Why Inflation Control Matters More Than Ever

Prices quietly shape everyday life. From the cost of vegetables and fuel to school fees and rent, inflation decides how far a salary stretches and how secure household planning feels. In recent years, price stability has moved from being a background economic concept to a front-page concern, discussed in newsrooms, policy circles, and family dining tables alike.

At the centre of this conversation stands the Reserve Bank of India. Often described as the country’s monetary authority, the RBI plays a decisive role in keeping inflation from spiralling out of control or falling too low. Understanding how this institution manages price stability is no longer just an academic exercise for economics students. It is essential knowledge for citizens trying to make sense of interest rates, growth debates, and economic headlines.

This article takes a deep-dive explainer approach. It breaks down, step by step, how the RBI controls inflation, why its tools matter, and what ordinary readers should watch as India navigates a complex global economic environment.

Read More: RBI Hold Repo Rate

Understanding Inflation in Simple Terms

Inflation refers to a sustained rise in the general level of prices over time. When inflation increases, each unit of currency buys fewer goods and services than before.

A simple example makes this clear. If a litre of milk costs ₹50 today and ₹60 a year later, purchasing power has declined. If income does not rise at the same pace, households feel poorer even if they earn the same salary.

Moderate inflation is not always harmful. It often accompanies economic growth and rising demand. The problem begins when price increases become unpredictable or persistently high. At that point:

- Savings lose value

- Fixed-income households suffer

- Business planning becomes uncertain

- Economic inequality can widen

Controlling inflation, therefore, is about protecting stability, confidence, and long-term growth.

The RBI’s Core Responsibility: Price Stability

The Reserve Bank of India has several roles, but one objective stands above all others in the modern framework: maintaining price stability while supporting growth.

This responsibility is formally defined under India’s inflation-targeting regime. The RBI is mandated to keep consumer price inflation around a specified target, with flexibility to respond to shocks. This framework helps anchor expectations across the economy.

When people believe inflation will remain under control, they make long-term decisions with greater confidence. Businesses invest, consumers spend rationally, and financial markets remain stable. The RBI’s credibility, therefore, is not just technical; it is deeply psychological.

How the Inflation Targeting Framework Works

India follows a flexible inflation targeting system. This means the central bank focuses on keeping inflation within a defined range rather than hitting an exact number at all costs.

The framework has three important features:

- A clear numerical target

- A tolerance band for temporary deviations

- Institutional accountability

Consumer price inflation is measured using a broad basket of goods and services that reflect household spending patterns. When inflation moves beyond acceptable limits, the RBI is expected to act and explain its decisions publicly.

This transparency is critical. It allows citizens, markets, and policymakers to understand why certain steps are taken, even if those steps are temporarily uncomfortable.

Monetary Policy: The Primary Tool for Inflation Control

Monetary policy is the main channel through which the RBI influences inflation. At its core, monetary policy regulates the availability and cost of money in the economy.

When money is cheap and abundant, spending rises. When money becomes costlier, borrowing slows and demand cools. Inflation responds to these shifts over time.

The RBI uses several interconnected tools to implement this policy, each serving a specific purpose.

Read More: Judicial Review explain

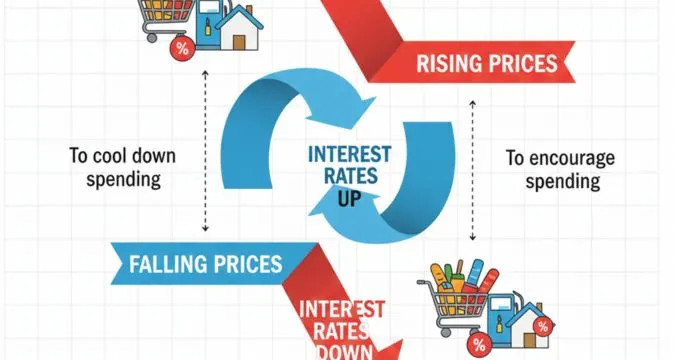

Policy Interest Rates: The Most Visible Lever

The policy repo rate is the interest rate at which banks borrow short-term funds from the RBI. It acts as the anchor for the entire interest rate structure in the economy.

When inflation is rising too fast, the RBI may increase this rate. The impact flows through multiple channels:

- Banks raise lending rates

- Loans become more expensive

- Consumer spending moderates

- Business expansion slows

When inflation is low or growth weak, the RBI may cut rates to encourage borrowing and investment.

This process does not work overnight. Monetary policy operates with a lag, often several months. That is why decisions are forward-looking, based on projections rather than current data alone.

The Role of the Monetary Policy Committee

Interest rate decisions are not made by one individual. They are taken by the Monetary Policy Committee, a body comprising RBI officials and external experts.

The committee meets regularly to assess economic conditions, inflation trends, and growth prospects. Each member votes independently, and the rationale behind decisions is published.

This structure adds institutional balance. It reduces the risk of arbitrary action and reinforces confidence that inflation management is guided by evidence rather than impulse.

Liquidity Management: Controlling Money Supply

Beyond interest rates, the RBI actively manages liquidity in the banking system. Liquidity refers to the amount of cash and credit available for lending.

If too much liquidity exists, banks may lend aggressively, fuelling demand and pushing prices higher. If liquidity is too tight, economic activity can stall.

To maintain balance, the RBI uses tools such as:

- Open market operations involving government securities

- Variable rate auctions to absorb or inject funds

- Standing facilities that set boundaries for short-term rates

These mechanisms allow fine-tuning. Instead of dramatic moves, the RBI can gradually adjust financial conditions to guide inflation toward its target.

Cash Reserve and Statutory Requirements

Banks are required to hold a portion of their deposits as reserves. These requirements limit how much banks can lend and influence credit growth.

Two key instruments are used:

- Cash reserves held with the central bank

- Mandatory holdings of government securities

By adjusting these ratios, the RBI can indirectly influence how much money flows into the economy. While these tools are used less frequently today, they remain part of the broader inflation-control toolkit.

Exchange Rates and Imported Inflation

In an open economy, inflation is influenced not only by domestic demand but also by global prices and currency movements.

When the national currency weakens sharply, imports become costlier. This can raise prices of fuel, edible oils, electronics, and industrial inputs. Such cost pressures often pass through to consumers.

The RBI does not target a fixed exchange rate, but it intervenes to prevent excessive volatility. Stable currency movements help limit imported inflation and maintain confidence among investors and traders.

Communication as a Policy Tool

One of the most underestimated tools of inflation control is communication.

When the RBI clearly signals its intentions, markets adjust behaviour even before formal actions take effect. Expectations play a powerful role in economic outcomes.

Clear messaging helps:

- Anchor inflation expectations

- Reduce speculative behaviour

- Improve policy transmission

Regular statements, press briefings, and detailed minutes ensure that decisions are not misinterpreted. In an era of instant information, this clarity is as important as technical expertise.

Broader Economic Context: Why Inflation Control Is Complex

Inflation is not driven by a single factor. It reflects a mix of demand pressures, supply disruptions, fiscal policy, global events, and behavioural responses.

For example:

- Poor monsoons can raise food prices

- Geopolitical tensions can affect energy costs

- Government spending can stimulate demand

- Global financial tightening can alter capital flows

The RBI cannot control all these variables. Its role is to respond judiciously, balancing inflation control with the need to avoid excessive economic slowdown.

This complexity explains why inflation management is often described as an art as much as a science.

Recent Shifts in the Inflation Landscape

In recent years, inflation dynamics have changed significantly. Supply chains have become more interconnected, and shocks travel faster across borders.

Several trends stand out:

- Greater sensitivity to global commodity prices

- Faster transmission of financial conditions

- Rising importance of services inflation

- Increased role of expectations in price-setting

These changes require central banks to be more agile. Traditional models alone are no longer sufficient. Continuous assessment and adaptability have become essential.

How Inflation Control Affects Ordinary People

Inflation management may sound technical, but its consequences are deeply personal.

For households, stable prices mean predictable expenses and meaningful savings. For borrowers, interest rate decisions influence loan affordability. For savers, returns depend on real purchasing power, not just nominal figures.

Businesses benefit from stability as well. Predictable inflation allows firms to plan investments, manage costs, and negotiate wages more effectively.

At a societal level, inflation control supports fairness. High inflation disproportionately harms those with fixed incomes and limited financial buffers.

Common Misconceptions About RBI and Inflation

Several oversimplified ideas often circulate in public discussions.

One common belief is that raising interest rates instantly reduces prices. In reality, policy actions take time to work through the system.

Another misconception is that inflation control always hurts growth. While aggressive tightening can slow activity, unchecked inflation creates deeper, long-term damage.

Some also assume the RBI can control food prices directly. In truth, many food price movements depend on agriculture, logistics, and state-level policies beyond the central bank’s reach.

Understanding these nuances leads to more informed public debate.

Coordination With Government Policy

Inflation control does not happen in isolation. Fiscal policy decisions, such as taxation and spending, influence demand and price trends.

Effective coordination between monetary and fiscal authorities strengthens outcomes. When both sides work in harmony, inflation management becomes more credible and less disruptive.

At the same time, institutional independence remains vital. The RBI’s ability to take unpopular but necessary decisions protects long-term stability.

This balance between coordination and autonomy is a defining feature of mature economic governance, a theme explored in several institutional explainers published by The Vue Times.

What to Watch Next: Signals That Matter

Readers interested in inflation trends should look beyond headline numbers.

Key signals include:

- Trends in core inflation excluding volatile items

- Changes in policy communication tone

- Global commodity price movements

- Credit growth patterns in the banking system

These indicators often provide early clues about where prices may head next and how the RBI might respond.

Understanding these signals empowers readers to interpret economic news with greater confidence.

Key Takeaways for Readers

Inflation control is central to economic stability and everyday well-being. The RBI uses a combination of interest rates, liquidity tools, and communication strategies to manage price pressures.

This process is gradual, data-driven, and deeply interconnected with global and domestic developments. While the tools may seem technical, their purpose is straightforward: preserving purchasing power and supporting sustainable growth.

A clear grasp of how inflation is managed enables citizens to move beyond headlines and engage meaningfully with economic debates shaping the country’s future.

Frequently Asked Questions

Why does inflation control take time to show results?

Monetary policy affects the economy through multiple channels, including borrowing, spending, and investment decisions. These responses unfold gradually as households and businesses adjust behaviour. Immediate price changes are rare, which is why central banks act based on forecasts rather than waiting for visible outcomes.

Can inflation ever be reduced without slowing growth?

In some cases, yes. If inflation is driven mainly by temporary supply shocks, improvements in production or logistics can ease prices without harming growth. However, when demand is excessive, slowing economic momentum slightly may be necessary to restore balance and prevent deeper instability later.

How does global inflation affect domestic price stability?

Global price movements influence energy, food, and industrial inputs. Even with strong domestic management, international shocks can push prices higher. Central banks respond by adjusting financial conditions to limit spillover effects and prevent temporary pressures from becoming entrenched.

Is price stability more important than economic growth?

Price stability and growth are interconnected rather than competing goals. Stable prices create the foundation for sustainable growth by reducing uncertainty and protecting purchasing power. Without stability, growth tends to be volatile and uneven, ultimately harming long-term development.

What should readers monitor to understand future inflation trends?

Beyond official inflation numbers, readers should follow policy statements, commodity price trends, and credit growth data. These indicators often signal shifts in inflation dynamics before they appear in headline figures, offering valuable context for interpreting economic developments.

Stay Informed. Think Deeper. Read Beyond the Headlines.

If you value clear explanations, credible analysis, and context that actually helps you understand how India’s economy works, explore more in-depth journalism at The Vue Times. Our reporting goes beyond breaking news to unpack the forces shaping policy, governance, and everyday life. Read, reflect, and stay ahead with insights that matter, only on The Vue Times.