burden under GST has often been a source of frustration for families trying to balance their monthly budgets. The GST Utsav is designed as a special nationwide initiative to give relief, boost consumption, and ensure that the middle class—the backbone of India’s economy—can manage household expenses with greater ease. By restructuring GST slabs, offering rebates, and simplifying compliance, the government aims to not only reduce the burden of indirect taxation but also inject a sense of positivity into consumer spending. For the common family, this reform is not merely about numbers on a tax chart—it directly affects how much money they save at the end of the month, how comfortably they can meet daily needs, and how well they can plan for the future.

The first and most immediate impact of GST Utsav on family budgets is the reduction in household grocery bills. Essentials like rice, wheat, pulses, cooking oil, packaged milk, and other daily consumables make up a large portion of middle-class spending. Earlier, many such items carried GST rates ranging from 5% to 18%, which increased overall monthly expenditure. Under GST Utsav, several of these products have been moved to lower tax brackets or exempted completely. For example, basic food items are now cheaper, soaps and detergents that were taxed at 18% have been shifted to a 12% bracket, and even commonly used packaged snacks and beverages have seen rate reductions. For a household that spends thousands each month on groceries and cleaning products, this translates into significant savings over the course of the year. The middle-class homemaker, who often struggles to stretch the monthly budget to cover every need, will feel a tangible difference as the shopping basket becomes more affordable.

Another critical area where GST Utsav brings change is healthcare. Medical expenses have always been one of the most unpredictable and stressful parts of a family’s financial planning. From doctor consultations and diagnostic tests to hospital admissions and the purchase of medicines, even a minor illness can cause a strain on the household budget. Earlier, many medical services, equipment, and drugs attracted GST rates that added to already high medical costs. With the new reforms under GST Utsav, a number of life-saving drugs and critical healthcare services have been exempted from GST or moved to the lowest tax slab. This means patients and their families will no longer face inflated bills simply because of taxation. For chronic illness management, which requires regular purchase of medicines, the relief is long-term and steady. Additionally, reductions in GST on health insurance premiums mean families can now secure better coverage at lower costs, making quality healthcare accessible without fear of financial breakdown. In this way, GST Utsav goes beyond numbers on paper to actually ease the worries of families during times of medical need.

Education is another pillar of middle-class expenditure, and GST Utsav has addressed this sector with thoughtful relief measures. Parents often invest a large portion of their income in their children’s schooling, coaching classes, online learning subscriptions, and skill development programs. The burden of GST on tuition, educational tools, and digital learning platforms has been a growing concern for families. From September 22, reduced GST rates on online education services, e-learning apps, and essential educational materials will make knowledge more affordable. This ensures that children can continue to access high-quality education without parents having to sacrifice other parts of the budget. For young professionals who pursue online certifications to upskill, this also comes as welcome news. Education is an investment in the future, and the government’s recognition of this fact through GST relief strengthens the sense of support for families trying to build better opportunities for their children.

Transportation is another category where household budgets take a hit every month, particularly in urban areas. The rising costs of fuel, maintenance, and daily commuting have forced families to cut corners in other areas just to keep up. GST Utsav introduces changes that reduce taxation on ride-hailing services like cabs and autos, as well as public transportation services. For families who rely on Ola, Uber, or local taxis for commuting to school, college, or offices, this translates to real savings. Beyond personal commuting, reduced logistics and transport costs for goods also bring down the overall prices of consumer products. For example, when transporters pay less in GST, the cost of delivery for groceries, vegetables, and even e-commerce items reduces, which directly benefits families at the consumer end. Over time, this chain reaction of reduced costs across logistics ensures lower inflationary pressure, giving households the breathing room they need to plan better financially.

Small business owners and self-employed professionals within middle-class families will also see direct benefits from GST Utsav starting September 22. Earlier, filing GST returns was often seen as a burden, requiring the help of accountants and consuming both time and money. The new reforms introduce simplified return filing processes, user-friendly digital platforms, and reduced penalties for late filings. This encourages small traders, freelancers, and professionals to comply easily while saving on administrative costs. In addition, festival season rebates and digital GST discounts during the Utsav period will stimulate higher consumer spending, which is a positive sign for shop owners and service providers. When families spend more on clothes, electronics, or gifts due to lower GST, small businesses also experience a boost in sales, creating a win-win situation for both consumers and traders.

Perhaps the most significant impact of GST Utsav on daily family expenses is the increase in disposable income. When groceries become cheaper, medical bills reduce, school fees and learning platforms are taxed less, and commuting costs go down, families are left with more money in hand each month. This extra disposable income can be directed toward savings, investments, or even improved quality of life through leisure activities, travel, or lifestyle upgrades. In a country where many households live with tight financial margins, even a few thousand rupees saved monthly through tax relief can make a substantial difference. Over time, these savings accumulate, helping families build emergency funds, pay off debts, or invest in long-term goals such as home ownership or children’s education. The psychological comfort of knowing that the government is actively working to reduce the financial burden also creates optimism and trust, encouraging families to spend wisely and confidently.

The larger economic implication of GST Utsav is that as families save more and spend more, the overall consumption in the economy rises. The middle class, which makes up a majority of India’s population, drives demand for everything from consumer goods to services. By putting money back into their pockets, GST Utsav indirectly stimulates growth across industries. Manufacturers, retailers, and service providers benefit from increased sales, while families enjoy affordability and better financial health. This cycle of spending and growth is what makes the initiative not just a tax reform but a national economic strategy. From September 22 onward, the benefits of this reform will be felt in everyday transactions, from the grocery shop to the hospital counter, from the tuition payment desk to the transport bill.