Gold has always held a special place in Indian culture and across the world. From weddings and festivals to investments and heirlooms, gold jewellery continues to be one of the most sought-after purchases for families. But buying gold is not just about choosing a beautiful design. The final price you pay includes several additional components beyond the actual weight of gold. If you’re planning to buy gold jewellery in 2025, understanding making charges, GST, and hallmarking is absolutely essential.

This comprehensive guide will walk you through every important factor so you can shop smart, avoid overpaying, and ensure you are getting genuine quality.

Why Buying Gold Jewellery Is Different From Buying Gold Coins

When you purchase gold coins or bars, you pay mostly for the pure weight of gold and a small premium. But jewellery is different. The price of your necklace, ring, or bangles includes design labour, brand margins, and sometimes even wastage costs. That is why two ornaments of the same weight can have very different prices.

Before finalizing your purchase, you must understand how jewellers calculate the total value.

1. The Basic Gold Rate

At the core of every jewellery bill is the daily gold rate, usually quoted per gram. This rate changes daily based on global market trends, currency exchange rates, and local demand. Jewellers generally display their daily gold rate prominently in their stores.

For example:

-

If the gold rate today is ₹6,200 per gram for 22 Carat gold

-

And you buy a 10-gram bangle

-

The base price = 10 × ₹6,200 = ₹62,000

This is the raw value of the gold content. But this is not the final bill.

2. Making Charges in Gold Jewellery

Making charges are the additional costs you pay for the craftsmanship involved in creating the jewellery piece. Jewellery making involves melting, moulding, cutting, polishing, setting stones, and intricate handwork.

-

Percentage Method: Some jewellers calculate making charges as a fixed percentage of the gold value. For example, 10% of ₹62,000 = ₹6,200.

-

Fixed Per Gram Method: Others charge a fixed rate per gram, say ₹500 per gram × 10 grams = ₹5,000.

Making charges vary widely:

-

Simple machine-made designs: 3–8% of gold value.

-

Handcrafted intricate designs: 10–25% or more.

-

Designer and branded jewellery: Can go much higher.

Tip: Always ask the jeweller whether they are applying a percentage or per-gram making charge, and compare between stores.

3. Wastage Charges

In certain jewellery styles, especially traditional ones, some amount of gold is lost in the process of cutting and shaping. Jewellers often add wastage charges to cover this. These are not as common today because of advanced techniques, but in handcrafted ornaments, wastage may still be included.

For example, if wastage is considered at 5%, your 10-gram ornament may be billed as 10.5 grams.

4. Goods and Services Tax (GST) on Gold Jewellery

In India, GST is levied at 3% on gold jewellery. This tax applies to the total of (gold value + making charges).

Example calculation:

-

Gold value: ₹62,000

-

Making charges: ₹6,200

-

Subtotal: ₹68,200

-

GST (3%): ₹2,046

-

Final bill = ₹70,246

Important: GST is uniform across India. Any jeweller trying to charge more is violating regulations.

5. Hallmarking — Your Proof of Purity

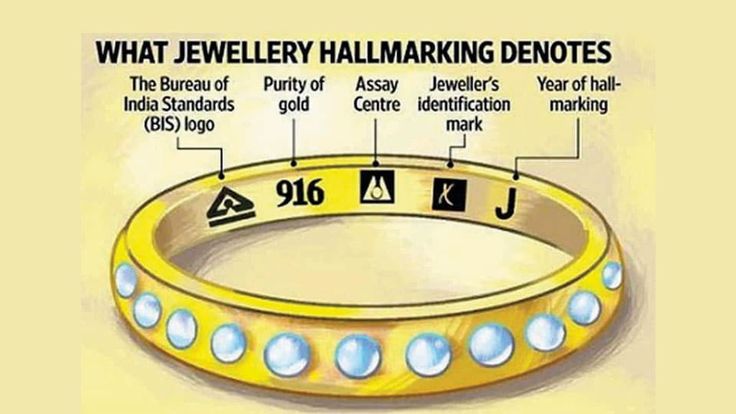

Hallmarking is one of the most important aspects of buying gold jewellery. It is the process of certifying the purity of gold through an official agency. In India, hallmarking is regulated by the Bureau of Indian Standards (BIS).

A BIS hallmark certifies that the piece you’re buying has the stated purity (for example, 22K = 91.6% pure gold).

What to check in a hallmark:

-

BIS logo

-

Purity/fineness grade (e.g., 22K916 for 22 Carat)

-

Assaying & Hallmarking Centre’s mark

-

Jeweller’s identification mark

Since 2021, hallmarking has been made mandatory in many categories, and by 2025, most reputed jewellers sell only hallmarked ornaments.

Tip: Avoid buying non-hallmarked jewellery, no matter how attractive the price.

6. Purity Levels – 22 Carat vs 24 Carat

-

24 Carat (99.9% pure): Too soft for daily-wear jewellery. Mostly used in coins/bars.

-

22 Carat (91.6% pure): Standard for Indian jewellery, balances purity with durability.

-

18 Carat (75% pure): Used in diamond jewellery for added strength.

-

14 Carat (58.5% pure): Increasingly popular in lightweight, trendy designs.

Always match your intended use (investment, daily wear, fashion) with the right purity level.

7. Stones, Diamonds & Additional Costs

If your jewellery has diamonds or precious stones, their price is added separately. Stones are charged based on quality, cut, and weight. Remember that stones also attract GST.

Important tip: Ask the jeweller for a breakdown of gold weight and stone weight separately, so you don’t pay the gold rate for non-gold components.

8. Why Making Charges & GST Matter for Resale

When you sell your jewellery back, jewellers usually pay you only for the net gold weight and purity. Making charges, wastage, and GST are non-refundable.

This means:

-

If you paid ₹70,000 for a piece, you may get back only the gold value at current rates, not the extra charges.

-

That’s why plain gold jewellery (with low making charges) usually gives better resale value than designer jewellery.

9. Buying Jewellery as Investment vs Fashion

-

Investment buyers should stick to simple, plain designs with low making charges and high purity.

-

Fashion buyers can explore 18K or 14K jewellery with diamonds/stones but must remember resale value is lower.