Why Repo Rate and Reverse Repo Rates Matter More Than Ever

If you are preparing for competitive exams, whether UPSC, SSC, RBI Grade B, banking exams, or state-level services, you will repeatedly encounter two terms that quietly shape India’s economic direction: the repo rate and the reverse repo rate.

These are not just textbook definitions to memorize. They are powerful monetary policy instruments that influence inflation, growth, employment, loan interest rates, and even household savings. In recent years, especially amid global inflation shocks, pandemic recovery, and geopolitical uncertainty, these rates have moved from obscure central banking jargon into mainstream economic conversation.

For exam aspirants, understanding them conceptually, not mechanically, is essential. Questions today increasingly test clarity, application, and impact rather than rote learning.

This article takes a deep dive approach. It breaks down repo rate and reverse repo rate in simple, exam-relevant language, connects them to real-world outcomes, corrects common misconceptions, and highlights what you should watch going forward.

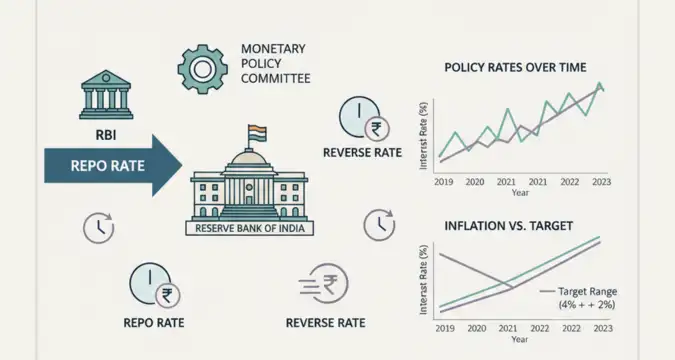

The Monetary Policy Context: Where Repo and Reverse Repo Fit In

Before defining the terms, it is important to understand the broader framework.

India follows a monetary policy system managed by the Reserve Bank of India (RBI). Its primary objectives are:

- Price stability (controlling inflation)

- Supporting economic growth

- Maintaining financial stability

To achieve these goals, the RBI uses several tools, including:

- Policy interest rates

- Liquidity management instruments

- Regulatory measures

Among all these, repo rate and reverse repo rate are the most frequently used and most examined tools.

They operate within the Liquidity Adjustment Facility (LAF), a system through which the RBI manages short-term liquidity in the banking system.

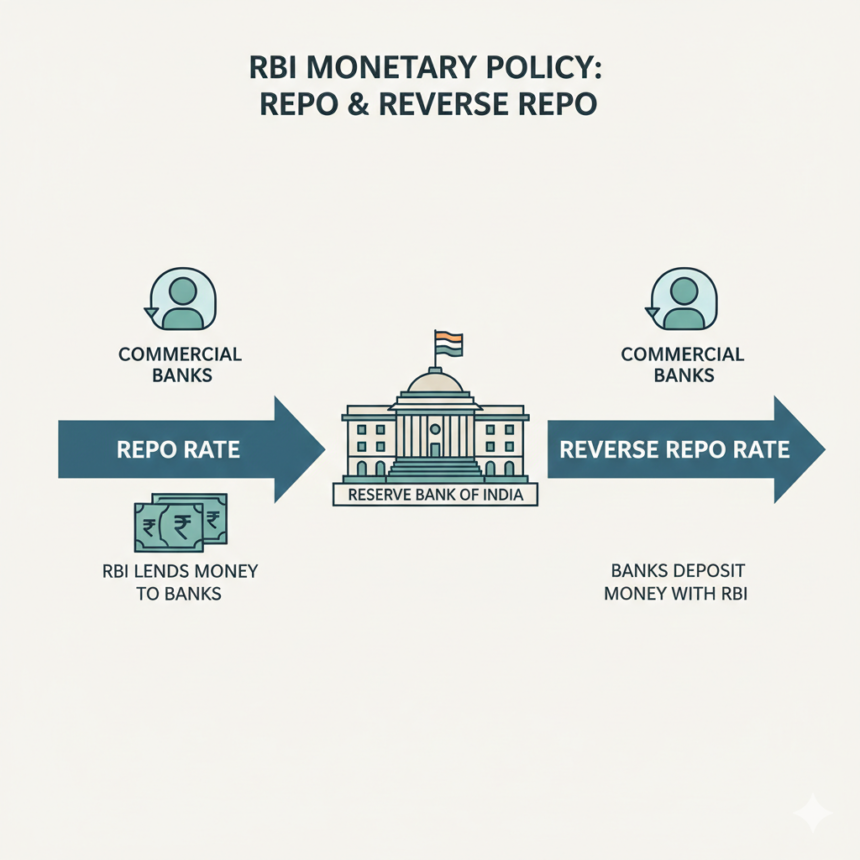

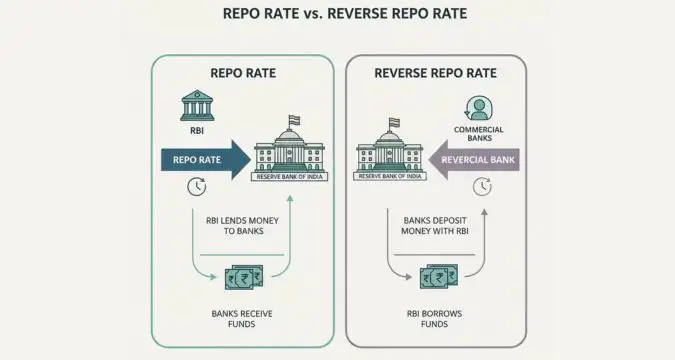

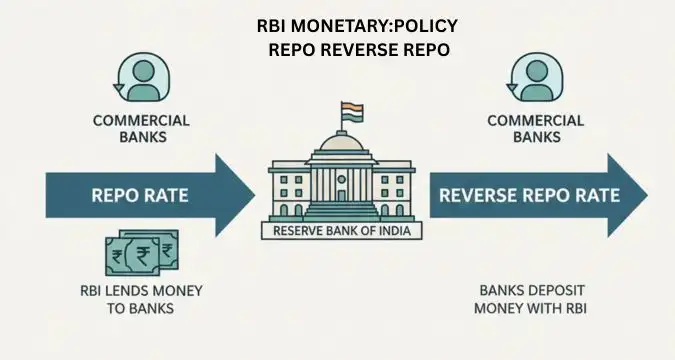

Understanding the Repo Rate: The Cost of Borrowing from RBI

What Is the Repo Rate?

The repo rate is the interest rate at which commercial banks borrow short-term funds from the Reserve Bank of India by pledging government securities as collateral.

In simpler terms:

- Banks need money to meet daily requirements.

- When they fall short, they borrow from the RBI.

- The interest charged on this borrowing is the repo rate.

It is essentially the price of money for banks.

How the Repo Mechanism Works

The repo transaction involves two parts:

- Repurchase Agreement

Banks sell government securities to the RBI with an agreement to buy them back later. - Short-Term Loan

The difference between the selling price and repurchase price reflects the interest paid.

Key characteristics:

- Short-term in nature (usually overnight)

- Fully collateralized

- Conducted through RBI auctions

Why the Repo Rate Is So Important

Changes in the repo rate influence the entire interest rate structure of the economy.

When the repo rate changes:

- Banks’ borrowing costs change

- Lending rates for businesses and consumers adjust

- Spending and investment patterns respond

This is why repo rate decisions are closely watched by markets, economists, and policymakers.

Repo Rate in Action: A Practical Example

Imagine the repo rate is reduced by 50 basis points.

What happens next?

- Banks borrow more cheaply from the RBI

- Their cost of funds decreases

- Loan interest rates may fall

- Businesses invest more

- Consumers borrow and spend more

- Economic activity picks up

Conversely, when the repo rate increases, borrowing becomes expensive, slowing down demand.

Understanding the Reverse Repo Rate: Parking Excess Funds Safely

What Is the Reverse Repo Rate?

The reverse repo rate is the interest rate at which the RBI borrows money from commercial banks.

In simple terms:

- Banks often have surplus funds.

- Instead of lending them out, they can deposit this excess money with the RBI.

- The interest earned on these deposits is the reverse repo rate.

It is the return banks earn on parking money with the RBI.

How Reverse Repo Operations Work

In a reverse repo transaction:

- Banks lend money to the RBI

- RBI provides government securities as collateral

- Banks earn interest at the reverse repo rate

This tool helps the RBI absorb excess liquidity from the system.

Why the Reverse Repo Rate Matters

The reverse repo rate acts as a floor for short-term interest rates.

Its key functions include:

- Encouraging banks to park surplus funds safely

- Preventing excess money from flooding the economy

- Supporting inflation control during high liquidity periods

When the reverse repo rate is attractive, banks prefer parking money with the RBI rather than lending aggressively.

Also Read: Parliamentary Committees Explained: Types, Roles, and Exam Relevance

Repo Rate vs Reverse Repo Rate: Key Differences Explained Clearly

Understanding the contrast between the two is critical for exams.

| Aspect | Repo Rate | Reverse Repo Rate |

| Direction of funds | RBI lends to banks | Banks lend to RBI |

| Objective | Inject liquidity | Absorb liquidity |

| Impact on economy | Encourages borrowing | Discourages excess lending |

| Impact on inflation | Can increase demand | Helps control inflation |

| Typical level | Higher | Lower than repo rate |

The gap between these two rates is also meaningful. A narrower gap usually signals accommodative policy, while a wider gap can indicate tightening liquidity conditions.

Historical Perspective: How These Rates Evolved in India

India did not always use repo and reverse repo as its primary policy instruments.

Pre-2000s Framework

Earlier, the RBI relied more on:

- Bank Rate

- Cash Reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

These were blunt instruments and less flexible.

Shift to Market-Based Tools

With financial sector reforms and globalization:

- India adopted the Liquidity Adjustment Facility

- Repo and reverse repo became central policy levers

- Monetary transmission improved gradually

This shift aligned India’s monetary framework more closely with global best practices.

Current Trends: How Repo and Reverse Repo Are Used Today

In recent years, central banks worldwide, including the RBI, have faced overlapping challenges:

- Supply-side inflation

- Volatile capital flows

- Global interest rate tightening

- Domestic growth recovery

As a result:

- Repo rate changes have become more calibrated

- Reverse repo has been used actively to manage surplus liquidity

- Communication from RBI has become more forward-looking

These trends matter for exams, especially in analytical questions.

Implications for Different Stakeholders

Impact on Businesses

- Lower repo rates reduce borrowing costs

- Investment decisions depend on interest rate outlook

- Credit availability affects expansion plans

Impact on Households

- Home loan and personal loan EMIs respond to repo rate changes

- Savings returns can be influenced indirectly through banking rates

- Inflation control affects purchasing power

Impact on Government Finances

- Interest rates affect government borrowing costs

- Debt servicing becomes cheaper or more expensive

- Fiscal-monetary coordination becomes critical

Common Misconceptions About Repo and Reverse Repo Rates

Misconception 1: Repo Rate Directly Sets Loan Rates

Reality:

The repo rate influences lending rates, but banks also consider:

- Risk

- Operating costs

- Market competition

Transmission is not automatic or uniform.

Misconception 2: Reverse Repo Is Irrelevant for the Public

Reality:

While consumers do not deal with it directly, reverse repo affects:

- Liquidity in banks

- Willingness to lend

- Stability of short-term rates

Misconception 3: Higher Rates Are Always Bad

Reality:

Higher rates can:

- Control runaway inflation

- Stabilize currency

- Encourage disciplined spending

What to Watch Next: Forward-Looking Signals for Aspirants

For competitive exams, static knowledge is no longer enough. You should monitor:

- RBI Monetary Policy Committee statements

- Inflation trends

- Liquidity conditions in banking

- Global interest rate movements

Understanding why the RBI adjusts these rates is more important than memorizing what the rate is.

If you want to deepen your understanding of monetary tools, you may also find value in reading related explainers on The Vue Times, such as articles exploring how central banks manage inflation in practice.

Key Takeaways to Remember

- Repo rate is the cost at which banks borrow from RBI.

- Reverse repo rate is the return banks earn by lending to RBI.

- Both are liquidity management tools under the RBI’s monetary policy framework.

- They influence inflation, growth, borrowing, and savings indirectly.

A strong grasp of these concepts equips you not just for exams, but for understanding how economic decisions shape everyday life.

Frequently Asked Questions (FAQs)

Why are repo and reverse repo rates so important for exams today?

Competitive exams now focus on economic awareness and policy understanding rather than rote definitions. Repo and reverse repo rates are frequently referenced in current affairs, RBI announcements, and analytical questions. Understanding their function and impact helps candidates connect static syllabus topics with real-world developments.

How do these rates affect inflation control?

When inflation rises, increasing the repo rate makes borrowing costlier, reducing demand. At the same time, a higher reverse repo rate encourages banks to park excess funds with the RBI. Together, these measures help absorb liquidity and moderate price pressures over time.

Do changes in repo rate immediately change loan EMIs?

Not always. While repo rate movements influence lending rates, banks adjust loan rates based on internal benchmarks, risk assessment, and market conditions. Transmission can be gradual, especially for existing loans, though external benchmark-linked loans respond faster.

Can reverse repo rate be higher than repo rate?

Under normal conditions, the reverse repo rate is lower than the repo rate. This maintains an incentive structure where banks prefer lending to the economy rather than parking funds with the RBI. A reversal would signal unusual liquidity conditions and is generally avoided.

What is the long-term significance of these rates for India’s economy?

Over the long term, effective use of repo and reverse repo rates supports price stability, sustainable growth, and financial system confidence. For a growing economy like India, balancing inflation control with credit availability through these tools remains a central policy challenge.