The pillar of India fiscal discipline architecture is the FRBM Act. The Act aims to institutionalize macroeconomic stability and contain fiscal deficit India experiences on recurrent basis, as well as increase transparency, foreseeability and intergenerational equity in the management of the India government finances. Since the last twenty years, it has transformed itself to be more of a flexible fiscal policy as a response to economic shocks, political economy restrictions, and federal negotiations.

The FRBM Act is difficult to comprehend unless there is one structural commentary rather than episodic commentary. It is not a deficit cap statute; it is an institutional design solution to fix the vice of fiscal profligacy, standardizing the expectations of the macroeconomy and disciplining the executive branch using statutory guidelines.

This article studies the Act in terms of institutional structure, functions, implications of governance and its long term dynamic in the changing financial condition of India.

Policy Context

The Pre-FRBM Fiscal Landscape

Fiscal imbalances were perpetuated in the 1980s and 1990s in India. Deficits in terms of high revenue, and deficit monetization by the central bank and increasing debt levels led to structural macroeconomic weaknesses. The balance of payment crisis revealed the weakness in the fiscal architecture in India by 1991.

Fiscal consolidation was still not stable even after liberalization. Central and state fiscal shortfalls were combined and went above sustainable levels. Lagging payment of interest consumed a huge percentage of revenue receipts pushing out developmental spending.

In the late 1990s, the fiscal deficit was constantly above the 5 percent central level of GDP. The level of revenue deficit was still there beaming in the fact that it was borrowing money that was being used in consumption; not in capital formation.

Rationale for the FRBM Act

The Fiscal Responsibility and Budget Management Act was passed in 2003 and it aimed at:

- Eradicating revenue deficit.

• Reducing fiscal deficit

• Assuring sustainability of debt.

• Enhancing fiscal transparency.

The core premise was simple: macroeconomic stability requires rule-based fiscal conduct. Discretionary expansionary policies, especially in politically sensitive periods, undermine long-term growth.

The Act marked the transition of discretionary fiscal management to the rule bound governance.

Stipulated by The FRBM Act of institutional architecture

Legislative Authority

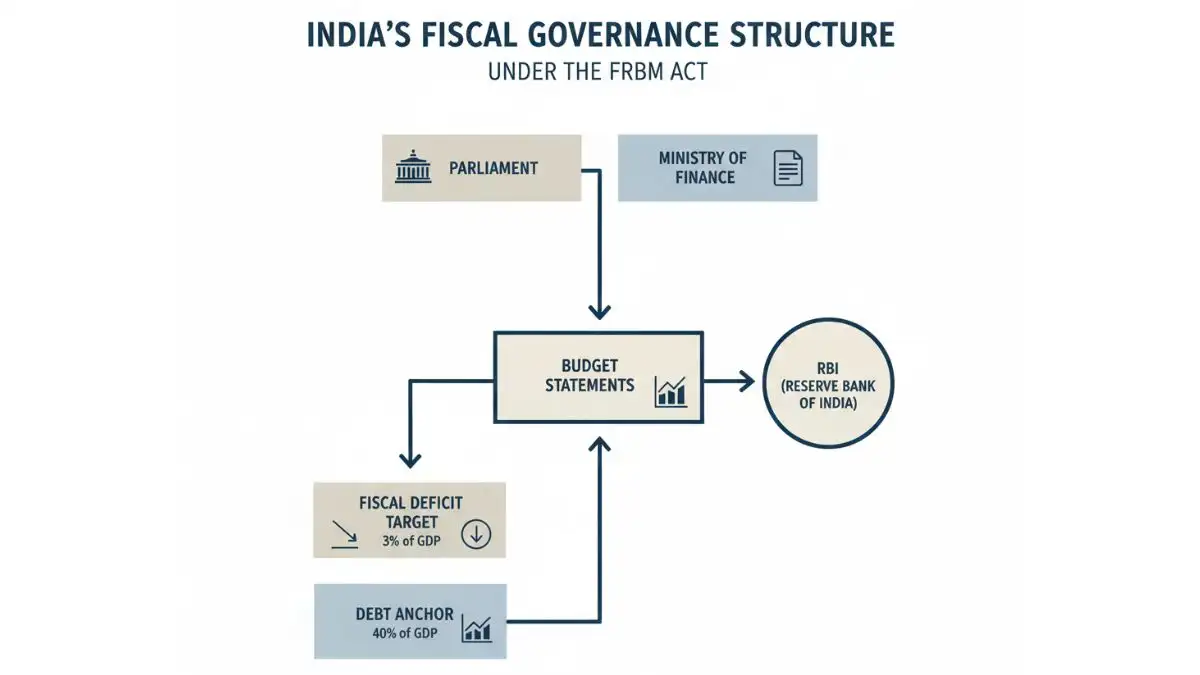

The parliament of India passed the FRBM Act, 2003, and it was operationalized by the ministry of finance by way of rules. It is a statutory fiscal rule that applies to the Union Government.

Ministry Involved

The Act is managed on a departmental level by the Department of Economic Affairs of the Ministry of Finance. It is responsible for:

- Establishing financial targets of the year.

• Publicity of fiscal policy statements.

• Monitoring compliance

• House of Commons representations of deviations.

Parliamentary Oversight

Along with the Union Budget the following documents must be presented by the Act:

- Medium-Term Fiscal Policy Statement.

• Fiscal Policy Strategy Statement.

• Macroeconomic Framework Statement.

These records constitute some form of accountability to Parliament, creating an increase in legislative attention to target the executive fiscal judgments.

Task of the Reserve Bank of India

Although the FRBM Act is not imposed directly by the reserve bank of India, the monetary policy apparatus is highly immersed with fiscal discipline. High levels of fiscal deficits raise the need to borrow, bond yield, and transmission of monetary policy.

After amendments, deficit monetization by primary market subscription by the central bank is not allowed except in extraordinary cases. This is in line with fiscal operations with inflation targeting models embraced by the RBI.

Federal Implications

As much as the FRBM Act is applicable to the Union Government, states passed similar fiscal responsibility laws. The Twelve and The Thirteen Finance Commissions encouraged states to implement fiscal laws by tying them to the limits of borrowing and grants.

So fiscal discipline became a teamwork federal system instead of an all-power mandating system.

Institutional reference proposal: Government of India, Magistrate of Finance, Budget Documents and fiscal policy statements.

Operational Framework and Mechanism of FRBM Act

Core Targets

Originally, the Act aimed to:

- Cut down the fiscal deficit to 3 percent of GDP.

• Eliminate revenue deficit

• Restrict governmental guarantees.

• Improve transparency

The later revisions added a debt to GDP anchor. Amendments in 2018 by the recommendation of the FRBM Review Committee chaired by N K Singh brought in:

- The central government debt target stands at 40% of GDP.

• Target on general government debt of 60 percent.

Frame Work Structural Diagram

Operational structure represented in writing:

- Fiscal rule is enacted by parliament.

• The Ministry of Finance has targets per year.

• Fiscal statement budget presentation.

• Outlays and borrowings carried out.

• RBI controls liquidity and auction of debts.

• Annual reporting and review to the Parliament.

• Deviation clause is to be triggered in case of extraordinary circumstances.

This is a cyclical system that instills discipline in the process of the annual budget.

Escape Clause

Economic turmoil awareness saw the addition of an escape clause in amendments that allowed deviation of up to a given percentage of GDP under:

- Security crises on a national scale.

• Natural calamities

• Fiscally related structural changes.

• Severe economic downturn

This brought in some form of flexibility without sacrificing credibility.

Transparency Provisions

The Act will require three reviews of the fiscal trends every three months and disclosure of contingent liabilities. This increases the transparency of the financial side and boosts investor confidence.

Economic and Governance Implications

Impact on Fiscal Health

The FRBM Act framework helped in fiscal consolidation in 2004-2008. The central fiscal deficit was showing a significant reduction prior to the global financial crisis.

Data point: In 2007-08, fiscal deficit India as measured as the central figure was shown to have come down to around 2.5 percent of GDP, which is the effect of rule-based consolidation.

However, stimulus spending in the wake of past crises, and expenditures that responded to the pandemic, produced deviations. The framework has therefore served as an anchor and not an absolute constraint.

Debt Sustainability

By incorporating fiscal deficit targets via debt anchors in the Act, the twin of flow variables and stock sustainability are brought in. Lower deficits mean lower debt accumulation and lower debt interest burden and raise sovereign credit metrics.

Federalism

State-level fiscal responsibility acts had the effect of tying subnational fiscal policy to national targets. Borrower ceilings are calibrated through the Finance Commission but it strengthens the practice of cooperative federalism in terms of finances.

However, off-budget borrowings of the states and contingent liabilities continue to be areas of concern.

Administrative Capacity

The Act requires sophisticated fiscal forecasting, medium-term expenditure frameworks as well as data transparency. This has led to an improvement in budgetary institutions in the Ministry of Finance.

However, off-budget liabilities, borrowing by the public sector undertakings and extra-budgetary resources sometimes destroy transparency.

Implications for the Private Sector

Stable fiscal policy lessens the fluctuation of the macroeconomies, it lowers risk premiums and stabilizes government bond markets. This is better capital allocation and avoiding crowding out of private investment.

High levels of fiscal deficit India raise costs of borrowings and restrain private sector credit expansion. Thus, indirectly, fiscal rules affect the investment climate.

Implementation Gaps

In spite of statutory design, various operational challenges still remain.

Repeated Target Revisions

Fiscal targets have been revised several times, because of:

- Global financial crisis

• Slowdown in growth cycles

• Pandemic-related expenditure

• Revenue volatility

Frequently changing rules undermines credibility of rules.

Off-Budget Borrowing

Public sector entities tend to take on borrowings secured by governmental guarantees. These do not necessarily reflect transparently in fiscal deficit calculations, which defeat the spirit of the FRBM Act.

Unrelenting Deficits in Revenue

Elimination of revenue deficit was an early objective. However there are structural expenditure commitments, which limit flexibility. Subsidies, interest payments and the welfare obligations result in rigid expenditure structures.

Payment Limits of Political Economy

Fiscal discipline generally clashes with electoral cycles. Expansionary spending before elections makes it difficult to follow strict deficit targets.

Criticism and Counter Arguments

Criticism 1: Procyclicality

Rigid deficit targets could create pressure for contractionary fiscal policy in economic downturns. This can deepen recessions.

Counter-Argument: cyclical shocks taken care of with escaping long term anchors.

Criticism 2: Focusing Too Much on the Deficit

Focusing on fiscal deficit India alone, may not pay attention to quality of expenditure. Borrowings made for the purpose of capital formation are not the same as those made for the purpose of consumption.

Counter-Argument: Amendments focus on reduction of revenue deficit and debt sustainability, which implicitly takes to capital expenditure bias.

Criticism 3: Unrealistic Goals

Critics claim that the 3 percent deficit norm is arbitrary.

Counter-Argument: The benchmark is equivalent to global practices on fiscal rules and also a transparent bench-mark against which markets have a benchmark.

Criticism 4: Weak Enforcement

The Act has no punitive enforcement mechanisms.

Counter-Argument: In parliamentary democracies, reputational cost and market discipline frequently replace formal discipline.

Future Outlook: 5-10 Years

India’s fiscal architecture has gone into a fiscal calibration regime.

Debt Stabilization Imperative

Post-pandemic levels of debt are high. Over the next decade, gradual consolidation will have to occur for restoring fiscal buffers.

Shift Toward Counter Cyclical Framework

Future reforms may include a focus on cyclical targets for reduced deficits instead of fixed targets for nominal deficits. This would incorporate volatility in growth in the fiscal planning.

Digital Public Finance

Improved data analytics, integrated financial management systems, and real-time monitoring of expenditures could be used to strengthen compliance.

Climate and Infrastructure Finance

Large scale capital expenditure to invest in infrastructure and to transition to clean energy will demand fiscal space tests. A nuanced interpretation of fiscal deficit India targets may be needed to make a distinction between productive borrowing.

Institutional Strengthening

An independent fiscal council has been implied in various policy discussions. Such an institution might promote credibility with the help of independent forecasts, compliance assessment.

Conclusion

The FRBM Act is the institutional commitment of India to a commitment to fiscal prudence. It took the management of the fiscal status from a more discretionary executive practice and replaced it with a rule-based statutory framework based on transparency and accountability.

While there have been deviations and calibrations during implementation, the Act still has struggled to function as an anchor for the macroeconomy. It affects borrowing behavior, facilitates co-ordination of monetary policy and affirms credibility to domestic and international investors.

The debate on fiscal deficit India must therefore be placed in this structural context. The FRBM Act is not a rigid austerity mandate but has been set up as an instrument of governance for balancing growth, stability, and intergenerational equity.

In the coming decade disease evolution is likely to be more against flexibility and staying the debt and institutional vision. This durability of India’s macroeconomic stability is thus intertwined to a very large extent on how well the FRBM Act adapts to more emerging fiscal realities on one hand, without compromising its core objective, which is disciplined and transparent public finance management.